Polymarket Sees 41% Chances For US Recession in 2025

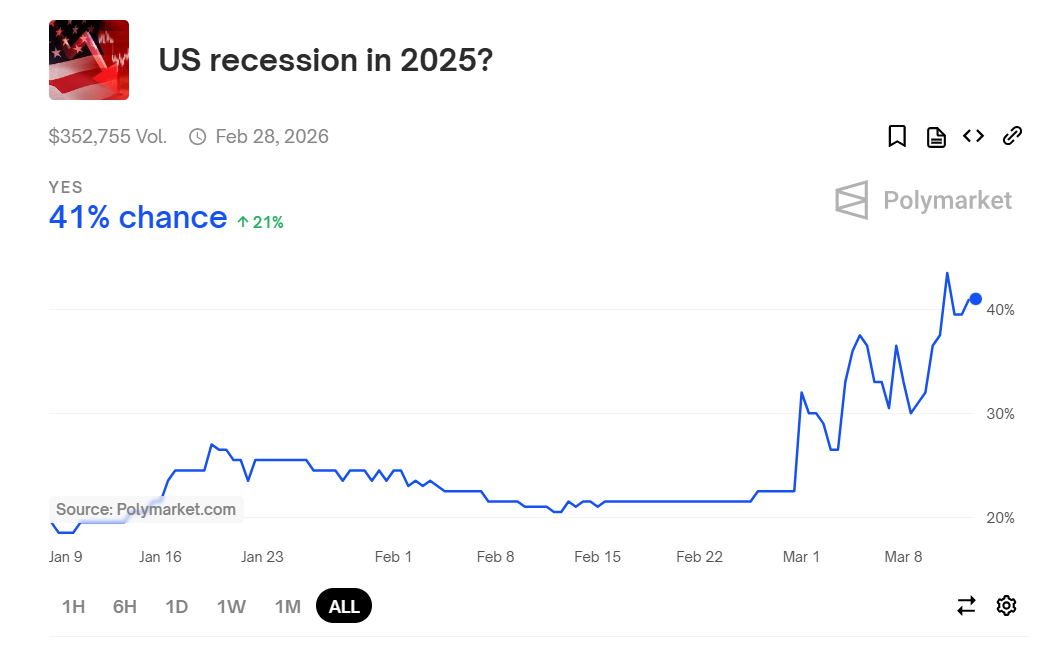

The decentralized event trading platform, Polymarket now sees 41% chances for potential recession in the US as President Donald Trump keeps on taking bold moves, one after another since his inauguration in January 2025.

While the event seems to be listed on Polymarket as a joke, people are now heavily invested into it with the total volume reaching $352k as of 12 March. The hike in trading this event has spiked since the beginning of March with its chances increasing over 21% in past month.

US Recession Chances in 2025 – Source: Polymarket

US Recession Chances in 2025 – Source: Polymarket

The fears of a US recession in 2025 are escalating due to various economic and policy factors driven by Trump’s ground shaking decisions. The recent major moves, including sweeping tariffs, mass federal layoffs, and spending cuts, are seen as significant headwinds to economic growth. Besides, consumer sentiment has also plummeted, and market measures such as the Conference Board’s Leading Economic Index (LEI) have declined, which indicates rising pessimism.

Moreover, recent economic concerns like the Atlanta Fed’s negative growth forecast for Q1 2025, a re-inverted yield curve, and declining consumer confidence, have fueled higher recession chances.

The U.S. recession has also set abuzz on X with several economic leaders sparking debates on it and criticising Trump’s recent decisions.

A popular economist, Peter Schiff believes that the U.S. economy has already entered into recession and it is getting worse.

“If the Trump administration and investors think the silver lining of a trade war and recession will be lower inflation and long-term bond yields, they’re in for a huge surprise,” Schiff said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation Shifts Focus Amid Criticism, Eyes Founder-Driven Growth

Ethereum’s leadership appears to be rethinking its strategy following growing criticism from investors and developers, with signs pointing toward a more founder-centric approach and capital formation.

New York Supreme Court to Review Libra Token Scandal as Lawsuit Alleges $100M Investor Fraud

The Supreme Court of New York is set to review the Libra (LIBRA) token scandal following a class-action lawsuit accusing its creators of misleading investors and siphoning over $100 million through deceptive liquidity pools.

Solana Deletes Controversial Ad Following Backlash Over Gender Identity Messaging

Solana removed a controversial advertisement from its official X account on March 18 after facing criticism for handling gender identity and political messaging.

US Minnesota Senator Introduces Bitcoin Bill After Shifting from Skeptic to Supporter