Research Report | Mint Blockchain Overview & MINT Market Cap Analysis

I. Project Introduction

Mint Blockchain is an Ethereum Layer2 network developed by NFTScan Labs and the MintCore team, dedicated to building infrastructure for NFT assets. The project started in October 2023, with its mainnet officially launching in May 2024. Built on OP Stack, Mint Blockchain operates as part of the Optimism Superchain, leveraging the Ethereum mainnet as its Data Availability (DA) layer to maintain security and EVM compatibility while significantly reducing transaction costs. This ensures greater scalability for the NFT ecosystem.

To support the complete lifecycle of NFT assets, Mint Blockchain has introduced five core modules:

- Mint Studio – NFT minting tools

- IP Layer – An IP assetization platform

- Mint Liquid – Cross-chain liquidity solutions

- RareShop – A marketplace for real-world asset (RWA) trading

- NFT-AI Agent – A tool integrating data analytics and trading support

These components facilitate NFT issuance, trading, asset management, and cross-chain liquidity, enabling developers to efficiently create a variety of NFT-based applications.

Mint Blockchain also provides ecosystem incentives through MintDAO and initiatives such as "NFTs to Earn," an ecosystem fund, ETH gas rebates, and RetroPGF rewards to encourage innovation in NFT asset formats and application development. Additionally, the project promotes NFT asset standardization, addressing key challenges such as liquidity constraints and copyright management, paving the way for a more structured NFT ecosystem.

Unlike a conventional transaction network, Mint Blockchain functions as a dedicated infrastructure layer for NFT assets. Its primary goal is to enhance the utility of NFTs across multiple use cases while offering developers and users more efficient and reliable tools.

II. Project Highlights

1. A Layer2 Solution Tailored for the NFT Ecosystem

As part of the Optimism Superchain, Mint Blockchain is built on OP Stack, inheriting Ethereum’s security and decentralization while optimizing NFT transactions and asset management. As an EVM-compatible Layer2 network, it significantly reduces gas fees, making NFT minting and trading more cost-effective while allowing developers to deploy smart contracts efficiently.

2. Comprehensive NFT Infrastructure Covering the Entire Asset Lifecycle

Mint Blockchain offers an end-to-end NFT ecosystem infrastructure, including:

- Mint Studio – NFT minting solutions

- IP Layer – NFT asset management

- Mint Liquid – Cross-chain liquidity tools

- RareShop – RWA trading marketplace

- NFT-AI Agent – Data analysis and trading assistance

This integrated suite supports the full NFT journey, from creation to trading and asset management, enhancing NFT usability and overall market value.

3. Cross-Chain Liquidity and Asset Interoperability

With Mint Liquid, NFTs and tokens can aggregate liquidity across multiple blockchains, improving trading depth and addressing NFT liquidity challenges. Additionally, the IP Layer supports 20+ major blockchains, including Ethereum, Solana, Optimism, and BNB Chain, enabling seamless cross-chain interoperability and expanding the reach of NFT assets.

4. Strong Ecosystem Incentive Programs

Mint Blockchain has established MintDAO and introduced various incentives, including "NFTs to Earn," an ecosystem fund, ETH gas rebates, and RetroPGF rewards, to encourage developers to create innovative NFT applications and protocols. These incentives foster both NFT asset innovation and infrastructure growth, ensuring long-term ecosystem sustainability.

III. Market Cap Expectations

As a Layer2 network dedicated to NFT asset infrastructure, $MINT plays a role in NFT minting, IP asset management, cross-chain liquidity, and RWA trading. To assess its potential market cap, we compare it with other Ethereum Layer2 scaling solutions such as Arbitrum ($ARB), Optimism ($OP), and zkSync ($ZK), an Ethereum scaling and privacy engine.

IV. Tokenomics

- Total Supply: 1,000,000,000 $MINT

- Initial Circulating Supply: 16.8%

Token Allocation & Vesting Schedule

- MintDAO: 50% (Released periodically)

- Early Contributors: 20% (10% unlocked at TGE, 6-month cliff, fully unlocked over 8 months)

- Community Airdrop: 12% (83.3% unlocked at TGE, remaining 16.7% reserved for Mint Forest V3 user incentives, airdrop in 2026)

- MintCore Team: 18% (10% unlocked at TGE, 1-year cliff, fully unlocked over 12 months)

Token Utility

- Governance: $MINT functions as Mint Blockchain’s governance token, allowing holders to participate in on-chain governance, vote on key parameters, protocol upgrades, and ecosystem development.

