Bitget Daily Digest (March 7) | Trump signs executive order to establish strategic Bitcoin reserve, Movement mainnet launch gains attention

远山洞见2025/03/07 08:53

By:远山洞见

Today's preview

1.U.S. February unemployment rate: Previous: 4.00%. Forecast: 4.00%.

2.U.S. February non-farm payrolls: Previous: 143K. Forecast: 160K.

3.White House Crypto Summit scheduled for March 7 at 18:30 (UTC).

Key market highlights

1.White House AI and crypto policy lead David Sacks announces

that President Trump has signed an executive order to establish a strategic Bitcoin reserve, funded through assets seized in criminal and civil cases—without any taxpayer involvement. The U.S. government reportedly holds around 200,000 BTC and will conduct a full audit. The Bitcoin in the reserve will not be sold. Additionally, a U.S. digital asset reserve has been created to manage other seized digital assets, operated by the Treasury Department, with no plans for additional government purchases.

2.Following an increase in Trump's WLFI crypto project holdings the previous day, $MOVE surges to a new short-term high.

Today, Movement officially announces its mainnet launch on March 10. Meanwhile, Gmeme, a memecoin issuance platform supported by Movement, is making moves, potentially triggering a new wave of speculative inflows. The market is closely watching ecosystem opportunities.

3.RedStone, a cross-chain oracle, faces major community backlash over its airdrop distribution, leading to the temporary suspension of its listing on CEXs. The controversy erupted after the project introduced new eligibility thresholds at the last minute, making about 98% of users ineligible and significantly reducing airdrop allocations. In response to mounting criticism,

RedStone announces an additional 2% token distribution to appease the community.

4.Trump announces a temporary suspension of 25% tariffs on specific goods from Mexico and Canada under the United States-Mexico-Canada Agreement (USMCA).

This exemption will last until April 2, offering a short-term buffer for both nations. The previous broad tariff policy had fueled risk-off sentiment, pressuring U.S. equities and the crypto market, with capital flowing into safe-haven assets. With this policy relief, market sentiment has improved, potentially benefiting Bitcoin and other safe-haven assets.

Market overview

1.BTC experiences short-term volatility, hovering around the 90,000 level. The broader market sees a pullback, with only $BGB and $BCH posting gains among the top 50. The new token $RED sees an initial surge at launch but later declines, likely impacted by community sentiment.

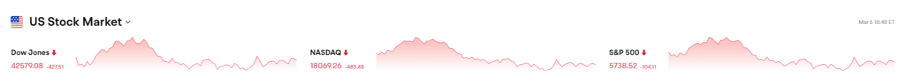

2.The Nasdaq plunges over 2%, entering a correction phase. Nvidia drops nearly 6%, while the U.S. dollar erases its post-election gains. The European Central Bank (ECB) follows through with its expected rate cut, lowering rates by 25 basis points.

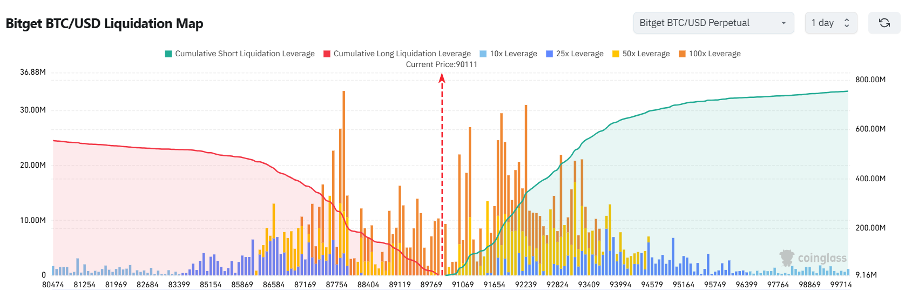

3.Currently standing at 90,017 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 89,017 USDT could trigger

over $176 million in cumulative long-position liquidations. Conversely, a rise to 91,017 USDT could lead to

more than $81 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

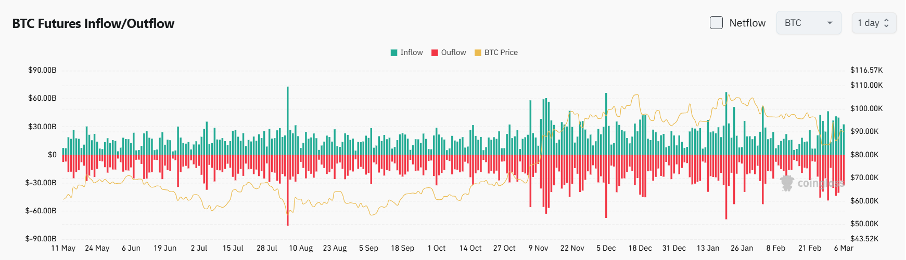

4.In the past 24 hours, BTC saw $3.48 billion in spot inflows and $3.41 billion in outflows, resulting in

a net inflow of $70 million.

