Texas Moves Forward with Second Bitcoin Reserve Bill, Eyeing $250M Allocation

Texas is exploring a bold fiscal pivot by weighing digital asset integration to refresh state reserves and modernize investment strategies amid shifting economic landscapes.

Key Takeaways:

- Lawmakers are considering digital assets to diversify traditional fiscal reserves.

- The initiative signals a move toward innovative, modern investment methods for public funds.

- The proposal fuels debate over balancing financial innovation with inherent market risks.

- It reflects a growing trend among states reexamining conventional reserve models.

On March 11, 2025, Texas lawmakers introduced House Bill 4258, the state’s second Bitcoin reserve bill, proposing a $250 million allocation from the state’s Economic Stabilization Fund for investments in Bitcoin and other cryptocurrencies.

Second Bitcoin Reserve Bill Would Allocate $250M from Economic Stabilization Fund

According to the second proposed Bitcoin reserve bill, Texas seeks to allow the state’s Comptroller of Public Accounts to invest up to $250 million in Bitcoin or other cryptocurrencies using money from the Economic Stabilization Fund (ESF), commonly known as the Rainy Day Fund.

This fund is a financial reserve created to help Texas manage budget shortfalls, economic downturns, and emergency expenses.

Additionally, the bill proposes allowing Texas municipalities and counties to invest up to $10 million each from local funds into Bitcoin or other cryptocurrencies.

This means the state and local governments would have the option to diversify their reserves with digital assets.

If passed, the bill would take effect on September 1, 2025, making Texas one of the first U.S. states to legally allocate government funds to Bitcoin.

Differences Between the First and Second Bitcoin Reserve Bills

The newly proposed bill builds upon previous efforts to introduce Bitcoin into the state’s financial system.

The earlier Senate Bill 778 laid the groundwork by allowing Texas to accept cryptocurrency for taxes and donations and create a Bitcoin reserve.

However, unlike the current proposal, it did not specify an investment amount for Bitcoin reserves.

Texas would also have a mandatory five-year holding period before any state-owned Bitcoin can be sold, reinforcing a long-term investment approach.

Earlier this month, the state Senate overwhelmingly approved the proposal to invest public funds in Bitcoin with a 25-2 vote.

The Texas House is now set to review the bill, with a final decision expected by May 24, 2025.

Debate Surrounding the Bitcoin Reserve Bill

Supporters of the bill believe that Bitcoin investments would diversify Texas’ reserves and hedge against inflation and uncertainty.

Skeptics raise concerns about volatility, regulatory risks, and the broader economic impact of allocating public funds to digital assets.

Recent global events have underscored these concerns, particularly following the March 4, 2025, tariffs imposed by the Trump administration—a 25% tariff on imports from Canada and Mexico and a 20% levy on Chinese imports—which significantly impacted financial and cryptocurrency markets.

The impact has also extended to cryptocurrencies, with the BTC price dropping approximately 3% from $89,000 to around $81,000 since the economic policy announcement.

