Frax community discusses proposal to invest $5 million in Trump-backed WLFI token

Quick Take Frax is discussing a governance proposal for a temperature check on potentially investing $5 million in World Liberty Financial. The proposal also suggested a follow-on investment of another $5 million contingent on the success of the initial investment.

A contributor to the decentralized stablecoin protocol, Frax Finance, submitted a governance proposal to invest $5 million in the native token of World Liberty Financial, the DeFi project associated with U.S. President Donald Trump, to “position Frax as part of WLFI’s ecosystem.”

The proposal also suggested a follow-on investment of another $5 million, contingent on the success of the initial $5 million investment. The project is governed via Frax Shares (FXS) tokens.

“With the newly elected Trump administration’s commitment to US-based DeFi projects, it’s important for FRAX to position itself in its rightful place as a leader in this movement,” Frax wrote. “As Trump’s only DeFi project, WLFI is the ideal partner to achieve this goal.”

Frax is the creator of the decentralized Frax stablecoin and Frax Ether, hosting a total value locked of $445 million .

World Liberty Financial has been swapping its stablecoin holdings for various cryptocurrencies over the past few days. For instance, on Trump’s inauguration day, the project bought $112.8 million worth of crypto , including ether, wrapped bitcoin, Aave, LINK, TRX and ENA.

“President Trump has a vision to make the United States the global leader in cryptocurrency, with WLFI a key part to achieving this goal,” Frax said. “Approving this investment empowers FRAX to expand adoption, increase visibility, and secure its role in the next phase of US DeFi growth.”

In response to the proposal, one community member commented that investing $5 million at a $5 billion fully diluted valuation in a “project without a proven track record is extremely risky and unreasonable.”

“Such a high FDV relative to the current market capitalization suggests significant potential for future dilution, which could negatively impact token value,” the community member said . Some other members also argued that a $5 million investment would be “a lot” to potentially start a conversation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Recent Surge Towards $90,000 Faces Possible Pullback Amid Tariff Uncertainty

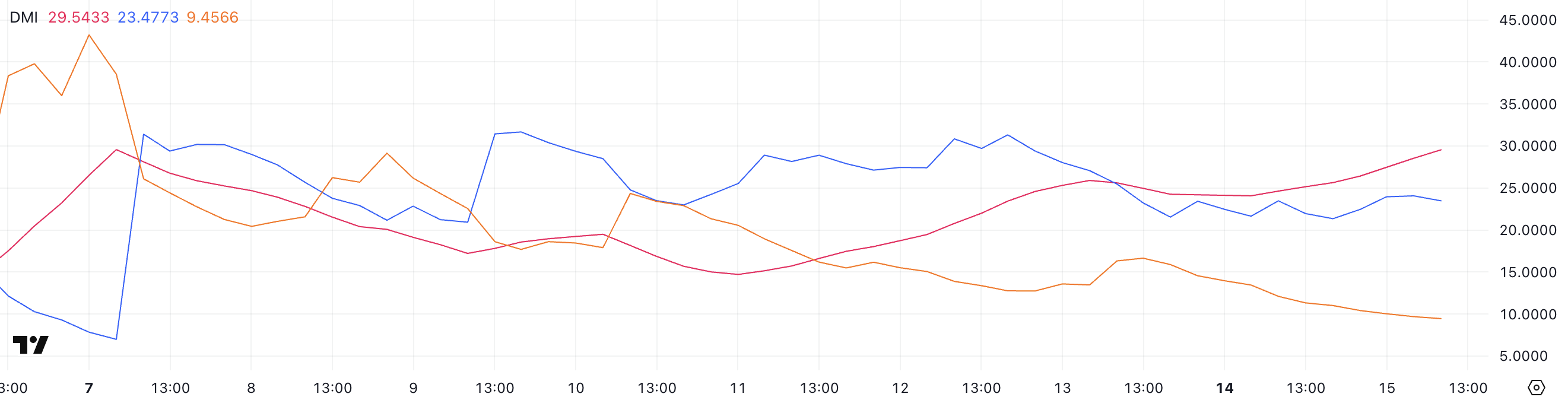

Solana’s Recent 20% Surge Suggests Potential to Test Key Resistance Levels Amid Rising DEX Activity

Bitcoin trader sees gold 'blow-off top' as XAU nears new $3.3K record

Bitcoin is in no mood to copy gold's bull run yet, but on the horizon is a "terminal" end to the record XAU/USD winning streak, a trader predicts.