WazirX Rebalancing Done, But Will Creditors Recover Fully?

The company is now attempting to move forward by proposing a Scheme of Arrangement to its creditors.

WazirX has announced that rebalancing has been completed and expects to begin a first fund distribution. Following the 2000 CR hack, the majority of users are frustrated with the obnoxious management by the CEO, Nischal, and his team in resolving the issue.

While users are waiting for over 6 months to get their cryptos back, the funds remaining in the exchange’s custody are to be distributed following a scheme WazirX proposes to users.

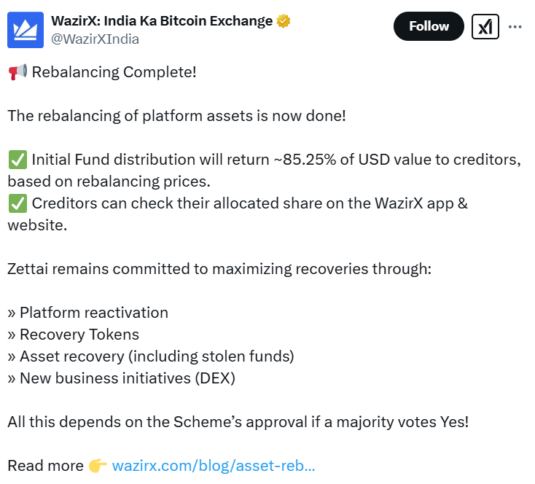

As per the recent post, the company aims to return approximately 85.25% of the USD value to creditors based on rebalancing prices in the initial fund distribution.

WazirX Rebalancing Done, Source: X

WazirX Rebalancing Done, Source: X

Following the WazirX hack, Zettai Pte Ltd, the entity managing the platform’s restructuring, has finalized the rebalancing of its Net Liquid Platform Assets (NLPA).

The company is now attempting to move forward by proposing a Scheme of Arrangement to its creditors. If approved by a majority, the scheme would enable the platform to restart operations and distribute the rebalanced assets within 10 business days of becoming effective.

If the majority rejects the scheme, fund recovery efforts could face significant delays. Without an approved arrangement, creditors may have to endure years of waiting, with some estimates suggesting potential delays until 2030.

WazirX has rebalanced its assets to align with liabilities, which means creditors will get tokens equivalent to the INR amount at the time of the hack and not get all the tokens they used to own. This assures proportionate distribution while exposing consumers to cryptocurrency price swings.

The first payout will be in crypto, with low-liquidity tokens such as ANT, LOVELY, PUSH, GFT, OOKI, MDX, BOB, and WRX partially converted to USDT or another stablecoin for better usability.

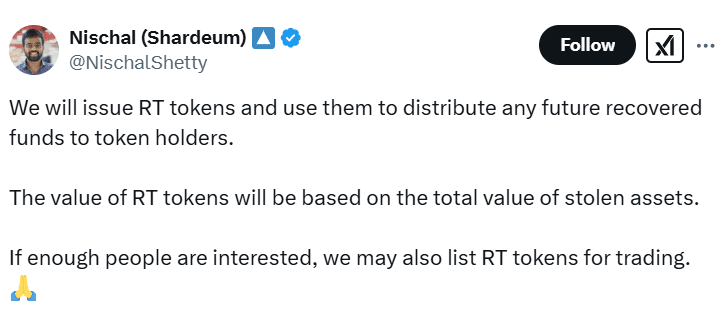

Nischal Shetty, owner of WazirX, also emphasized there is also introducing Recovery Tokens, which will be airdropped to creditor accounts. The value of the RT token will be tied to the total stolen assets.

Nischal Shetty on RT Tokens, Source: X

Nischal Shetty on RT Tokens, Source: X

Nischal has also hinted that if the creditors demand, WazirX may also list the tokens for trading.

These include stolen asset recovery, where retrieved funds could be used to buy back tokens, profit sharing if WazirX becomes profitable, and new ventures like a planned decentralized exchange (DEX) to generate revenue.

With all this happening, one thing is sure: WazirX users are not getting their crypto assets back, and WazirX is forcing them a not-so-great deal. They are not getting all their crypto assets, which means they have missed the opportunity to actually gain profit in the bull run that began in Dec last month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pump.fun Launches PumpSwap Amid Decline in Revenue

Shiba Inu Prepares for Potential Price Rally

BONE Token Sees Significant Price and Volume Increase

PumpSwap Launch Aims to Boost pump.fun’s Activity