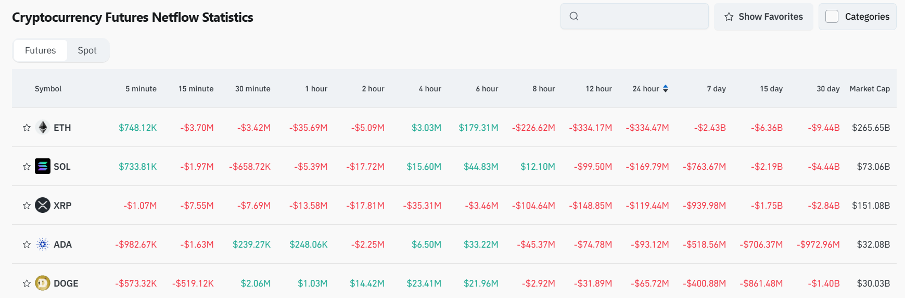

5.In the last 24 hours, $BTC, $ETH, $XRP, $SOL, and $ADA led in

net outflows in futures trading, signaling potential trading opportunities.

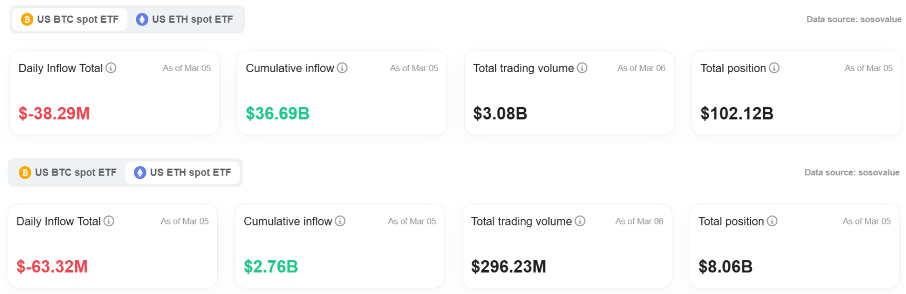

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $38.2958 million, while the cumulative inflows amount to $36.688 billion, with total holdings at $102.119 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $63.3202 million, with cumulative inflows of $2.758 billion and total holdings of $8.053 billion. Outflows have increased compared to the previous day.

Institutional insights

Glassnode: The strategic Bitcoin reserve narrative has become a classic "sell the news" event. The key BTC price level is $92,000.

Read the full article here:

https://cointelegraph.com/news/is-bitcoin-price-going-to-crash-again

Greeks.live: Options market data shows a 33.3% probability of BTC hitting $100,000 by the end of March and a 48.64% probability by the end of June.

Read the full article here:

https://x.com/BTC__options/status/1897612624923127995

News updates

1.The Texas Senate passes Bitcoin strategic reserve bill (SB 21).

2.ECB delivers an expected 25-basis-point rate cut.

3.Emirates NBD, a Dubai government-backed bank, launches crypto trading via the Liv X app.

4.Japan's ruling party proposes lowering the maximum crypto tax rate to 20%.

Project updates

1.World launches the World Chat mini-app, which integrates seamlessly with the World app wallet.

2.Trump family crypto project WLFI partners with Sui Network.

3.RedStone to distribute an additional 2% of total RED tokens to previously missing community members.

4.Jito Foundation contributors initiate discussions on token buybacks and incentives.

5.UXLINK partners with Japan's Web3 accelerator Pacific Meta to expand into the Japanese market.

6.Suilend experiences service disruptions due to third-party custodian issues; funds remain safe.

7.Bitget Wallet integrates with the Sonic ecosystem, enabling market tracking and trading support.

8.Multi-signature wallet provider Safe identifies North Korean hacking group TraderTraitor as the culprit behind a previous attack.

