2021 Dogecoin Boom Revisited: Can Another 10,000% DOGE Rally Emerge?

- Elon Musk’s leadership of the Department of Government Efficiency (D.O.G.E.) and its Dogecoin emblem fueled excitement but stirred market volatility, impacting DOGE prices.

- Analysts predict Dogecoin could surge to $14.78 by 2025, but inflationary tokenomics and resistance at $0.3614 remain key challenges.

With Elon Musk’s appointment to lead the Department of Government Efficiency (D.O.G.E.), the tech and crypto communities buzzed and fueled speculation about its impact on the crypto sector. A day after its launch, the department’s official website revealed the Dogecoin logo as its emblem, sparking a wave of enthusiasm among DOGE supporters.

The surge in excitement briefly lifted Dogecoin’s price by 12%, peaking at $0.39.

However, market volatility swiftly wiped out those gains, bringing the price back down to $0.3050 within 24 hours, reflecting about an 11% drop, according to TradingView .

Can Dogecoin Repeat Its 10,000% Surge?

Despite the rollercoaster start to the year, optimism around Dogecoin’s future has not waned. A strong sense of hope prevails among its supporters, with nearly 90% of the community remaining confident in the coin’s long-term growth potential. Notable crypto analyst Ali Martinez fueled that optimism by sharing a bold prediction.

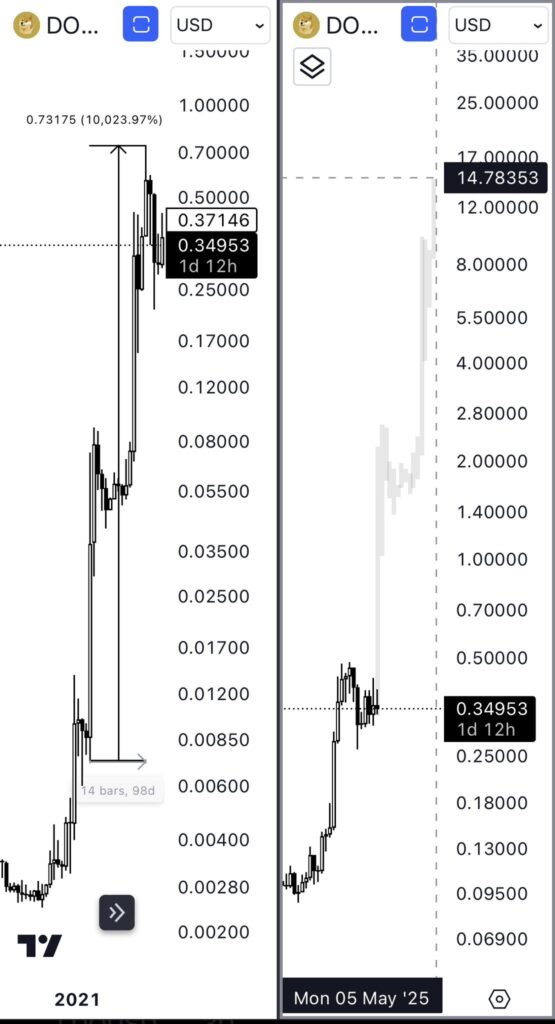

“During the 2021 bull cycle, #Dogecoin $DOGE skyrocketed by over 10,000% in just 98 days,” Martinez noted in a recent X post.

By analyzing historical data, Martinez suggested that if DOGE replicates a similar pattern, it could soar to an extraordinary $14.78 by May 2025. While this outlook excites many, others remain cautious, particularly due to the inflationary nature of Dogecoin’s tokenomics. With 5 billion new DOGE tokens entering circulation annually, the constant devaluation poses a significant challenge.