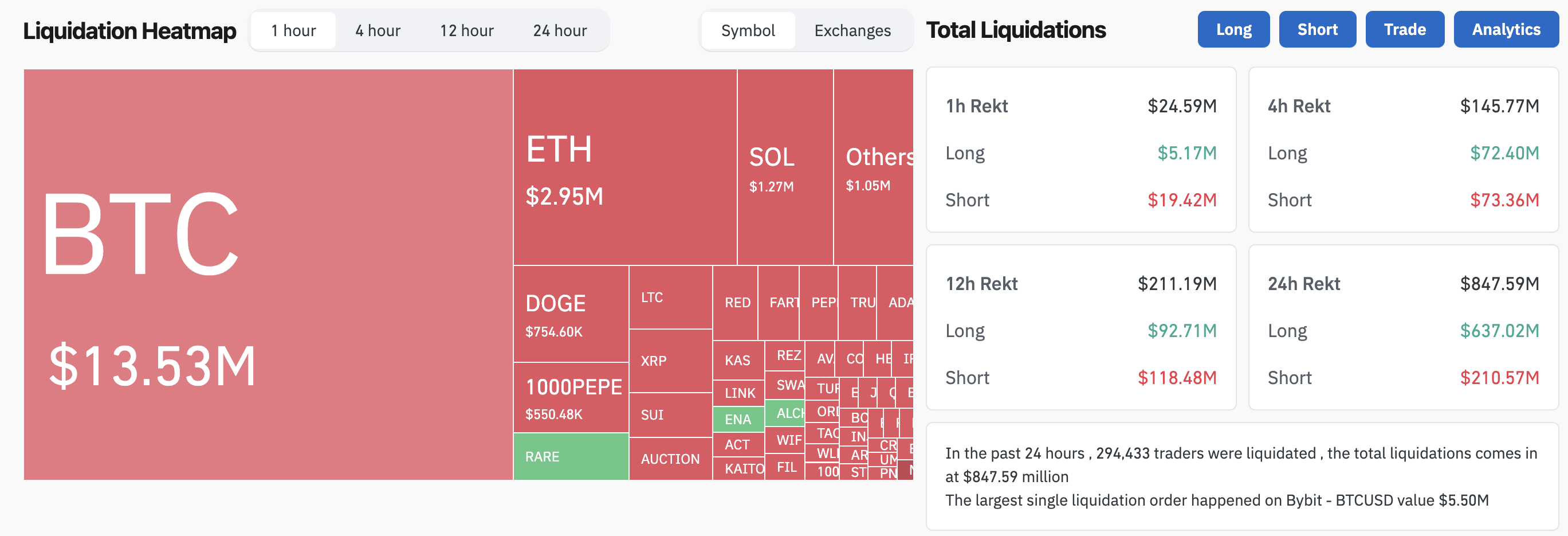

The volatility has also led to significant liquidations. On March 9, over $450 million in crypto positions were wiped out , and the next day, the U.S. stock market lost $1.75 trillion in value. Bitcoin, often seen as a store of value, has struggled under these economic pressures.

Additionally, the broader crypto market has mirrored Bitcoin’s downturn.

Solana, for instance, plummeted more than 60% from its January high of nearly $300 and is currently trading around $120 .

Ethereum has also declined and fallen below $2,000 with an 8.52% drop over the past week.

The global cryptocurrency market capitalization has decreased by 1.95% in the last 24 hours to $2.65 trillion.

However, should the Texas Bitcoin reserve bill pass and take effect as scheduled in September 2025, lower Bitcoin prices might offer Texas the opportunity to acquire digital assets at reduced costs, potentially enhancing long-term financial resilience.

Other States Continue Push for Bitcoin Reserves

Texas is not the only state considering cryptocurrency investment strategies. At least 20 U.S. states are currently exploring similar initiatives.

Rhode Island has been one of the most proactive states in this regard. Representative Stephen M. Casey recently introduced H6007, the Strategic Digital Asset and Precious Metal Reserve Act, which proposes that the state allocate funds to Bitcoin and other digital assets.

According to Bitcoin Reserve Monitor data , these states are at different stages of legislative approval.

Nineteen states have pending cryptocurrency reserve legislation, two are still considering proposals, and five have rejected similar initiatives.

Five Bitcoin reserve bills have been rejected so far | Source: Bitcoin Reserve Monitor

There has also been a movement toward crypto adoption at the federal level.

In March 2025, President Donald Trump announced the establishment of a Crypto Strategic Reserve , which will include Bitcoin, Ethereum, Solana, Cardano, and XRP.

As Texas and other states continue to evaluate cryptocurrency investments, the broader implications become clearer: adopting Bitcoin as a financial reserve may offer protection from traditional economic turbulence, but it also amplifies exposure to crypto-market volatility.

Texas’ decision could be pivotal—either serving as a successful model for prudent government investment or highlighting the perils of integrating digital currencies into state finances.

The outcome will undoubtedly shape future legislative approaches across the United States.

Frequently Asked Questions (FAQs)

By integrating digital assets into fiscal reserves, states aim to diffuse risk from traditional markets while stimulating modern investment strategies that enhance long-term economic stability and agile public finance.

A mandated holding period aims to mitigate crypto’s swift fluctuations, cultivating a strategic investment model that safeguards public resources while methodically embracing digital asset diversification.

Texas’ initiative may prompt broader fiscal reform as states observe digital asset integration’s dual role in spurring innovation and enforcing risk management, potentially reshaping national investment strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty