BIG Solana Price Prediction: Will SOL Price Crash to $50?

Solana has been one of the top-performing cryptocurrencies, but recent market trends have sparked concerns about its future. With growing uncertainty in the crypto world, many are asking the big question: Could Solana’s price crash all the way to $50? In this Solana price prediction article, we’ll break down what’s happening with Solana, the factors influencing its price, and whether investors should prepare for a steep drop—or hold on tight for a potential rebound.

How has the Solana Price Moved Recently?

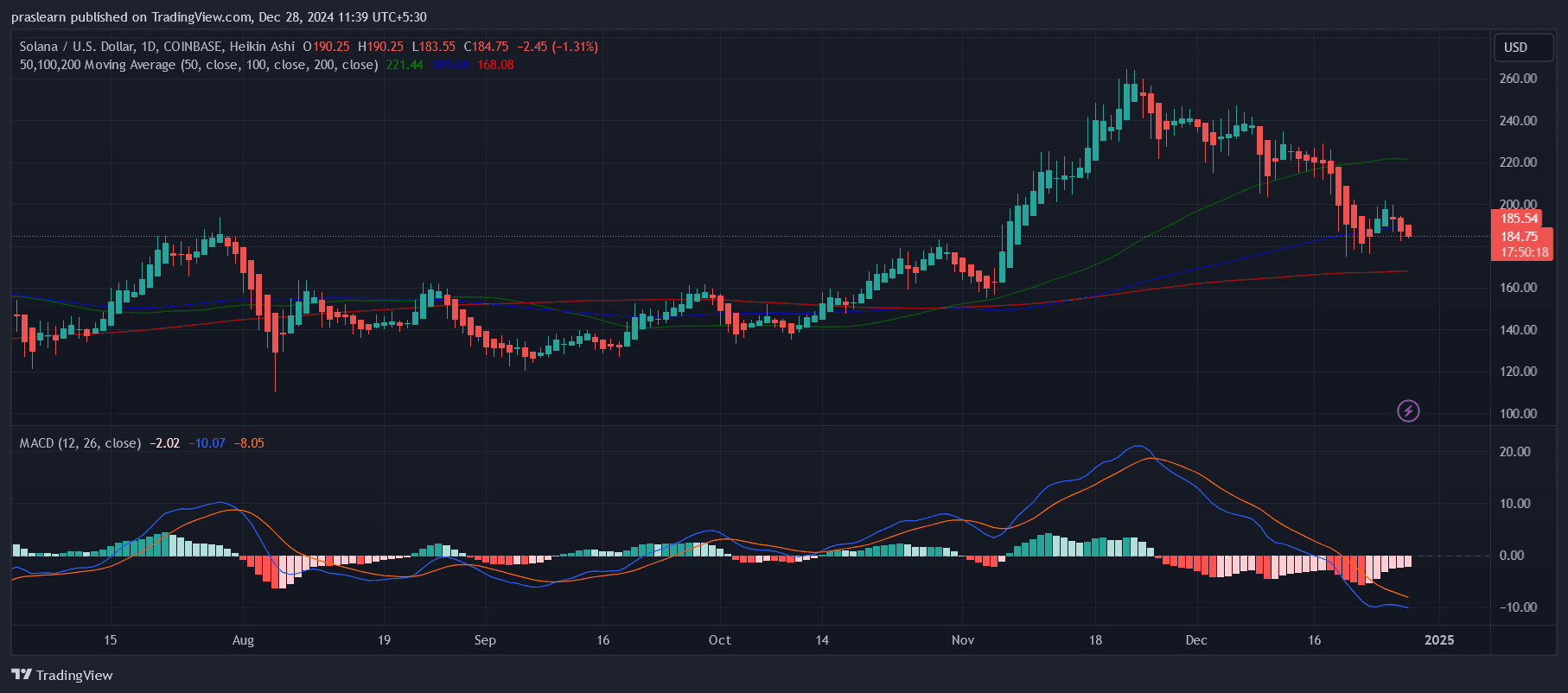

SOL/USD Daily Chart- TradingView

SOL/USD Daily Chart- TradingView

Solana is currently priced at $186.42 , with a 24-hour trading volume of $15.03 billion, a market cap of $89.38 billion, and a market dominance of 2.69%. Over the past 24 hours, SOL's price has declined by 1.81%.

The cryptocurrency hit its all-time high of $263.58 on November 22, 2024, while its all-time low of $0.503701 was recorded on May 11, 2020. Since its peak, the lowest price Solana reached was $176.66, while its highest point since that low was $201.82. The current market sentiment around Solana’s price remains bearish, despite the Fear Greed Index indicating a score of 72, reflecting a state of greed.

Solana has a circulating supply of 479.45 million SOL out of a maximum supply of 533.68 million. The yearly supply inflation rate stands at 11.88%, with 50.93 million SOL tokens minted in the past year.

Solana Price Prediction: Will SOL Price Crash to $50?

The recent SOL price movements and on-chain activity trends suggest Solana (SOL) is facing short-term bearish pressure, though a crash to $50 appears unlikely based on current indicators. After failing to hold above $200 and underperforming the broader cryptocurrency market with a 5.1% correction, concerns about SOL's price trajectory have intensified. The sharp decline in Solana's on-chain network volumes —down 30% in a week—and significant drops in DApp activity (e.g., 39% declines for Orca and Phoenix) highlight waning user engagement and network demand. Furthermore, the poor performance of memecoins on Solana has dented one of its key growth drivers for attracting new users.

From an analytical perspective, these factors collectively indicate reduced network utility and interest, both of which are critical for sustaining SOL's price. However, derivatives data showing continued optimism among whales and market makers suggests that downside risk below $180 may be limited. This optimism implies that key stakeholders are betting on a recovery in activity or broader market conditions improving.

Will Solana Crash to $50?

While Solana’s current challenges could lead to further price declines, a crash to $50 seems improbable without significant external shocks. The $50 level would represent an over 70% drop from current prices, requiring either a systemic failure in Solana’s ecosystem or a broader crypto market collapse. The present issues, such as reduced on-chain activity and competition from ecosystems like Ethereum, are moderate bearish factors but do not indicate such catastrophic levels.

Looking forward, Solana's ability to bounce back will hinge on reinvigorating on-chain activity and capturing more decentralized finance (DeFi) and non-fungible token (NFT) market share. If these metrics improve, SOL could stabilize or even rally. However, failure to address these issues in the short term could see SOL testing lower support levels, potentially dipping below $150 but staying well above the $50 mark.

Prediction:

In the near term, Solana's price may hover around $180, with limited downside risk due to institutional support. For a significant rebound, renewed interest in its ecosystem and broader market recovery will be essential. A crash to $50 appears unlikely unless compounded by severe external market turmoil or major project failures within the Solana ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Analysts Predict New All-Time High By 2025

TRUMP Token Price Doubles; No Evidence of Team Sale

Belo Horizonte Moves to Become Bitcoin Capital

Conor McGregor Advocates Irish Bitcoin Strategic Reserve