FTX's $500 million bet on Anthropic would be worth nearly $2.5 billion — if it hadn't sold

Quick Take Sam Bankman-Fried led Anthropic’s Series B, with a $500 million investment to acquire approximately 13% of the AI development firm. This initial $500 million investment would now be worth close to $2.5 billion, assuming the usual amounts of dilution. Bankman-Fried, who has long argued that FTX was solvent but illiquid, is apparently pleading for clemency from President Trump.

Anthropic raised $3.5 billion at a $61.5 billion valuation in a round by Lightspeed Venture, according to an announcement on Monday. Cisco Investments, D1 Capital Partners, Fidelity, General Catalyst and Salesforce Ventures, among others, participated.

In 2021, the now-bankrupt crypto exchange FTX and trading firm Alameda Research invested $500 million in Anthropic, an AI development company founded by former OpenAI researchers. FTX, founded by Sam Bankman-Fried, held an approximately 13% stake in the company at the time.

Had FTX held its stake, its initial $500 million investment could have been worth as much as $2.5 billion, assuming its holdings were diluted at rates similar to other Silicon Alley ventures given the amount of subsequent rounds.

FTX collapsed in November 2022 amid allegations of fraud and mismanagement and entered bankruptcy proceedings. As part of its efforts to liquidate assets and repay creditors, the FTX bankruptcy estate sold its entire stake in Anthropic. FTX's Anthropic stake was worth over $1.3 billion when the AI firm hit a $18 billion valuation last year. This was later lowered to about 8% due to dilution.

Dilution varies depending on how much capital is raised and at what valuation, but can be conservatively estimated to be about 10% per round for early investors. This means that after six rounds, FTX's ownership stake would be closer to 3%, which would be worth around $2 billion at Anthropic's current valuation following its most recent Series E funding round.

Bankman-Fried led Anthropic's $580 million Series B in 2021 with participation from FTX employees Caroline Ellison and Nishad Singh. At the time, FTX held an estimated 13.56% stake in Anthropic at an $3.7 billion post-money valuation. Anthropic has announced at least eight distinct funding events since its founding in 2021, though it has not always been consistent with its terminology. For example, on two separate occasions Anthropic raised funds from Google and Amazon, and simply referred to them as "funding rounds."

In March 2024, FTX sold about two-thirds of its stake in Anthropic for $884 million. ATIC Third International Investment Company, a firm with ties to Abu Dhabi’s Mubadala sovereign wealth fund, was the largest buyer, having purchased $500 million in shares. Jane Street, the trading firm where Bankman-Fried and several FTX executives worked before founding the exchange, also participated. FTX sold its remaining Anthropic shares worth about $452 million in mid-2024, bringing the total dollar value of its investment to about $1.3 billion.

Bankman-Fried has argued, including in his first public comments since being incarcerated , that FTX was solvent but illiquid and that all customers could have been made whole had he not filed for bankruptcy.

FTX and Alameda were early buyers of several cryptocurrencies, including Solana’s SOL and Sui’s SUI. Last year, Mysten Labs paid $96 million to repurchase FTX’s equity stake and tokens.

The exchange began its first round of disbursements to former users on Feb. 18. Many former customers have complained that their refunds reflect the market value of digital assets at the time of FTX’s collapse, in November 2022, rather than current prices.

Updated Mar. 3 (19:55 UTC): Amount of possible valuation reduced by estimated diluted amounts given the amount of subsequent investments into the firm.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