9.Pump.fun sees no newly graduated tokens surpass $1 million in market cap in the past 24 hours.

10.BlackRock resumes Bitcoin purchases after a two-week hiatus, now holding approximately $51.9 billion in BTC.

Highlights on X

@lanhubiji: The U.S. crypto strategic reserve – A two-pronged defense for dollar hegemony and future currency battles

The core purpose behind the U.S. crypto strategic reserve is to fortify dollar dominance. On one hand, by stockpiling crypto while it poses no immediate threat to the USD's supremacy, the U.S. controls its circulation and pricing power, preventing alternative national or supranational digital currencies from gaining traction. On the other, it acts as a contingency plan for a potential decline of the USD, ensuring that if the traditional fiat system is disrupted, crypto can serve as a decentralized hedge against emerging currencies like the digital CNY. This strategy tempers crypto’s disruption of the monetary system while preserving the U.S.'s strategic flexibility amid global financial shifts, reinforcing its monetary hegemony through a defensive-first approach.

@Ice_Frog666666: RedStone airdrop controversy – Changing rules and a collapse in community trust

The RedStone airdrop fiasco has sparked outrage over last-minute rule changes, including a new "special role" requirement that disqualified 98% of participants. Additionally, allegations of insider allocation emerged, as only 4000 addresses received tokens. The final distribution was also drastically reduced — while the project originally promised 10%, only 2% was ultimately allocated. The project lured users with task-based incentives, only to alter the rules at the last minute, betraying community trust. RedStone's exchange listing and regulatory narrative appear to be a façade to justify what many see as a predatory cash grab.

Rui: 2025 Crypto market outlook – Key trends in policy, liquidity, and innovation

This year's crypto market is set to be shaped by policy battles, liquidity shifts, and infrastructure advancements: The U.S. crypto reserve strategy (BTC holdings) is a long-term play for dollar supremacy, though near-term implementation remains challenging. Market fragmentation is intensifying — high-risk traders (Solana memecoins, leveraged DEXes) coexist with long-term investors (RWA tokens, compliant stablecoins). Institutional capital is being steered by ETF expansion and macro policies. Blockchain competition is focused on performance and ecosystem integration: Solana's SIMD proposals aim to stabilize price volatility. Hyperliquid's HyperEVM seeks to bridge trading and smart contracts. Monad's testnet demonstrates high TPS potential. Emerging projects are targeting Web2-Web3 bridges (such as Validator-as-a-Service), yield-generating BTC solutions, and compliant stablecoin entry points. The industry is gradually transitioning from idealistic decentralization to commercial viability, fostering a hybrid landscape of decentralization and regulatory alignment.

hoeem: Surviving crypto's high-volatility rotational cycles

The current crypto market cycle is one of extreme volatility and fading strategies. From meme coins to AI narratives to RWA tokens, the hype cycle is spinning at record speed—most assets see rapid spikes followed by sharp corrections, leaving slow-exiting traders with zero gains. The market whipsaws between fake breakouts and emotional swings, with liquidity constantly shifting to VC-backed projects, short-term fads, and newly launched protocols. Any delayed position adjustment risks getting wiped out by sharp pullbacks. Profit windows are shrinking, requiring precise timing and strict profit-taking discipline. Whether it's political token speculation or airdrop windfalls, success hinges on agility and execution.

12

4

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

APT and RENDER Testing Key Support Amid Major Decline – Will This Pattern Spark a Recovery?

CoinsProbe•2025/03/09 21:55

Movement (MOVE) Gains Momentum with Key Breakout – Will it Carry Upside Momentum?

CoinsProbe•2025/03/09 21:55

Pi Network (PI) Suffers Double-Digit Decline – What to Expect Ahead?

CoinsProbe•2025/03/09 21:55

Is Ethereum (ETH) About to Make Bullish Reversal? Whale Moves and Key Patterns Point to a Rally

CoinsProbe•2025/03/09 21:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$80,982.21

-6.14%

Ethereum

ETH

$2,026.43

-8.09%

Tether USDt

USDT

$1

+0.04%

XRP

XRP

$2.14

-8.50%

BNB

BNB

$555

-6.63%

Solana

SOL

$127.11

-7.55%

USDC

USDC

$0.9999

-0.01%

Cardano

ADA

$0.7189

-11.23%

Dogecoin

DOGE

$0.1682

-12.83%

TRON

TRX

$0.2334

-4.43%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now