Top 7 Token Unlocks of the Week (January 13-19)

Over $192 million in crypto will be unlocked this week, potentially affecting the coins' prices

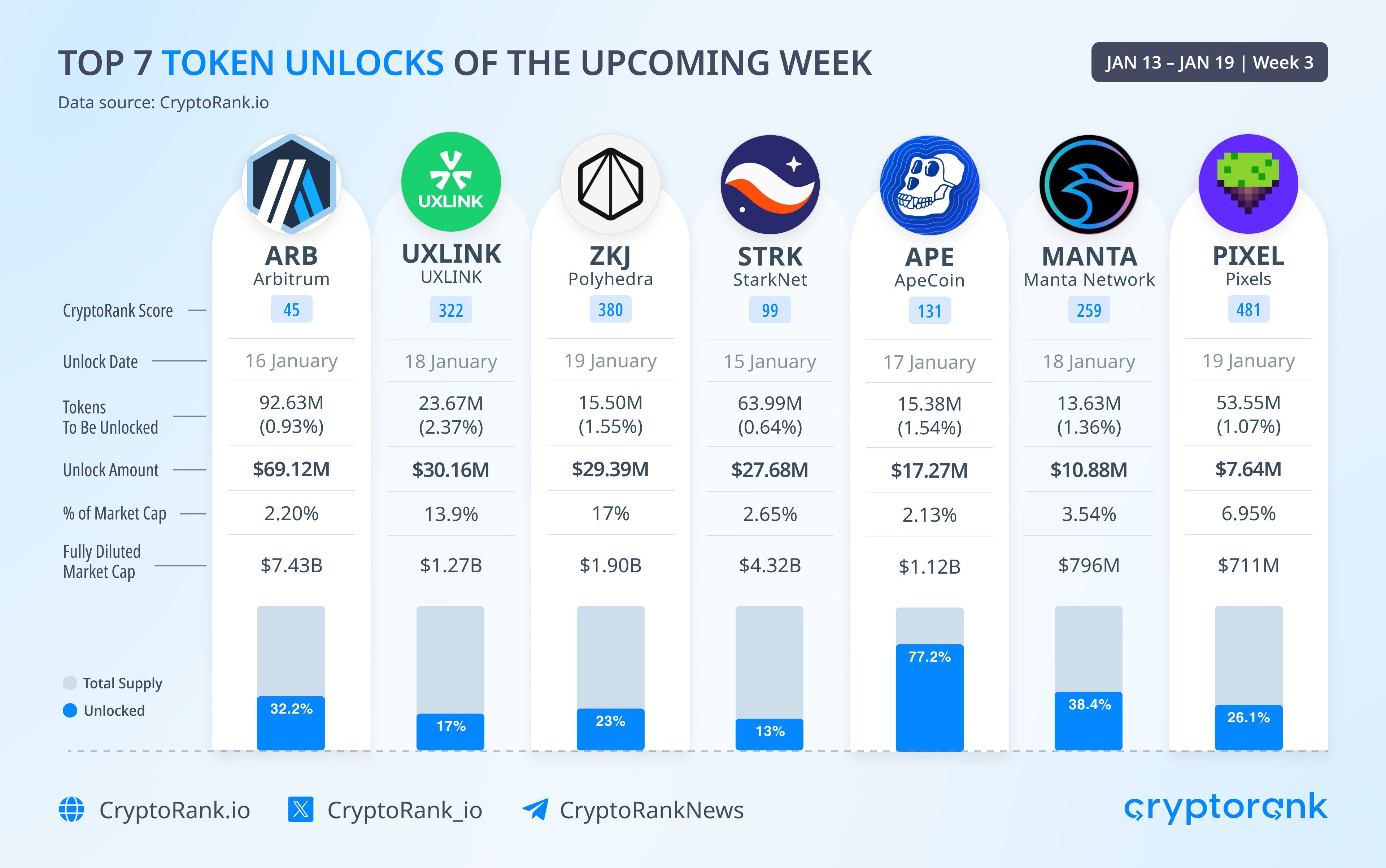

This week, over $192 million in crypto will be unlocked, potentially triggering buying or selling pressure for the digital assets and creating market volatility. Here are the top seven token unlocks worth watching.