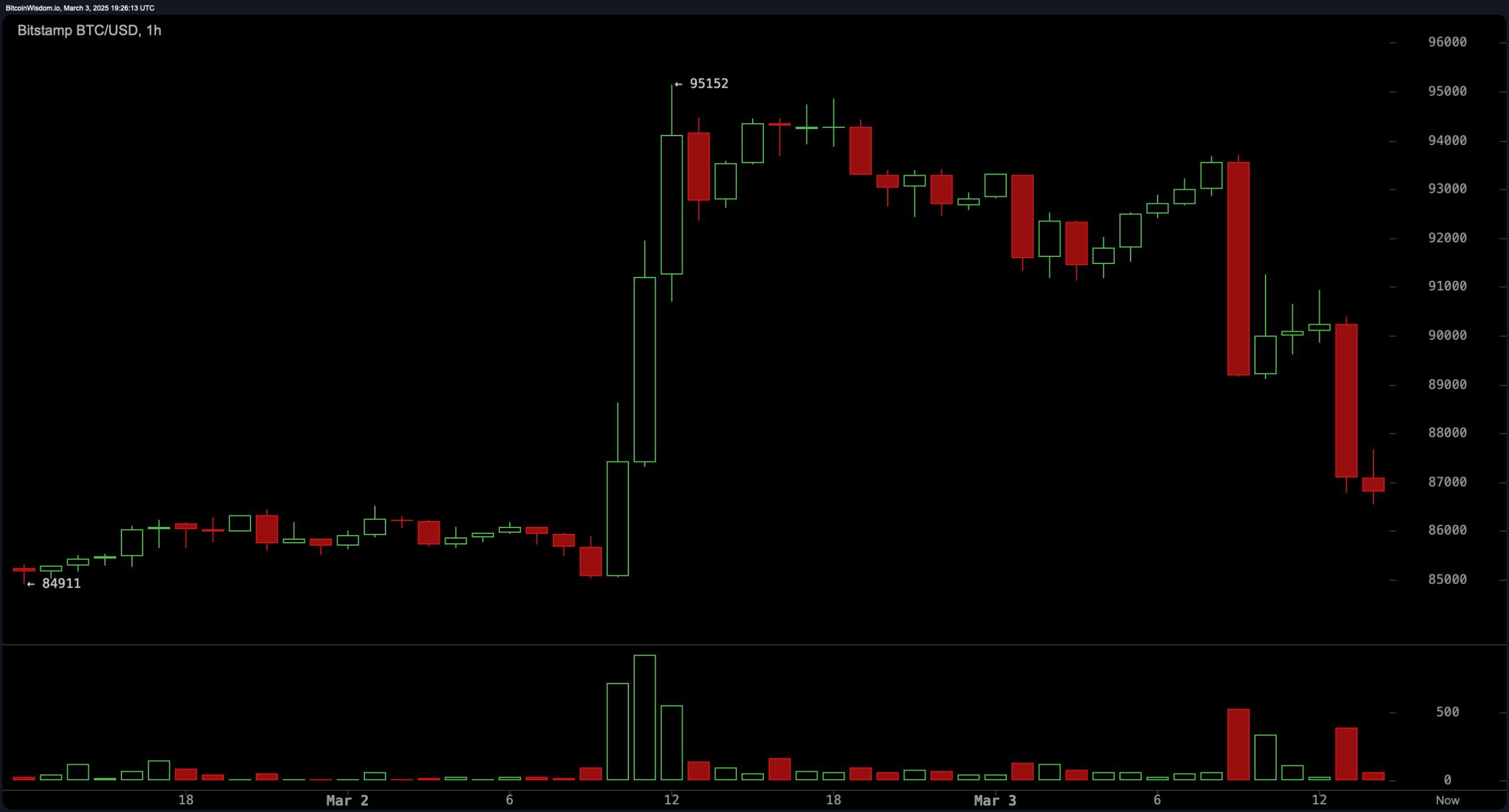

BTC in Freefall: Trump’s ‘External Agricultural Product’ War Wipes 7% Off Crypto Markets

Litecoin, SOL and XRP Price Drop Ahead of Trump “Big Announcement”

Trump’s latest post teased, “TOMORROW NIGHT WILL BE BIG. I WILL TELL IT LIKE IT IS!”

Breaking the Trendline: Bitcoin’s Route to $109K

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?