Bitcoin Price Still Below $90K: 12% Of Addresses At A Loss

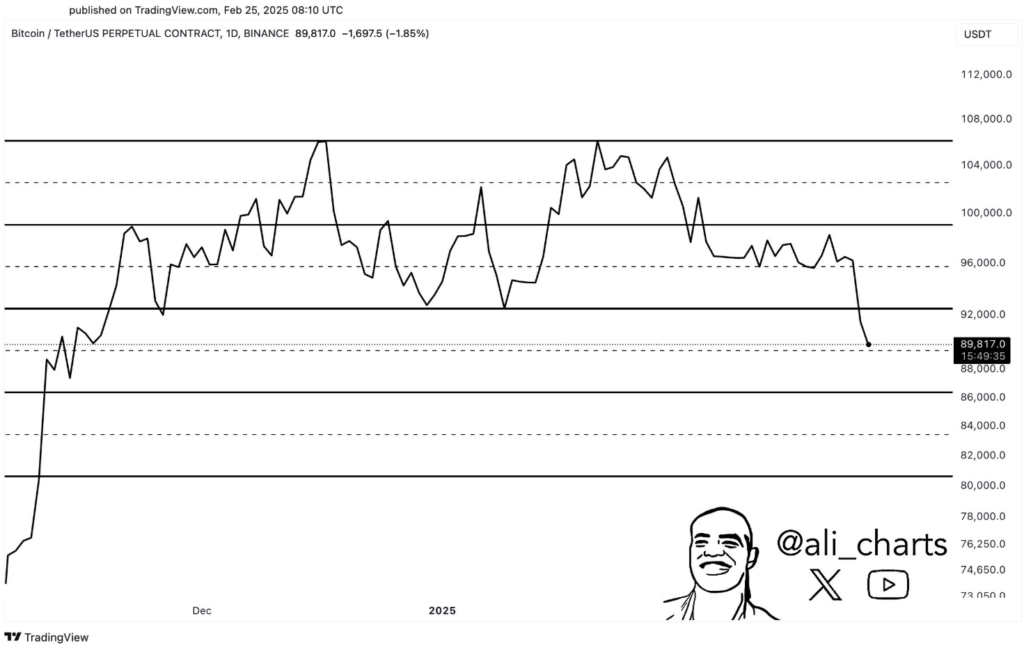

12% of Bitcoin addresses are at a loss, the highest since October 2024. Bitcoin sentiment drops to its most bearish level in a month. Bitcoin has broken below a key parallel channel, targeting $81k unless $92.5k is reclaimed.

