What to Expect from Solana (SOL) in February 2025

Solana’s February outlook hinges on speculation about CME futures and a major token unlock. Will institutional demand drive prices higher, or will supply pressures push SOL below $200?

The meme coin mania pushed Solana to a new all-time high of $295.83 on January 19. Although SOL’s price has since declined by 22%, investors remain optimistic that it will reclaim this peak in February and surge past it.

In this analysis, BeInCrypto examines the likelihood of a rally back above $290 or an extension of its current downtrend.

Solana Faces Mixed Signals

The rumored launch of Solana futures contracts on the Chicago Mercantile Exchange (CME) could propel SOL’s price higher in February.

On January 22, a post briefly surfaced on CME’s website, suggesting that Solana futures could debut as early as February 10, pending regulatory approval. The news triggered a 3% uptick in SOL’s price before CME clarified that the post was made in error, stating that no official decision had been made regarding the launch of futures contracts for the asset.

Despite this clarification, market sentiment remains watchful. Given CME’s history of legitimizing institutional access to cryptocurrencies, any confirmation of Solana’s futures could be a major catalyst for price appreciation, potentially pushing SOL toward its all-time high.

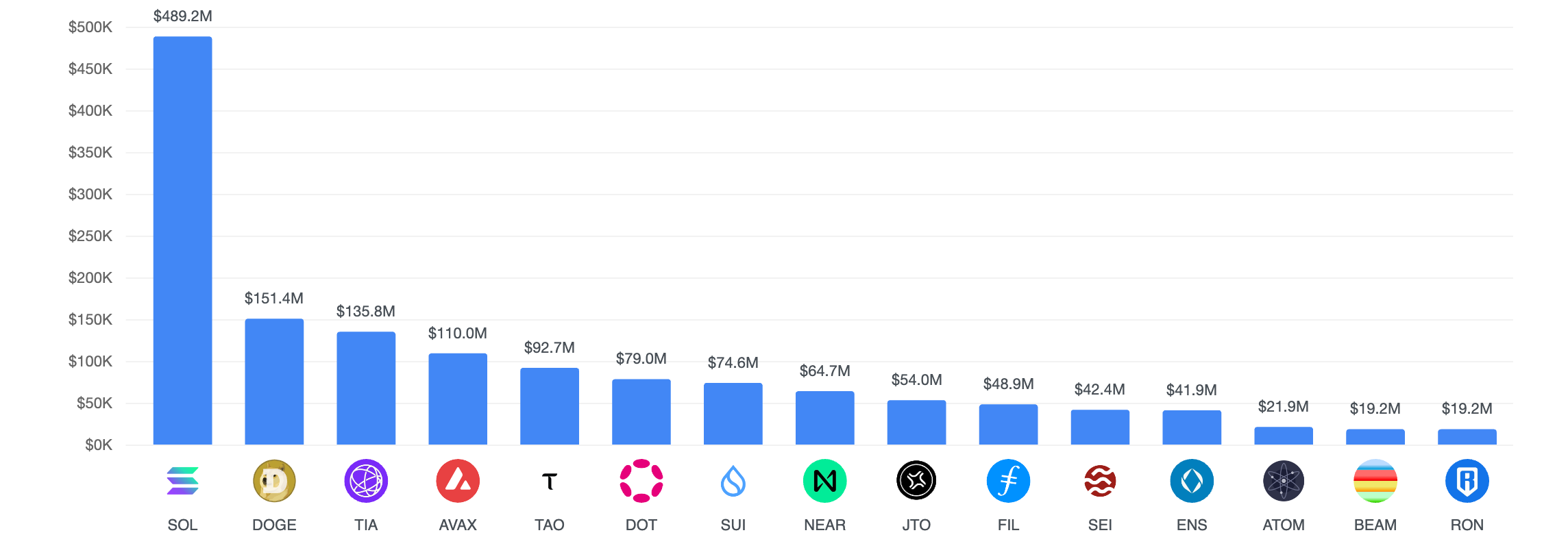

Linear Unlocks in February 2025. Source:

Tokenomist

Linear Unlocks in February 2025. Source:

Tokenomist

However, this bullish projection could be invalidated by an impending token unlock. According to Tokenomist, Solana is set to release $489.2 million worth of coins in a linear unlock in February, which could exert downward pressure on the market by increasing available supply.

Token unlocks often create uncertainty and fear among investors. Therefore, SOL’s price could dip if the SOL influx is not met with a corresponding demand to absorb the coins.

SOL Price Prediction: Will Coin Sink Below $200?

SOL trades at $231.53 at press time, shedding 9% of its value over the past week. Readings from its Moving Average Convergence Divergence (MACD) indicator highlight the waning demand for the altcoin.

On Tuesday, SOL’s MACD line (blue) crossed below its signal line (orange), confirming the bearish trend. When this indicator is set up this way, it indicates that selling activity exceeds accumulation among market participants, hinting at the possibility of an extended decline.

If this bearish trend strengthens, SOL’s price could drop below $200 to trade at $187.71 over the next few weeks.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, a resurgence in demand, driven by another meme coin run or the launch of SOL futures contracts, would invalidate this bearish projection. In that scenario, SOL’s price could revisit its all-time high and rally beyond it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arizona Senate Approves Bitcoin Reserve Bill: A Leap Towards Crypto Dominance in the U.S?

Trailblazing or Isolated Incident? Evaluating Arizona's Groundbreaking Bitcoin Reserve Bill and Its Potential Ripple Effect Across U.S. States

DeepSeek’s Debut Stirs Crypto Market, BTC ETFs Drop by $457M – Insights Revealed

DeepSeek's Entry Culminates in $534M Crypto Outflows, Shaking BTC and Ethereum ETFs While XRP Shows Resilience

Ethereum’s Active Users Soar 37%: Are Institutions and DeFi Driving Growth?

Unpacking the Factors Behind Ethereum's Rise: Examining the Role of DeFi and Institutional Investment