Bitcoin Faces Increased Selling Pressure Amid Miner Sell-Offs – CryptoQuant

Bitcoin's price decline deepened as miners offloaded holdings to cover rising costs, intensifying concerns over market stability.

Bitcoin (BTC) is facing increased selling pressure as miners offload their holdings, contributing to recent price declines.

Data from CryptoQuant shows a surge in miner transfers to exchanges, particularly during price dips, indicating financial strain within the mining sector.

Increased Miner-to-Exchange Flows Signal Strain

In February and early March, Bitcoin repeatedly dipped below $80,000, reaching a low of $76,807 on March 11 before a slight recovery to around $82,500 on March 12.

Analysts at CryptoQuant said that miners historically sell more Bitcoin during price declines to cover operational costs.

These forced sellers contribute significantly to market liquidity, and their increased activity at local bottoms suggests mounting financial pressure.

Rising operational costs, coupled with the Bitcoin halving event in April 2024, exacerbate this situation.

The trend of increased miner-to-exchange flows began in September 2024 and peaked on Dec. 16, when these flows reached 11,365 BTC in a single day.

On March 11, miner-to-exchange flows also remained high, reaching 8,024 BTC.

Bitcoin Mining Sector Faces Revenue Squeeze

February presented significant challenges for Bitcoin miners , with overall monthly mining revenue declining by 11.5% to $1.24 billion .

Concurrently, transaction fees experienced a 19% drop, indicating a decrease in network demand.

Adding to the strain, the mining difficulty increased by 2%, placing smaller mining operations under considerable pressure.

The financial impact extended to publicly traded mining companies, with their stock values taking a substantial hit. Bitdeer saw its shares plunge by 25%, while Cipher Mining’s shares fell by 17%, both companies reporting widening losses.

Growing Sell Pressure Triggers Analyst Warnings

Bitcoin faces increasing scrutiny as selling pressure continues to build, prompting analysts to warn that further declines are possible.

BitMex founder Arthur Hayes, via a March 11 post on X, delivered a stark warning, stating that Bitcoin could drop to $70,000 if this selling pressure persists.

Markus Thielen, head of research at 10x Research, also issued a stark forecast, predicting Bitcoin’s price could slide to as low as $73,000.

In a report published on March 11, Thielen cautioned traders to prepare for further downside.

“This is a critical time when risk management, recognizing historical parallels, analyzing chart patterns, and closely monitoring market structure becomes essential,” Thielen wrote.

He added that losses can accelerate quickly under deteriorating conditions, and he urged investors to proceed with caution.

Thielen also pointed out that the current cycle bears striking similarities to the end of previous crypto bull markets.

He compared today’s situation to the market conditions seen in 2017 and 2021, where “loudest promoters hyped the market with catchy slogans, fueling promises of unlimited upside – only for volatility to be reframed as a feature when prices collapsed.”‘

Highlighting the cyclical nature of market hype, Thielen drew attention to the shifting narratives and leading cryptocurrencies across different bull runs.

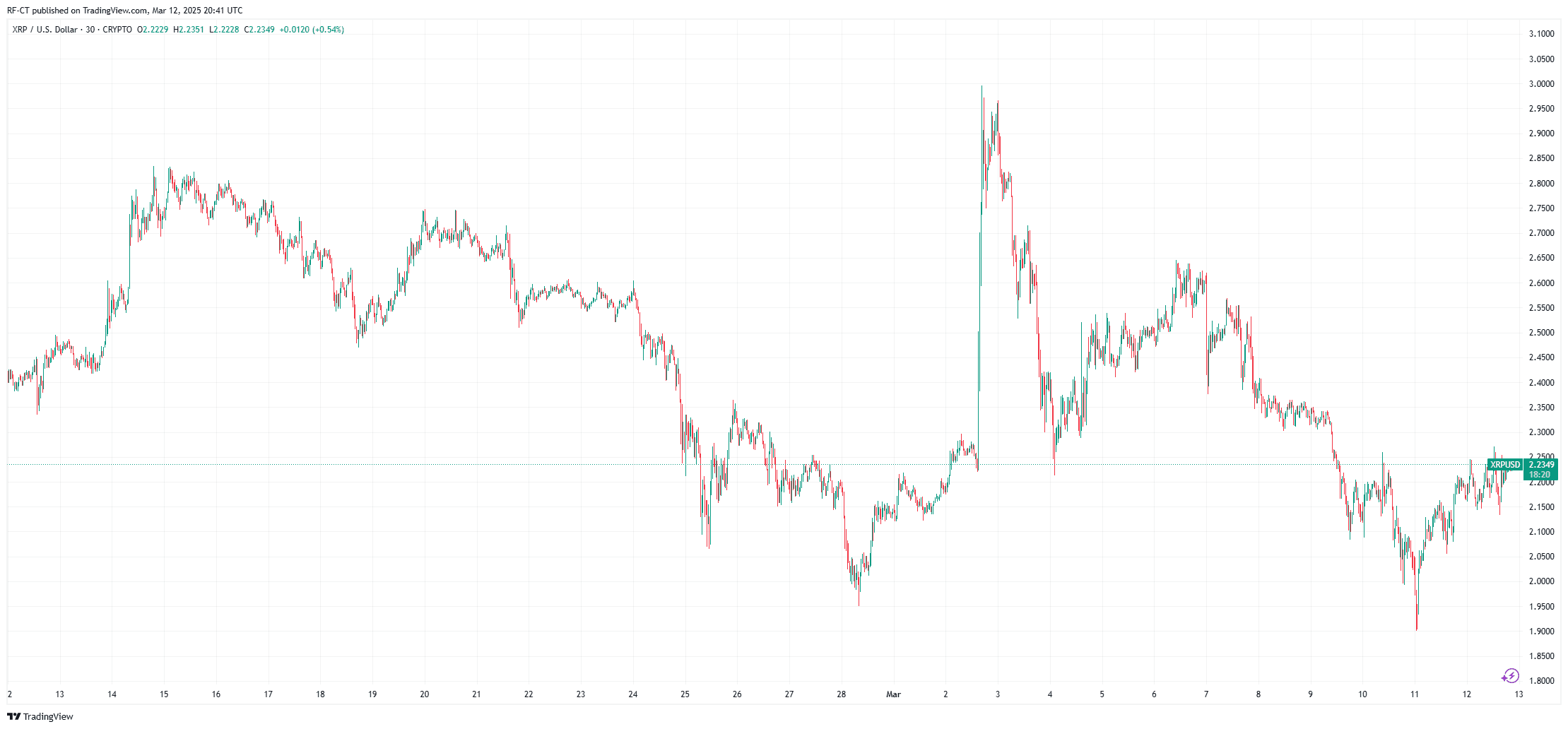

“In 2017, Ripple’s XRP surged to become the second-largest cryptocurrency by market cap. Yet in the 2021 bull run, XRP failed to reclaim that position,” he noted.

According to Thielen, the same pattern is now emerging with Ether ( ETH ), as market narratives have evolved from payments in 2017 to decentralized finance (DeFi) and non-fungible tokens (NFTs) in 2021, and now to meme coins in 2025 – “each cycle bringing a new hype wave, shifting from Ripple to Ethereum to Solana.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin must secure weekly close above $89K to confirm bottom has passed

SEC vs. Ripple Case Nears Conclusion: Impact on XRP and Crypto Regulation

Pi Network Jumps 28% — Will the Surge Last?

Research Report | Space Nation Project Overview & OIK Market Analysis