Crypto Perpetuals Trading Hit All-Time High in 2024, CoinGecko Report Shows

CoinGecko’s latest report reveals record-breaking crypto perpetuals trading in 2024, with centralized exchanges dominating at $58.5 trillion.

According to CoinGecko, the crypto perpetuals market hit record-high trade volumes in 2024, surpassing the previous highs in 2021. Despite a few upsets in the decentralized exchange market, most of its constituent pieces stayed steady.

Perpetual trade volumes on centralized exchanges reached $58 trillion, and decentralized ones reached $1.5 trillion. This smaller market proved much more chaotic.

CoinGecko Analyses Crypto Perpetuals Trading

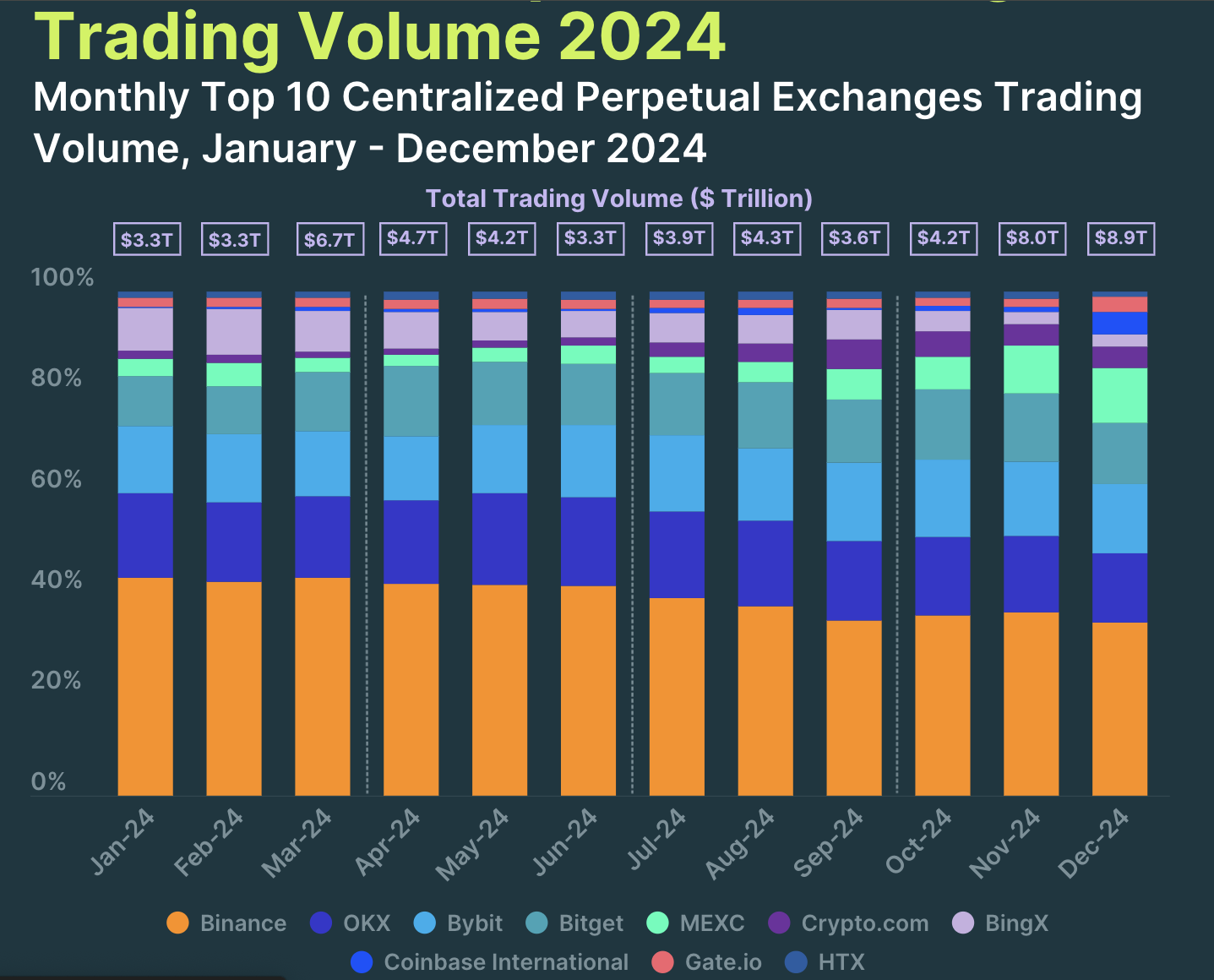

According to the latest CoinGecko report, the total volume of crypto perpetual futures trading on the ten largest centralized exchanges reached $58.5 trillion, surpassing 2021 to set a new record.

