Floki Price Prediction: FLOKI Plummets 5% As Investors Shift To This AI Pepe That’s Raised $5.2 Million In Presale

The Floki price plummeted 25% in the last week and 5% in the last 24 hours to trade at $0.00009442 as of 00:12 a.m. EST on trading volume that dropped 41% to $166 million.

Floki Price On A Sustained Bearish Trend

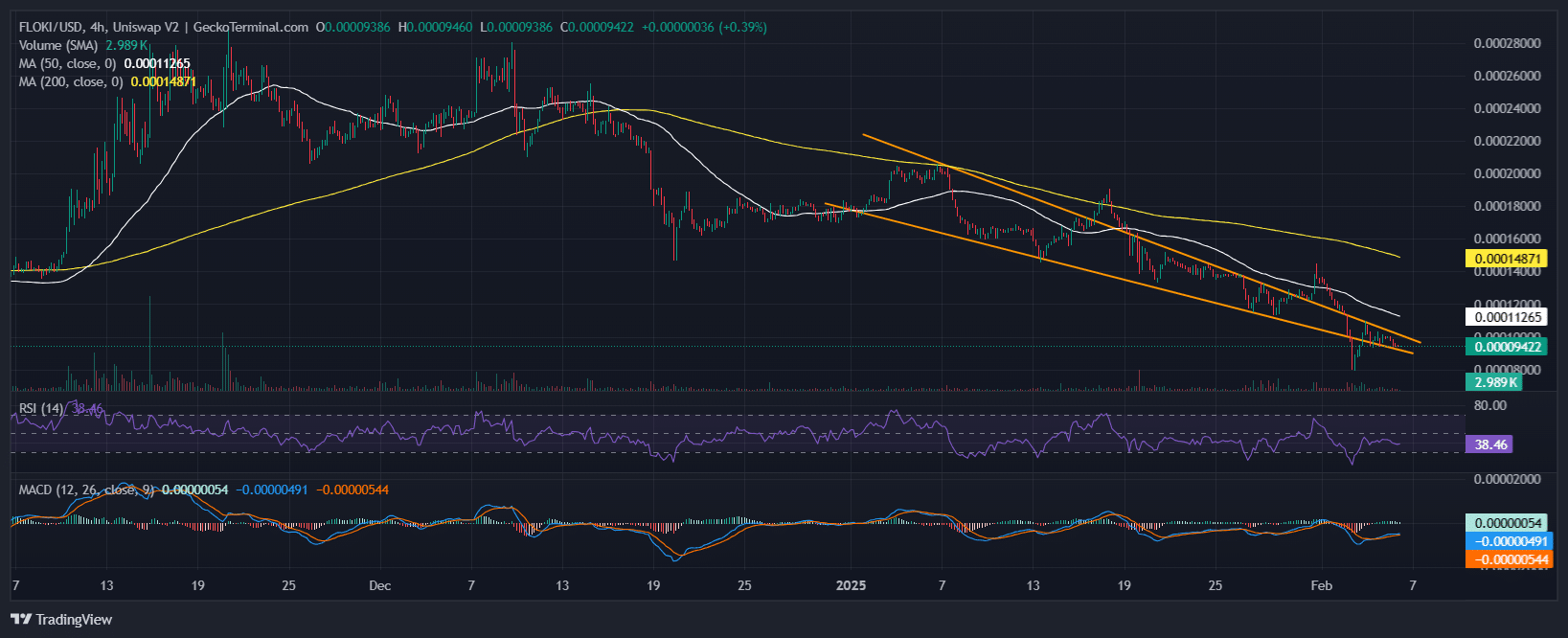

The FLOKI price analysis on the 4-hour chart exhibits a clear downtrend within a falling wedge pattern, indicated by two converging trend lines.

The Floki price has been making lower highs and lower lows, which suggests strong bearish momentum in recent weeks.

Currently, FLOKI is attempting to break out of this descending wedge, hovering around $0.00009422. However, the price of Floki remains below key moving averages, which suggests that bearish pressure is still dominant, according to GeckoTerminal data

The 50-day Simple Moving Average (SMA) (white line) is acting as a dynamic resistance, while the 200-day SMA is positioned even higher at $0.00014871, confirming that the long-term trend remains bearish. If bulls can push the price above the 50-day SMA, it could signal an early sign of recovery.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows signs of a slight rebound, with the blue MACD line crossing above the orange signal line.

FLOKI/USDT Chart Analysis Source: GeckoTerminal

FLOKI/USDT Chart Analysis Source: GeckoTerminal

Will FLOKI Rally Or Crash?

Given the current technical setup, FLOKI remains in a downtrend, but there are early signs of a possible bottoming formation near the lower boundary of the falling wedge pattern.

If the Floki price continues to struggle below the 50-day SMA ($0.00011265), we may see further declines towards $0.00009000 or even lower within the channel.

Conversely, if the price of FLOKI bulls push FLOKI above the falling wedge and 50-day SMA, a rally towards the 200-day SMA ($0.00014871) could be on the horizon.

Meanwhile, investors are rushing to buy a new AI agent crypto called MIND of Pepe (MIND) . 99Bitcoins, a popular crypto channel on YouTube with over 724K subscribers, says MIND has the potential to soar 20X after its launch.

Mind of Pepe Presale Raises Over $5.2 Million

The crypto market’s new hybrid AI project, MIND of Pepe, is hurtling towards the $6 million milestone in presale funding as it continues to gain traction in the crypto space.

Investors are buying into the project for its AI ecosystem, which combines trading features with meme coin culture.

Instead of relying on basic algorithms for market analysis, MIND of Pepe scans everything from X chatter to blockchain data, picking up on potential narratives and shifts that human traders might overlook.

For example, if the crypto space has an increase in GambleFi token mentions, the project will share these insights with MIND holders in a private community channel.

MIND Could Be The Next Big Crypto

MIND also has built-in trading features that can handle routine market moves, such as swapping tokens or pursuing new yield opportunities.

MIND holders also have the opportunity to stake their tokens for a stratospheric 438% annual percentage yield (APY).

Currently, MIND tokens are priced at $0.0032662 and can be bought with either crypto or bank cards via the easy-to-use widget embedded on the project’s website.

Interested investors should buy MIND before a price hike in less than 18 hours.

Check out MIND here.

Related News

- PENGU The Biggest Loser On CoinMarketCap After 12% Drop

- Bitcoin Price Prediction As MicroStrategy Rebrands

- Best Crypto To Buy Now

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy has lost $3 billion on the 246,876 bitcoins it bought since November last year