- Dom Kwok of EasyA sparks XRP price speculation with an optimistic market outlook.

- Digital Asset Investor references a past prediction suggesting XRP could surpass $17.

- The crypto community debates the feasibility of a trillion-dollar Ripple valuation.

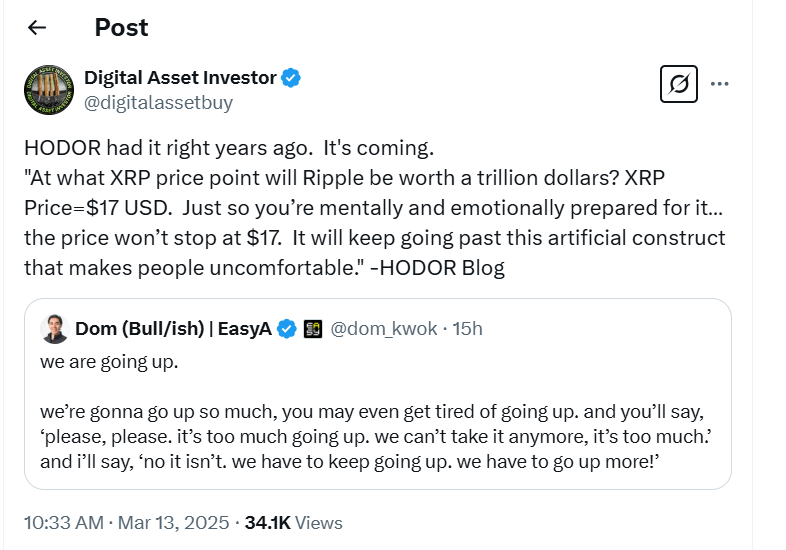

Speculation about XRP’s future price has increased following comments by Dom Kwok, co-founder of EasyA. In a post on X, Kwok suggested that crypto prices could rise so significantly that investors might “get tired of going up.” His comments have since fueled speculation within the XRP community.

Following Kwok’s remarks, Digital Asset Investor, a prominent XRP supporter, referenced an older blog by HODOR that estimated that XRP reaching $17 would push Ripple’s valuation to $1 trillion.

The post went even further, claiming the price wouldn’t stop there, highlighting the potential for continued growth beyond psychological resistance points.

Predictably, this fueled the more optimistic corners of the XRP community. One commenter suggested that after a potential IPO, Ripple could rank among the top 10 companies globally by market capitalization. He went on to say that even a number one position is not “impossible.”

This perspective aligns with those who believe XRP has significant long-term potential. But not everyone’s buying the hype.

XRP: Bullish Dreams vs. Bearish Reality?

Skeptic Graham Unsworth, expressed his frustration with the prediction and other ambitious XRP projections widespread in the community.

“Sick of hearing all these price forecasts. It’s a few cents higher than in November 2020, just before the SEC case,” Unsworth wrote.

He argued that significant price movement wouldn’t occur until the lawsuit concludes and regulatory clarity is established, calling current discussions “clickbait.” As of this press time, XRP is trading at $2.27, a 3.78% rise in the past day.

Related: XRP Soars 16% as Franklin Templeton Files for ETF, SEC Delays Weigh

Adding another layer of complexity, another community member claimed that XRP’s primary use case in facilitating cross-border payments could actually limit its price appreciation. He argued that lower XRP prices benefit financial institutions.

However, this view is at odds with those who believe in astronomical XRP prices solely because of institutional investment.

The Ripple-SEC Saga: Still No Resolution

The elephant in the room, of course, is the Ripple vs. SEC case, and it may be nearing its end, according to journalist Eleanor Terrett. She reports that Ripple is negotiating to get better settlement terms, delaying the resolution. A key issue is the $125 million fine and the ban on XRP sales to institutions.

Related: Settlement In Sight For Ripple vs. SEC Case, Though Final Terms Still Under Negotiation

Ripple argues it should not be penalized if the SEC is backing off past crypto cases. Accepting the ruling would mean admitting wrongdoing, while the SEC itself is unsure if any occurred. With no clear precedent, negotiations are taking longer than expected.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.