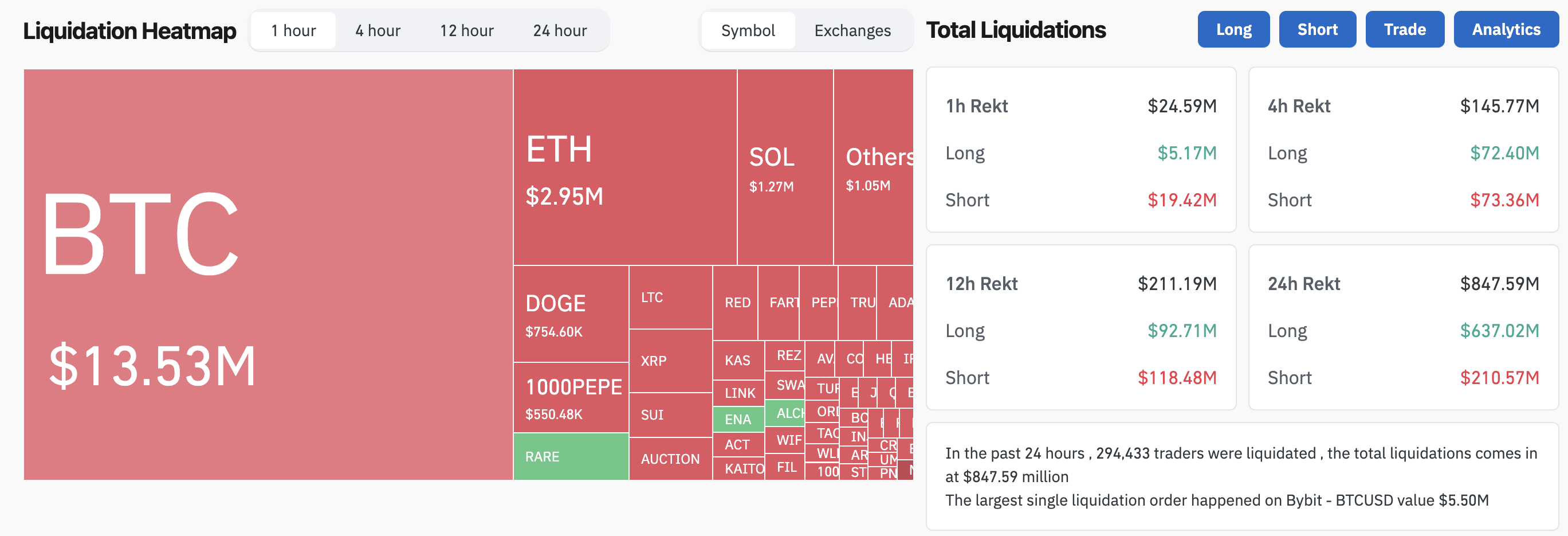

The market reacted strongly to Bitcoin’s brief fall beneath $90,000, which caused panic among traders and financial investors. The recent price drop caused Bitcoin addresses to reach 12% negative unrealized loss status, the highest since October 2024 peak.

Bitcoin Historical In/Out of the Money | Source: Intotheblock

Bitcoin Historical In/Out of the Money | Source: Intotheblock

A loss becomes unrealized when investors maintain ownership of assets that lost value before selling them.

The Bitcoin holders who maintain their assets would experience losses if they decided to sell their coins at the present market value.

This significant rate of addresses experiencing losses indicates a change in market sentiment because investors now show concern about additional price declines.

Moreover, the ongoing decline of the Bitcoin price below a technical parallel channel pattern suggests investors should prepare for a deeper market correction.

The asset may move toward $81,000 if Bitcoin fails to regain $92,500 support, and this development would cause additional stress for investors who already showed signs of nervousness.

Bitcoin Faces Bearish Sentiment Amid Regulatory News

The price decline of Bitcoin occurs amid mounting regulatory pressure alongside changing market sentiment, which intensifies the market’s uncertainty.

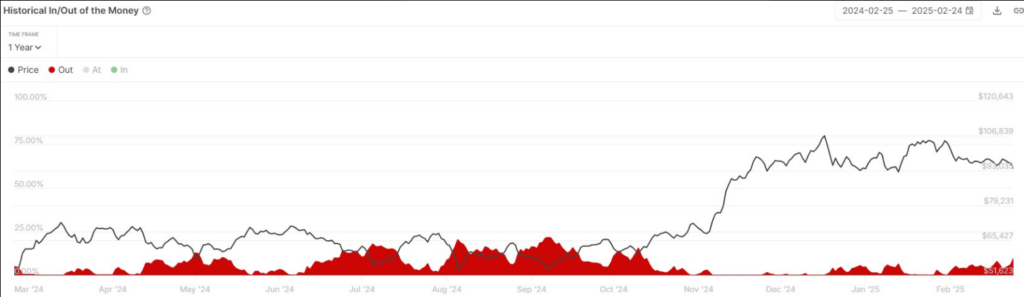

The sentiment index for Bitcoin reached its lowest point since January 2025 at 14.7% during the previous month.

With this shift, the market shows rising investor uncertainty as well as skepticism, which explains this sudden price change.

Source: CryptoQuant

Source: CryptoQuant

Additionally, the bearish market sentiment continues to grow stronger because of existing regulatory obstacles. The Wyoming state legislature made a decision on February 10, 2025 to deny bill (HB0201), which would enable state public funds to invest in Bitcoin.

