LINK Faces Volatility Amid Whale Activity: Can It Hold Support?

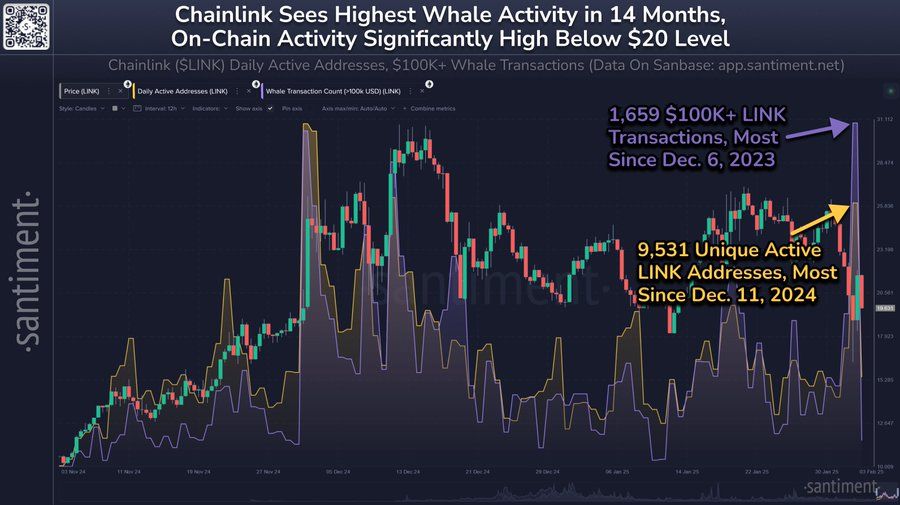

- Chainlink records 1,659 transactions over $100K, the highest since December 2023.

- 9,531 active wallets recorded, marking the most since December 2024 for Chainlink.

- Whales offload 4.13 million LINK in 48 hours, triggering volatility in price action.

Chainlink (LINK) attracts significant investor interest levels during a recent market correction period. At press time, LINK price stands at $19.93, which has decreased by 4.39% throughout the day. Chainlink experiences heightened scrutiny because of significant whale transaction patterns, including market buying and selling behaviors during market volatility. What impact will whale movements have on LINK’s ongoing price recovery from its recent market drop?

Whale Activity Influences LINK’s Price

Chainlink’s recent price action shows fluctuations between $19 and $21. Based on its price consolidation, LINK appears to have reached an essential support zone. According to Santiment, LINK saw 1,659 transactions exceeding $100K, the highest level since December 2023. The asset also recorded 9,531 active wallets, the highest number since December 2024. The rising whale transactions and active wallet numbers show growing LINK investor interest, suggesting the digital asset could experience a market price movement when market stability returns.

Source:

X

Source:

X

LINK shows signs of downward pressure despite increased whale activity as whales completed recent sell-offs. According to Ali Martinez’s analysis, the offloading of 4.13 million LINK by whales in the last 48 hours is significant since it might cause additional pricing pressure. The substantial price decline of LINK occurred after whales unloaded their vast holdings, which reached highs of $21. The chart Ali provides shows how whale movement affects LINK price trends during this substantial market dump.