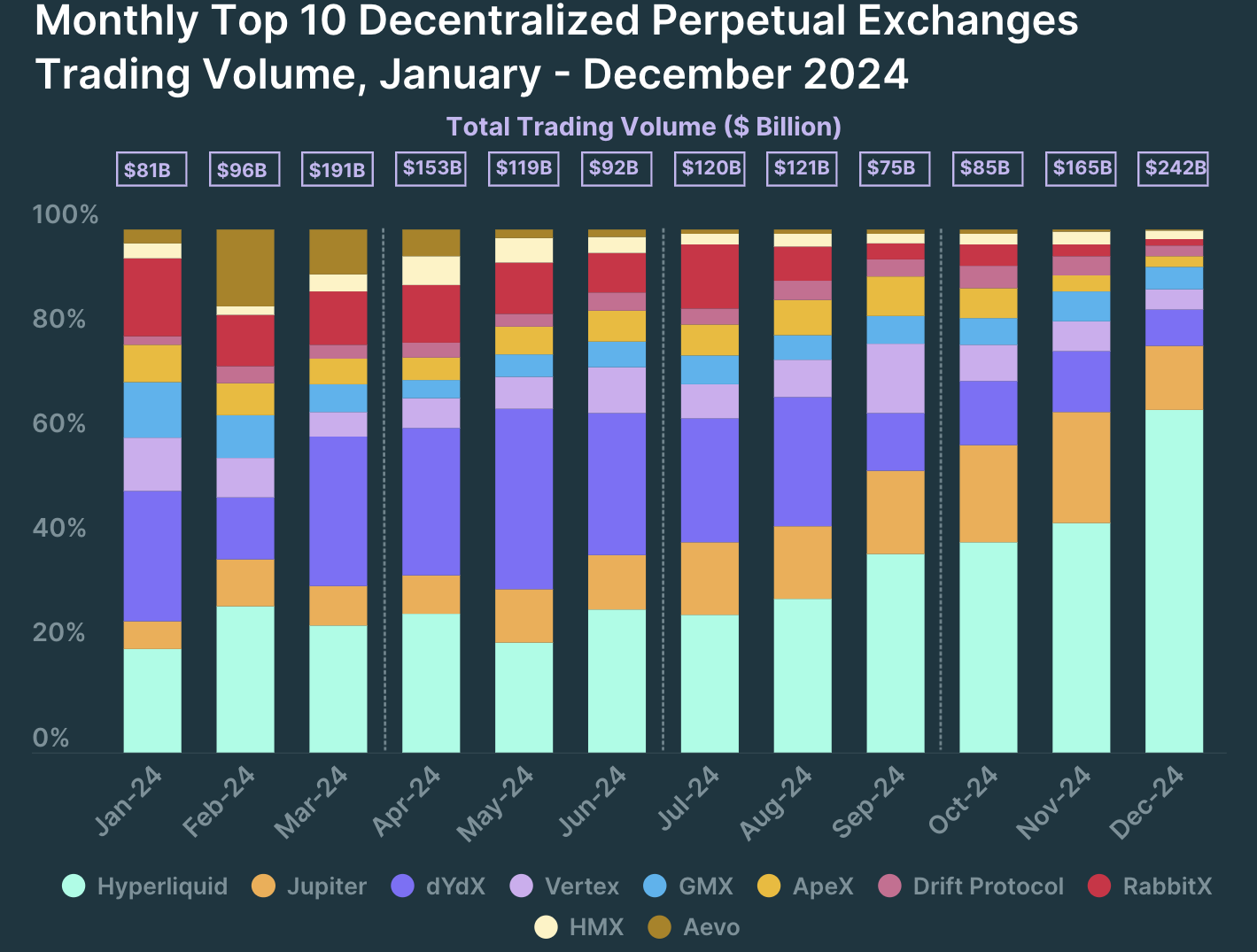

The corresponding number from decentralized exchanges was much smaller but still significant, at $1.5 trillion.

Perpetuals Volume on Centralized Exchanges. Source:

CoinGecko

Perpetuals Volume on Centralized Exchanges. Source:

CoinGecko

Interestingly, Binance, the world’s largest crypto exchange, is losing its lead over the perpetuals market. The report claims that Binance remained the most popular perpetuals exchange throughout the year.

However, its market share fell from 43% in January to 34% in December.

Despite these declines, Binance demonstrated a consistent ability to impact the broader crypto market with its perpetuals contracts, and it has continued offering new products in 2025.

Although the exchange lost a substantial chunk of its dominance, no single competitor captured the majority of Binance’s market share. Coinbase, at least, did make 4x gains.

The decentralized crypto exchanges in the perpetuals market managed to achieve much more radical shifts. Hyperliquid grew dramatically throughout the year, shifting from under 20% of the market share to over 65%. CoinGecko primarily attributes this growth to the exchange’s massive HYPE airdrop.

Perpetuals Volume on Decentralized Exchanges. Source:

CoinGecko

Perpetuals Volume on Decentralized Exchanges. Source:

CoinGecko

Despite these impressive gains, Hyperliquid has experienced notable corrections in the current cycle. HYPE fell 24% this week, bringing it to a three-month low.

The decentralized exchanges are very chaotic in this market, as dYdX fell from a narrow market leader to a distant third within a few months.

Overall, the market for crypto perpetuals grew in 2024, but most of the firms and products involved with this trade behaved pretty stably. Bitcoin futures consistently held most of the open interest share and generally dominated actual trade volumes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Breakout Signals Bullish Momentum Ahead

Altcoins are gearing up for a major breakout as market momentum shifts. Here's what you need to know.Altcoins Set to Surge as Market Momentum BuildsFactors Driving the Altcoin BreakoutWhat to Watch Moving Forward

U.S. Sells Gold Cards for $5M Each—Debt Solution?

The U.S. sold 1,000 gold cards at $5 million each. Can this help reduce the growing national debt crisis?A $5 Billion Gold RushCan It Fix the Debt Crisis?What’s Next?

Jed McCaleb Bets $1B on Space Startup Vast Space

Crypto billionaire Jed McCaleb invests $1B in Vast Space to build the first commercial space station.From Crypto to the CosmosWhat Is Vast Space Planning?Crypto Funding the Final Frontier

Bitcoin Sharpe Ratio Nears “Low Risk” Zone for Entry

Bitcoin’s Sharpe Ratio is nearing the “Low Risk” zone. A prime buying opportunity could be close!Sharpe Ratio Signals Potential Buying WindowWhy Sharpe Ratio Matters for BTCTiming the Next Move