A 1-7-1-0 vote by the H09 – Minerals committee resulted in the failure of the Wyoming state legislature proposal to establish Bitcoin reserves, thereby eliminating any near-term possibility for Wyoming to hold Bitcoin reserves.

Therefore, the state of Wyoming faced a significant setback in Bitcoin adoption following this regulatory decision, which stands against cryptocurrency adoption throughout the United States.

Such a bill passing through the legislature would have inspired additional states and institutions to establish Bitcoin reserves, which could boost its future value. The rejection led investors to worry about stricter regulations, which caused them to become even more cautious.

Moreover, Bitcoin faces difficult short-term conditions as the market sentiment stands at its lowest point in a month and Bitcoin faces both price difficulties and political barriers.

Will BTC Price Drop to $81K as it Breaks Below Key Support Levels?

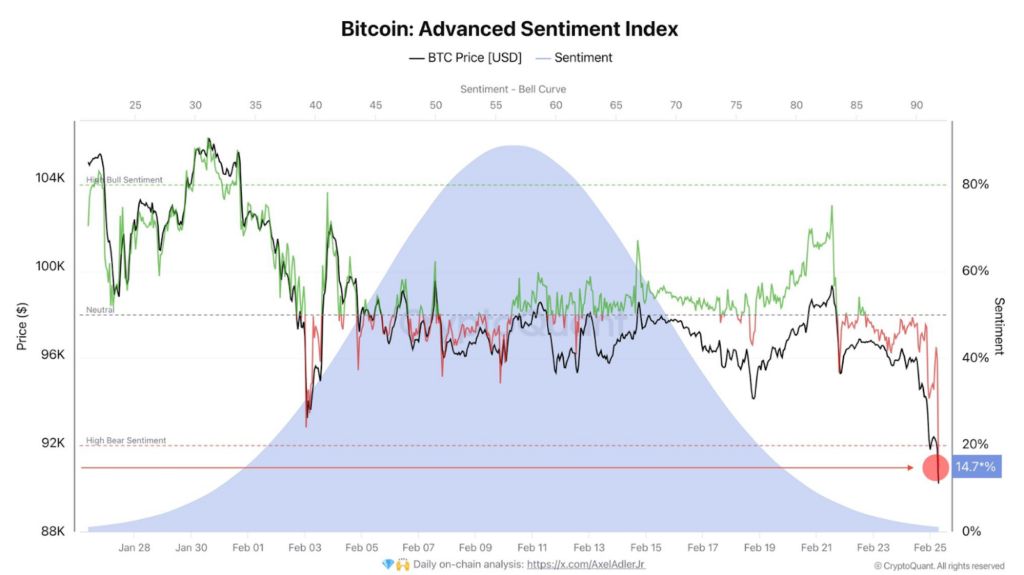

According to an analysis posted on X by Ali Charts, the technical setup of Bitcoin continues to worry traders because it broke through an essential parallel channel, which indicates potential trend change or continuation.

Bitcoin’s future depends on its ability to rise above $92,500 within the next period, as experts predict $81,000 will become the next important support level.

The price movements of Bitcoin have consistently played in the parallel channels, a price pattern that often signals either a trend continuation or reversal.

Source: Ali Charts

Source: Ali Charts

In December 2024, Bitcoin experienced a steep price drop, which ended with a support level near $85,000.

The asset recovered at that time, but current negative market sentiment leads investors to predict another major price drop.

$92,500 functions as an essential threshold that demands significant attention. A successful breakout above $92,500 would likely restore bullish momentum that could drive Bitcoin prices towards $95,000 or higher.

Bitcoin will face increased prospects of reaching the $81,000 support level if it fails to surpass this key resistance level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network Under Pressure: Will Pi Coin Hold or Plunge Below $1?

Bitcoin’s Correction Might Be Ending Amid Weak Dollar and Stable Derivatives Markets

Trump’s New Tariffs on Canada: Potential Impacts on Bitcoin and Market Uncertainty