Bullish Reversal Potential — Critical Resistance at $0.3614

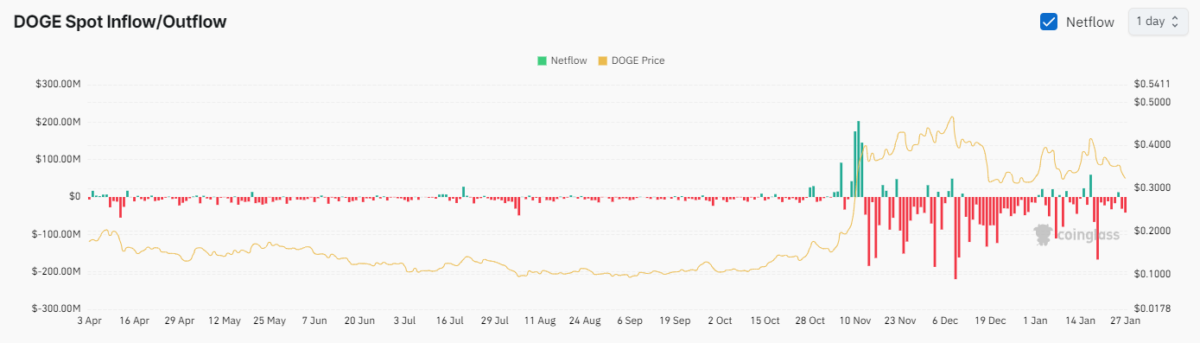

Fluctuating trends have marked the price movements of Dogecoin. Early November 2024 saw net positive inflows exceeding $100 million, coinciding with a price peak of approximately $0.50. However, heavy outflows during December and January, surpassing $200 million, signaled increased selling pressure, dragging the price below $0.20.

January 2025 has been a tug-of-war between bullish optimism and bearish dominance. The Relative Strength Index (RSI) indicates bearish control, but expanding Bollinger Bands hints at increased price volatility. A critical resistance level of $0.3614 looms as a potential turning point. If DOGE breaks through that barrier, it could ignite a bullish reversal.

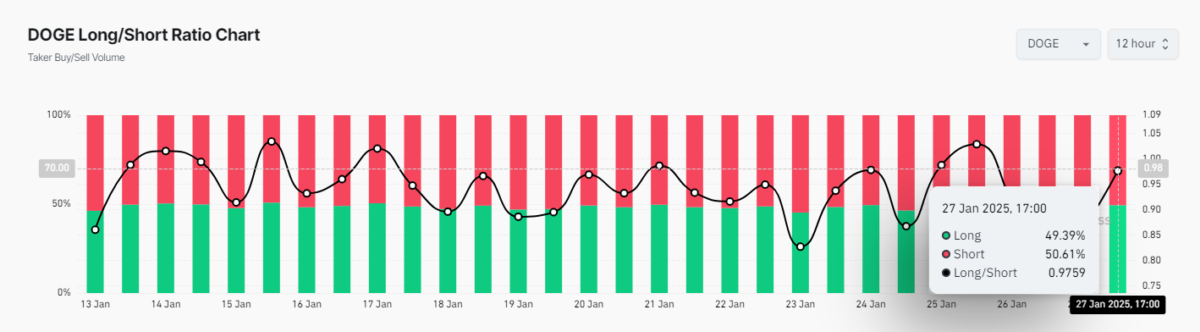

The Long/Short Ratio chart highlights the ongoing struggle between optimism and caution in the market. As of January 27, 2025, longs accounted for 49.39% of the taker buy/sell volume, while shorts slightly edged ahead at 50.61%. This near-equal split reflects a delicate balance of sentiment, with neither side dominating.

Historical patterns and community enthusiasm may inspire visions of another meteoric rise like that of 2021, but challenges like inflationary tokenomics and market volatility demand a measured approach. Whether Dogecoin can reclaim its former glory or not, the next few months will likely define its trajectory in a market known for its unpredictability.

Recommended for you:

- Buy Dogecoin Guide

- Dogecoin Wallet Tutorial

- Check 24-hour Dogecoin Price

- More Dogecoin News

- What is Dogecoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why TradFi firms could turn to bitcoin margin loans: Maple CEO

Maple’s Sid Powell said that TradFi firms have been in contact with the firm about lending and borrowing in crypto

The Daily: ECB President Lagarde rejects bitcoin for Eurozone reserves while the Czech central bank considers it and more

European Central Bank President Christine Lagarde said bitcoin is not an option as a reserve asset for the Eurozone’s central bank reserves, citing liquidity, security and regulatory concerns.Meanwhile, the Czech National Bank approved a proposal from Governor Aleš Michl to assess diversifying some of its country’s reserves into bitcoin.

'Inevitable collapse': Trump’s crypto push sparks concern at Paul Singer's Elliott Management: FT

The hedge fund said in a new investor letter that the “inevitable collapse” of the crypto bubble “could wreak havoc,” according to the Financial Times.Elliott’s Paul Singer has never been a fan of crypto, telling WSJ in 2023 that cryptocurrencies are “completely lacking in any value.”

Kiyosaki Dumps Gold and Silver, Projects Bitcoin at $250K by 2025