Top 7 Token Unlocks of This Week – Over $192 Million in Crypto

CryptoRank – Top 7 token unlocks of the week

CryptoRank – Top 7 token unlocks of the week

1. Arbitrum (ARB)

On January 16, over 92 million ARB tokens will be unlocked, representing 0.93% of the total supply. The unlock amount is a little over $69 million or 2.2% of the fully diluted market cap of the token, at $7.43 billion.

So far, over 32% of the token supply has been unlocked, according to CryptoRank.

Today, ARB is down by over 5%, and the coin is trading above $0.68, having a market cap of $2.88 billion.

ARB price in USD today2. UXLink (UXLINK)

On January 18, over 23.6 million UXLINK tokens will be unlocked, representing over 2.3% of the total token supply. The unlock amount is over $30 million tokens or almost 14% of the fully diluted market cap of the token at $1.27 billion.

So far, 17% of the total supply of the token has been unlocked, CryptoRank data shows.

Today, UXLINK is down by almost 10% and the coin is trading at $1.12, having a market cap of over $190 million tokens.

UXLINK price in USD today3. Polyhedra (ZKJ)

On January 19, 15.5 million ZKJ tokens will be unlocked, representing over 2.3% of the total token supply. The unlock amount is over $29 million, or 17% of the fully diluted market cap of the token at $1.9 billion.

So far, 23% of the total token supply has been unlocked.

The price of ZKJ is down by almost 1% today, and the token is trading at $1.91 with a market cap of over $215 million.

ZKJ price in USD today4. StarkNet (STRK)

On January 15, almost 64 million STRK tokens will be unlocked, representing 0.64% of the total token supply. The unlock amount is over $27.6 million, or 2.65% of the fully diluted market cap of the token at over $4.3 billion. So far, 13% of the total token supply has been unlocked.

Today, STRK is down by over 6%. The coin is trading close to $0.4 and has a market cap of over $366 million.

STRK price in USD today5. ApeCoin (APE)

On January 17, 15.38 million APE coins will be unlocked. This represents 1.54% of the total token supply. The unlock amount is over $17.2 million or over 2% of the fully diluted market cap of the token at $1.12 billion.

So far, over 77% of the total supply of APE has been unlocked.

APE ‘s price is down by 6.7% today, and the coin is trading at $1.03, with a market cap of over $774 million.

APE price in USD today6. Manta Network (MANTA)

On January 18, over 13.6 million MANTA tokens will be unlocked, representing 1.36% of the total token supply. The total unlock amount is over $10.8 million or 3.54% of the fully diluted market cap of the token at $796 million.

So far, over 38% of the total token supply has been unlocked.

MANTA is down by almost 10% and the coin is trading at $0.7. MANTA has a current market cap of almost $443 million.

MANTA price in USD today7. Pixels (PIXEL)

On January 19, over 53.5 million PIXEL tokens will be unlocked, representing over 1% of the total token supply. The unlock amount is over $7.6 million tokens or almost 7% of the fully diluted market cap of the token at $711 million.

So far, over 26% of the total token supply has been unlocked.

Today, PIXEL is down by over 9% and the coin is trading at over $0.12.

PIXEL price in USD todayPIXEL has a market cap of over $152 million.

These upcoming token unlock events are important as they can create market volatility by triggering buying or selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

33% of French looking to buy crypto in 2025 but Italians are even more bullish

Share link:In this post: A third of French people intend to purchase cryptocurrencies this year. New study shows Italians as most bullish among surveyed nations in Europe. The crypto sector’s growing legitimacy helps attract more investors, researchers say.

Spanish Police End Crypto Scam Ring That Used AI to Swipe $21 Million From Investors

Survey reveals 1 in 5 Americans own crypto, with 76% reporting personal benefits

Trade war hits Treasurys

10-year yield climbed Tuesday night, with the possibility that basis trade is unwinding