- Ecosystem Incentives: Used to reward developers contributing to the Mint Blockchain ecosystem, including infrastructure development, NFT protocol innovation, and RWA asset issuance.

- Network Asset: $MINT serves as the native asset of Mint Blockchain, used for transaction fees, staking for network security, and as an official payment method.

- Asset Pricing: Acts as a pricing benchmark for RWA, NFTs, meme tokens, and other assets, ensuring market stability and predictability.

$MINT Staking & Restaking Mechanism

Staking $MINT offers a 15% APR mining reward (funded by MintDAO). Stakers receive sMINT as a staking certificate, which can be further converted into BC721 Mint-eNFT for restaking, allowing them to earn 50% of Mint Blockchain’s Sequencer transaction revenue.

V. Team & Funding

Team Overview

- MintCore – The core development team behind Mint Blockchain, responsible for blockchain architecture, Layer2 development, cross-chain bridges, transaction sequencing, and other key components.

- NFTScan Labs – The team behind NFTScan, a leading blockchain infrastructure provider and co-founding team of Mint Blockchain, responsible for key infrastructure such as block explorers, NFT browsers, developer documentation, SDK tools, and NFT hardware/software solutions.

Funding

- May 31, 2024 – Completed seed round funding, raising $5 million.

- Investors: Mask Network, SNZ Holding, GoPlus Security, Jsquare, PANONY, Antalpha Ventures, NFTScan, WhiteList Ventures, Mike, Victor Zhang, BlockAI Ventures, Predator Capital.

VI. Potential Risks

- NFT Market Cyclicality: The NFT market is highly cyclical—experiencing surges in bull markets but contractions in bear markets. Since 2022, the NFT sector has cooled down, with many blue-chip NFT prices dropping significantly. If NFT market activity continues to decline, it could hinder Mint Blockchain’s growth and ecosystem adoption.

- Developer and Project Adoption: As a new Layer2 network, Mint Blockchain must attract developers and projects to build a thriving ecosystem. However, the majority of NFT activity currently takes place on Ethereum, Solana, and Polygon. To gain traction, Mint Blockchain must offer compelling technical advantages and incentives to encourage developers to migrate or launch applications on its network.

VII. Official Links

- Website: https://www.mintchain.io/

- Twitter: https://x.com/Mint_Blockchain

- Discord: https://discord.com/invite/mint-blockchain

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto in a bear market, rebound likely in Q3

Coinbase reports a shrinking crypto market and bearish signals but expects a potential rebound later in 2025.

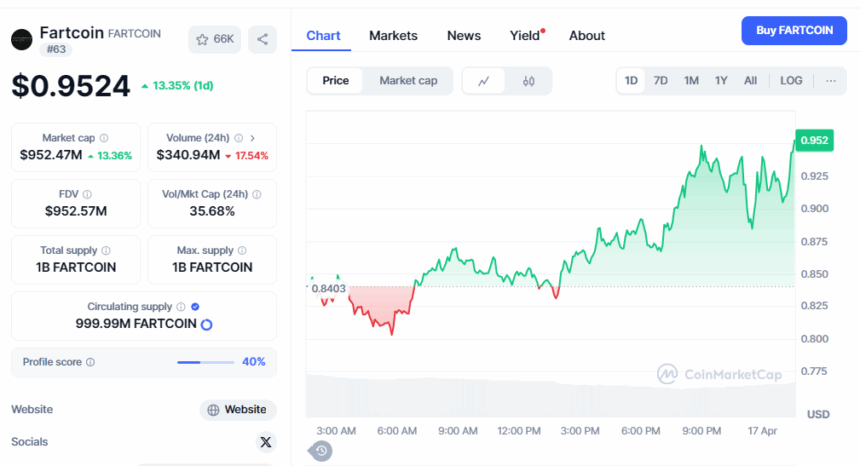

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?