Crypto losses hit $1.7B in 2024 from access flaws

Access control vulnerabilities caused $1.7 billion in losses in 2024, making up 75% of total damages in the crypto sector, according to Hacken’s latest report.

These losses spanned decentralised finance (DeFi), centralised finance (CeFi), and gaming and metaverse platforms.

This marks a sharp increase from 2023 when such vulnerabilities accounted for 50% of total damages.

The report highlights significant incidents, including CeFi hacks at DMM Exchange and WazirX (CRYPTO:WRX), which together lost over $500 million.

In DeFi, compromised smart contract management led to events like the Radiant Capital (CRYPTO:RDNT) breach, resulting in $55 million in losses.

Gaming and metaverse projects were also severely affected, with the PlayDapp (CRYPTO:PDA) exploit alone accounting for $290 million.

Weak private key management, social engineering attacks, and insecure backup practices were identified as primary drivers of these losses.

“Access control vulnerabilities have emerged as the leading cause of crypto hack losses in 2024,” the report noted.

Hacken recommended measures such as advanced multisig management, automated incident response, and adherence to the Cryptocurrency Security Standard (CCSS) to mitigate these risks.

While DeFi losses declined by 40% compared to 2023, with bridge-related losses dropping from $338 million to $114 million, gaming and metaverse platforms continued to struggle.

These sectors faced $389 million in losses in 2024, representing 20% of total crypto hacking damages.

Notably, three major incidents in Q1 accounted for over 80% of the gaming and metaverse losses, with emerging platforms like Blast (CRYPTO:BLAST) encountering multiple rug pulls.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

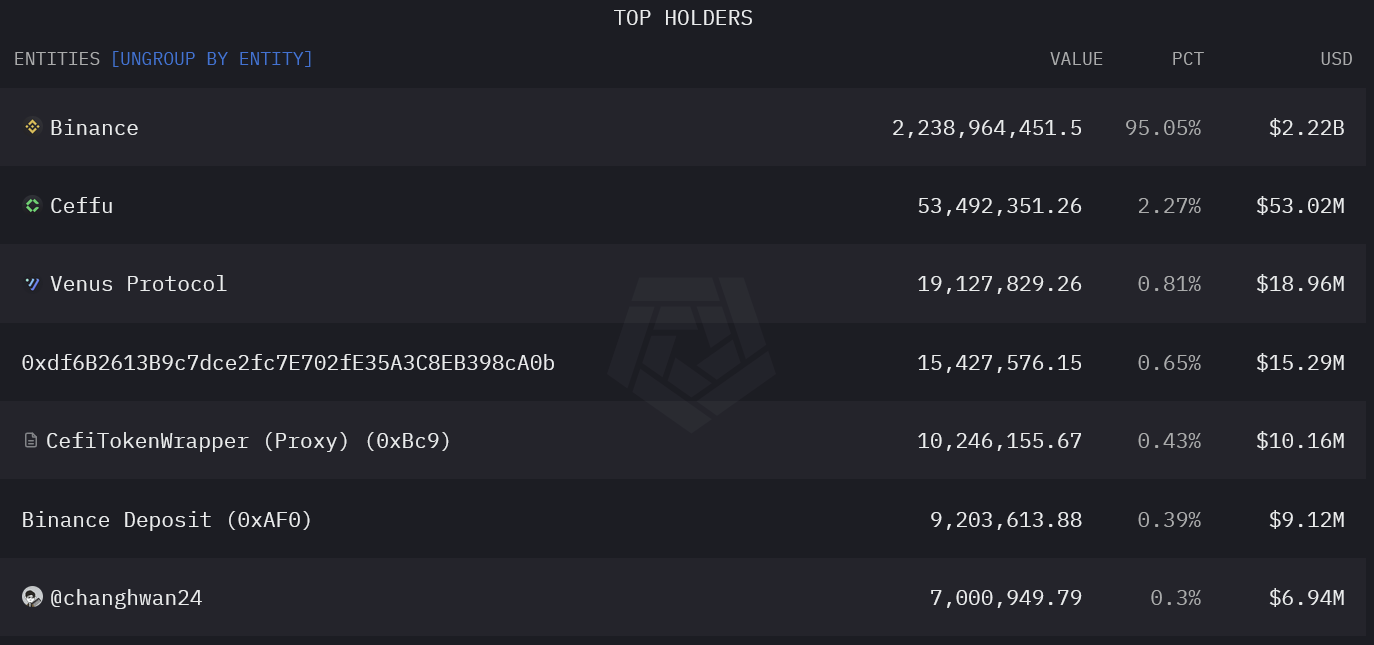

Justin Sun’s allegations of FDUSD insolvency cause 9% depeg

The Binance-affiliated stablecoin lost about $200M of market capitalization

Trump's tariffs hit US stocks hard, Nasdaq plunged more than 1,000 points

Global stocks pay for Trump's tariff plan, with U.S. stocks performing worst since September 2022