Gold-Back Cryptos Outperform as Precious Metal ETF Inflows Near Three-Year High

From coindesk By Francisco Rodrigues| Edited by Stephen Alpher

What to know:

- ETFs backed by gold just experienced their largest weekly inflow since March 2022, reaching 52.4 tons, valued at approximately $4.9 billion.

- Gold's price has risen nearly 11% year-to-date and by more than 43% over the past year, driven by geopolitical tensions and uncertainty surrounding tariffs.

- Among crypto tokens benefitting are PAXG and XAUT.

While spot bitcoin exchange-traded funds yesterday registered their largest-ever daily outflow as investors pulled out nearly $1 billion, spot gold ETFs continue to see large inflows, a potential boon for gold-backed cryptocurrencies.

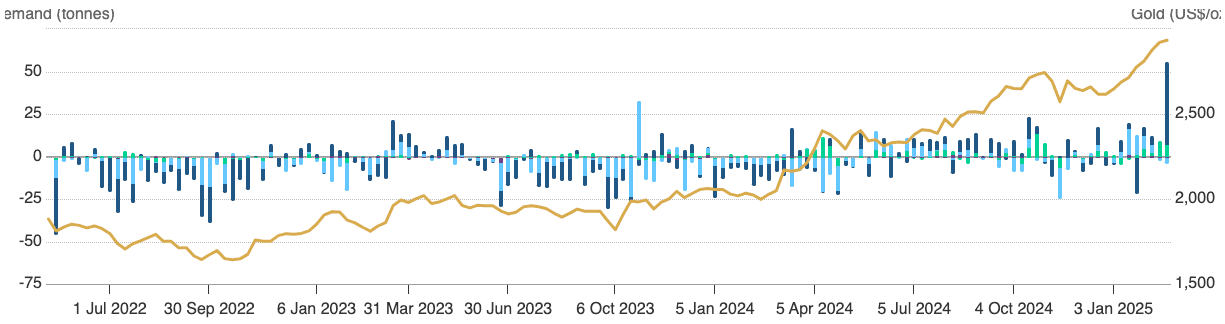

Physically-backed gold ETFs last week saw their largest weekly inflow since March 2022, according to data from the World Gold Council , which showed inflows of 52.4 tons, or roughly $4.9 billion, with most of the added demand coming from North America.

In all, gold ETF holdings are at 3,326 tons worth roughly $314 billion, according to the group.

Gold ETF demand and price (World Gold Council)

Despite some declines over the past few days, gold is higher by just shy of 11% so far in 2025, 43% year-over-year and currently trading at $2,910 per ounce. Among the reasons noted by analysts could be growing geopolitical tensions and uncertainty surrounding threatened Trump tariffs.

Gold-backed cryptocurrencies, including Paxos gold (PAXG) and Tether gold (XAUT), which were designed to track the metal's price, have thusly outperformed the broader crypto market which is higher by 26% year-over-year as measured by the CoinDesk 20 Index .

Demand for these tokens has risen as well. Data from RWA.xyz shows that over $25 million worth of commodity-backed tokens were minted this month, the largest monthly volume since December 2022, while around $12 million were burned.

With demand for gold rising steadily, supply seems to have barely been changing. Data from the World Gold Council shows that mining production in the fourth quarter of last year dropped by around two tons over the previous quarter, while hedging and recycling grew. In total, tracked supply rose around 1% year-over-year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK Finance Minister calls for ‘ambitious new relationship’ with EU while navigating US tariffs impact

Share link:In this post: UK Finance Minister Rachel Reeves urges a bold reset in relations with the European Union to eliminate trade barriers and rebuild post-Brexit trust. Reeves warns that Donald Trump’s newly imposed tariffs could devastate the UK economy and ripple across global markets. In response to rising trade tensions, the UK government unveils a £20 billion boost in export financing to support struggling industries and supply chains.

ai16z founder: Launchpad platform auto.fun may be launched this week

Crypto Crash Hits Hard: 5 Cryptos That Collapsed in 24 Hours