Hedera (HBAR) Stuck Below Key Resistance Amid Bearish Pressure

Hedera HBAR struggles below key resistance after a sharp pullback. While bearish signals persist, a golden cross could trigger a 23% rally.

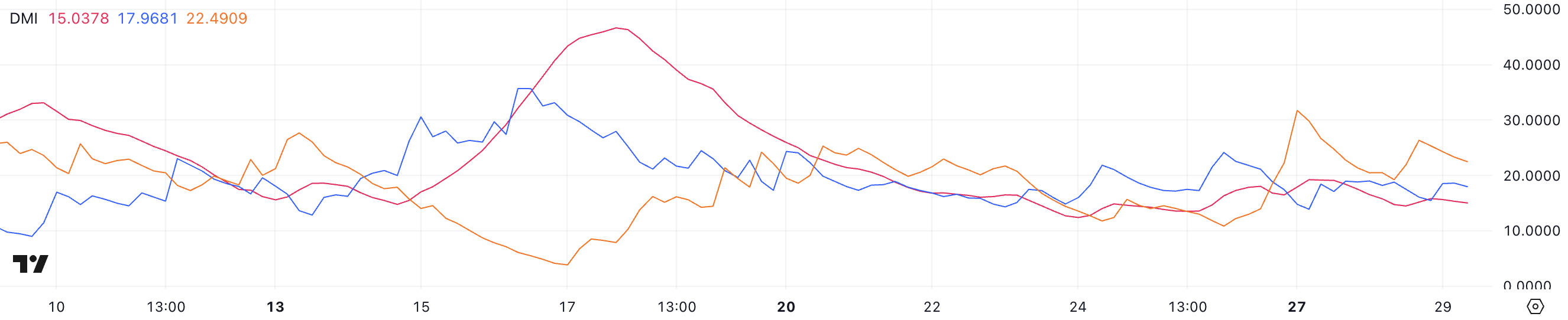

Hedera (HBAR) price is down more than 5% in the last 24 hours, pulling back after reaching levels close to $0.40 in mid-January. The DMI chart shows weak trend strength, indicating consolidation after a strong downtrend emerged two days ago.

Meanwhile, the Ichimoku Cloud signals a bearish outlook, with HBAR struggling to break above key resistance. If momentum shifts, a golden cross could spark a rally toward $0.35 and $0.37, while further downside may lead to a retest of $0.29 or even $0.25.

HBAR DMI Signals Uncertainty After Recent Downtrend

Hedera DMI chart shows its ADX at 15, fluctuating between 12 and 20 for the past eight days, indicating weak trend strength.

ADX measures the strength of a trend, with values below 20 signaling consolidation and above 25 suggesting a stronger directional move. With ADX staying low, HBAR’s trend lacks momentum, making its next move uncertain.

HBAR DMI. Source:

TradingView

HBAR DMI. Source:

TradingView

Currently, +DI is at 17.9, while -DI is at 22.4, down from 31.7 two days ago when HBAR dropped from $0.33 to $0.29. This suggests that bearish pressure is weakening, but the downtrend remains intact.

If +DI starts rising and crosses above -DI with a strengthening ADX, a reversal could begin. Otherwise, HBAR may continue struggling to find support, extending its downtrend.

Hedera Ichimoku Cloud Shows a Bearish Setting

The Ichimoku Cloud chart shows that HBAR price is currently trading below the cloud, indicating a bearish trend. The red cloud ahead suggests that resistance remains strong, making it difficult for HBAR to regain upward momentum.

Additionally, the price is struggling to break above the blue Tenkan-sen line, which is acting as a short-term resistance level.

HBAR Ichimoku Cloud. Source:

TradingView

HBAR Ichimoku Cloud. Source:

TradingView

If HBAR fails to reclaim the cloud, it may continue its downward movement, testing lower support levels. However, a breakout above the cloud could signal a potential trend reversal.

For now, the overall outlook remains bearish, with consolidation likely unless Hedera gains enough momentum to push through key resistance levels.

HBAR Price Prediction: A Potential 23% Upside?

HBAR price recently formed a death cross, signaling bearish momentum, and another one could be on the horizon. If this happens, HBAR may retest the $0.29 support level, which it reached a few days ago.

Losing this support could trigger further downside, potentially leading to a drop toward $0.25, marking a 16.6% correction.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

On the upside, if HBAR reverses its trend, a golden cross could emerge, signaling bullish strength. A breakout above the $0.31 resistance level could open the door for a rally toward $0.35 and even $0.37, representing a possible 23% gain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Daily: ECB President Lagarde rejects bitcoin for Eurozone reserves while the Czech central bank considers it and more

European Central Bank President Christine Lagarde said bitcoin is not an option as a reserve asset for the Eurozone’s central bank reserves, citing liquidity, security and regulatory concerns.Meanwhile, the Czech National Bank approved a proposal from Governor Aleš Michl to assess diversifying some of its country’s reserves into bitcoin.

'Inevitable collapse': Trump’s crypto push sparks concern at Paul Singer's Elliott Management: FT

The hedge fund said in a new investor letter that the “inevitable collapse” of the crypto bubble “could wreak havoc,” according to the Financial Times.Elliott’s Paul Singer has never been a fan of crypto, telling WSJ in 2023 that cryptocurrencies are “completely lacking in any value.”

Kiyosaki Dumps Gold and Silver, Projects Bitcoin at $250K by 2025

Bulls Eye Reversal as Solana Tests Support After 25% Drop