SushiSwap acquires Shipyard to enhance DEX performance

Sushi Labs has announced the acquisition of Shipyard Software, aiming to improve the functionality of the SushiSwap decentralised exchange (DEX).

This move comes as SushiSwap faces significant challenges, including a sharp decline in total value locked (TVL) since its peak in 2021.

The acquisition is intended to tackle common issues that DEXs encounter, such as mitigating impermanent loss and optimising liquidity provisioning.

Sushi Labs stated that these improvements will also enhance multichain trading efficiency.

The DEX has struggled to maintain its position amid rising competition from platforms on Solana (CRYPTO:SOL) and newer chains like Hyperliquid (CRYPTO:HYPE).

SushiSwap's TVL has fallen dramatically from its all-time high of over $8 billion, currently sitting at approximately $230 million, according to DefiLlama.

Shipyard's offerings include innovative products like Blade (CRYPTO:BLADE), an automated market maker designed to reduce impermanent loss, and Kubo, which facilitates liquidity for decentralised perpetual futures exchanges.

Sushi plans to integrate Kubo into its platform as a new branded product aimed at improving trading experiences.

Impermanent loss is a significant concern for liquidity providers on DEXs, stemming from fluctuations in cryptocurrency values within liquidity pools.

SushiSwap was once among the most popular DEXs but has seen its ranking drop to 13th place by TVL, trailing behind leaders such as Uniswap (CRYPTO:UNI) and Raydium (CRYPTO:RAY).

Despite these challenges, the decentralised finance (DeFi) sector is witnessing a resurgence, with total TVL across DeFi nearing $119 billion which is an increase of over 100% year-on-year.

This growth is attributed to the rise of liquid restaking tokens and Bitcoin-native (CRYPTO:BTC) layer-2 networks, alongside a bullish trend in cryptocurrency prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

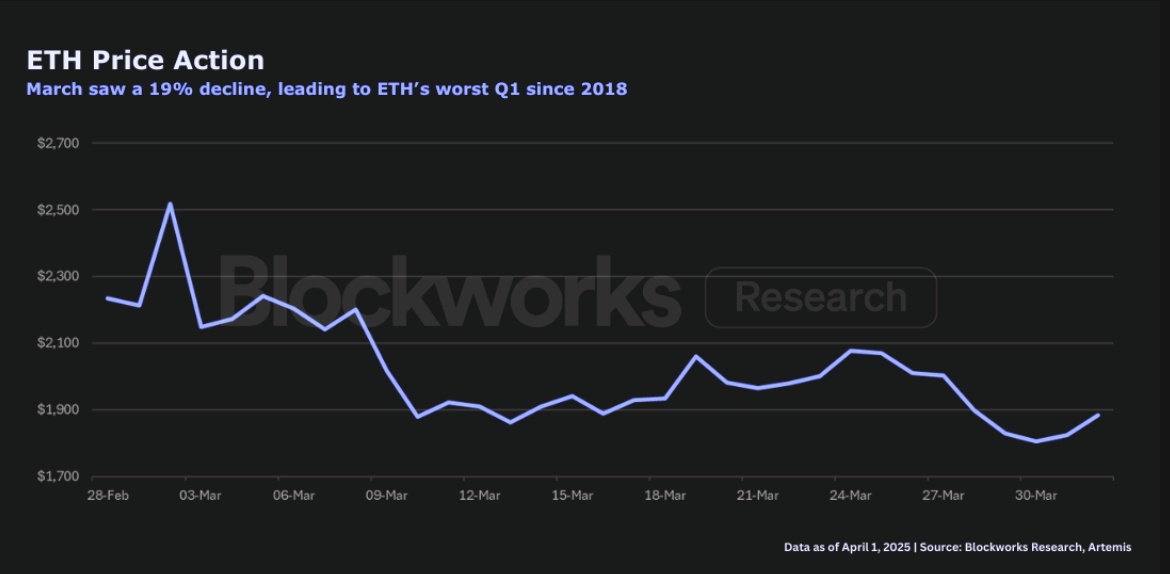

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far