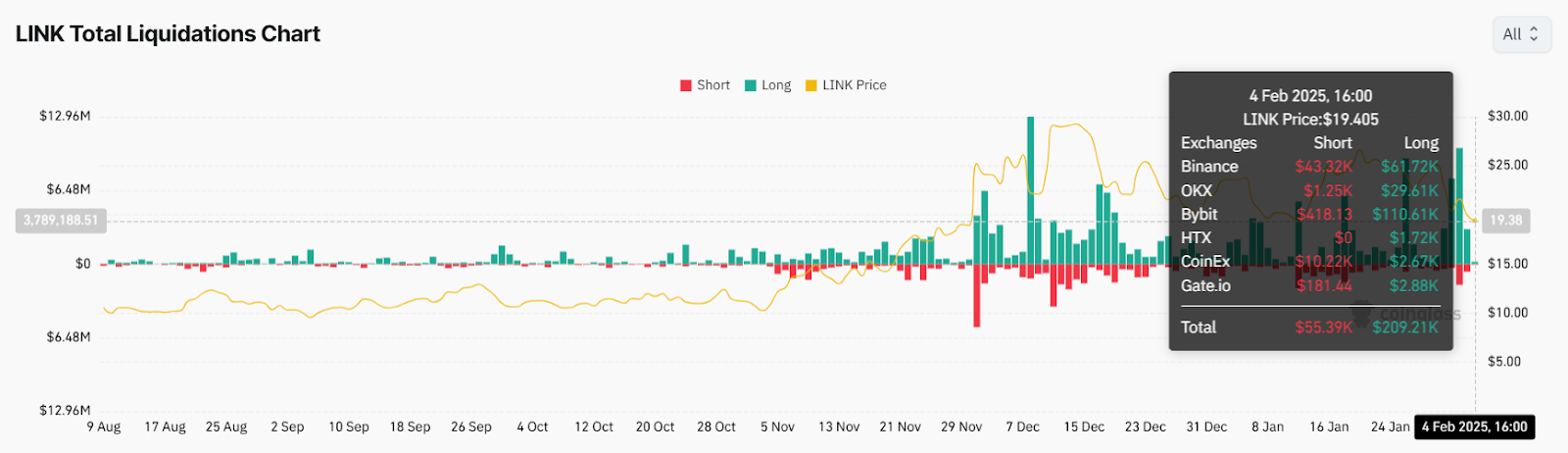

Chainlink’s Total Liquidations: How Are Traders Reacting?

Total liquidations indicate that Chainlink has faced major market oscillations. On February 4, 2025, traders faced extensive position closures that strongly affected holders investing long. The market data suggests traders are both collecting profits and closing their positions due to market confusion. Increasing market liquidations threatens to decrease LINK prices when market sentiment turns more negative.

Source:

Coinglass

Source:

Coinglass

Related: Chainlink Eyes $35 Amid Developments and Technical Strength

Conclusion: Can Chainlink Maintain Its Momentum?

Despite recent market dips, investor attention toward Chainlink remains intact based on the data showing major transactions coupled with multiple wallet address activities. The offloading of 4.13 million LINK by whales, while the technical indicators point to bearish behavior, presents potential negative risks for LINK. Link’s recovery to a bullish trend will become more likely once market conditions strengthen and temporary selling pressure declines. LINK has a neutral market direction that reveals multiple challenges and prospective benefits to traders at the present time.

The post LINK Faces Volatility Amid Whale Activity: Can It Hold Support? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Under pressure, Trump’s crypto czar divests his $200M+ crypto holdings

David Sacks divested over $200 million in digital-asset holdings to avoid conflicts of interest. Senator Elizabeth Warren criticized Sacks, questioning his crypto holdings. Sacks’ divestment details were revealed shortly before Warren’s letter requesting crypto ownership clarification.

Smart Contract Risks Could Be Global Finance’s Ticking Time Bomb, Warns Movement Labs Co-Founder

Cooper Scanlon emphasizes the serious vulnerabilities in blockchain infrastructure, especially Ethereum, highlighting the growing threat to global finance and calling for secure innovations like Move programming.

VIPBitget VIP Weekly Research Insights

Over the past month, the cryptocurrency market has faced a downturn due to multiple factors. Global macroeconomic uncertainties, such as shifts in U.S. economic policies and the impact of tariffs, have heightened market anxiety. Meanwhile, the recent White House crypto summit failed to deliver any significant positive news for the crypto market, further dampening investor confidence. Additionally, fluctuations in market sentiment have led to capital outflows, exacerbating price declines. In this volatile environment, selecting stable and secure passive-income products is more crucial than ever. Bitget offers solutions that not only provide high-yield fixed-term products but also flexible options for users who need liquidity. Furthermore, with the added security of the Protection Fund, investors can earn steady returns even amidst market volatility.

SEI Price Surges Following World Liberty Financial Purchase