EU Commission investigates depth of EU safety net for stablecoin holders

By:reuters.com

MILAN, Jan 23 (Reuters) - The European Commission is investigating the extent to which EU rules on crypto assets protect the redemption rights of the bloc's investors in identical e-money tokens (EMTs), the value of which is pegged to that of a single official currency.

France's Autorité de contrôle prudentiel et de résolution (ACPR), the country's banking and insurance supervisor, last year asked the European Banking Authority to establish

, opens new tab whether it would be possible to have technically identical and fully fungible EMTs issued by both an entity licensed in the European Union and by another elsewhere not subject to EU rules.

The EBA then turned the matter over to the EU Commission as it is a matter of interpretation of EU law.

The EU in 2023 adopted an extensive set of rules for crypto assets, known as MiCAR, under which issuers of EMTs must receive supervisory clearance to operate and hold reserves, including as bank deposits, against tokens sold to ensure they can repay investors when required to.

In the United States, President Donald Trump has vowed to ease the regulatory burden faced by cryptocurrency companies, with the U.S. Securities and Exchange Commission this week creating a task force to work on new rules.

Some issuers operate both within and outside the EU. For example, Circle, whose U.S. dollar-pegged 'USDC' is the world's second largest stablecoin by market value, operates in the EU as Circle SAS. USDC issued by Circle SAS are fully fungible

, opens new tab with those issued by Circle LLC.

France's ACPR also asked whether, in case of identical EMT issuance both within and outside the EU, it would be possible to allow only EU customers to present redemption requests to the EU-based entity.

ACPR declined to comment further.

"The MiCA regulation already has quite a bit of flexibility built in, to avoid stifling innovation," said Andrea Resti, a finance professor at Milan's Bocconi University.

"To start interpreting the rules in ways that have not been clearly spelled out in the text could engender risks and weaken the effectiveness of the newly minted rules."

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

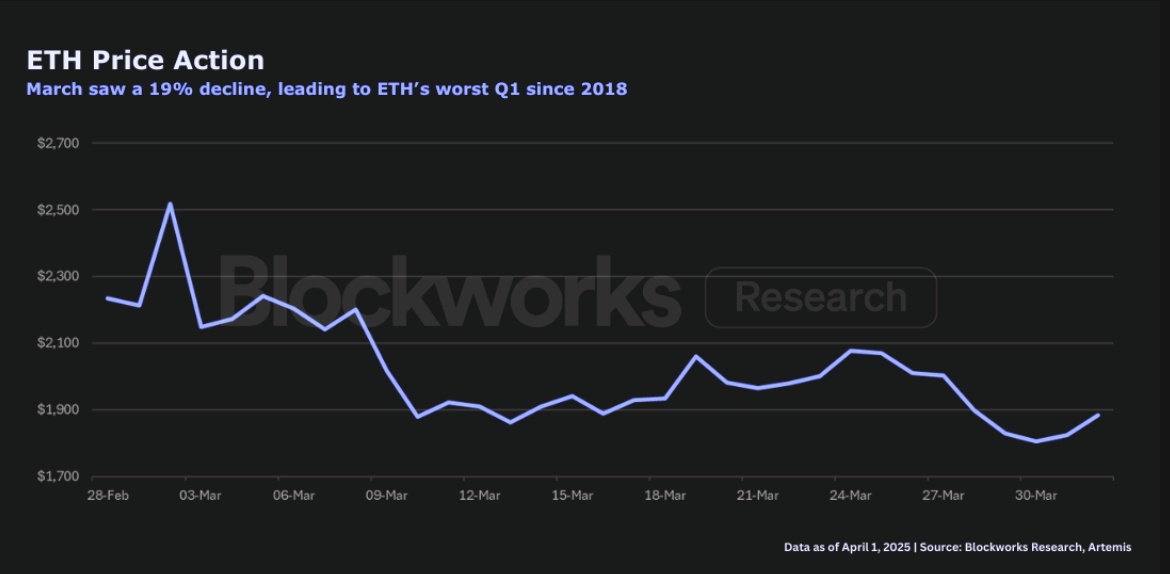

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Blockworks•2025/04/04 18:22

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

CryptoNewsNet•2025/04/04 17:00

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far

CryptoNewsNet•2025/04/04 17:00

GameStop just announced a $1.5 billion Bitcoin deal

Kriptoworld•2025/04/04 16:11

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,088

+2.34%

Ethereum

ETH

$1,806.95

+1.31%

Tether USDt

USDT

$0.9994

-0.03%

XRP

XRP

$2.12

+3.74%

BNB

BNB

$597.02

+1.39%

Solana

SOL

$122.01

+5.57%

USDC

USDC

$0.9997

-0.03%

Dogecoin

DOGE

$0.1706

+7.27%

Cardano

ADA

$0.6600

+3.59%

TRON

TRX

$0.2400

+1.63%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now