Delphi Digital 2025 DeFi Outlook Summary: From Consumer Applications to Yield-Generating Stablecoins, 8 Key Trends and Notable Projects to Watch

The revenue-sharing stablecoin creates a new model - "Stablecoin Distribution as a Service."

Author: DeFi Warhol

Compiled by: Deep Tide TechFlow

While everyone is immersed in the festive atmosphere, I decided to take this time to do some research.

@Delphi_Digital recently released the research report "DeFi Outlook 2025," summarizing 8 key trends and recommended projects to watch:

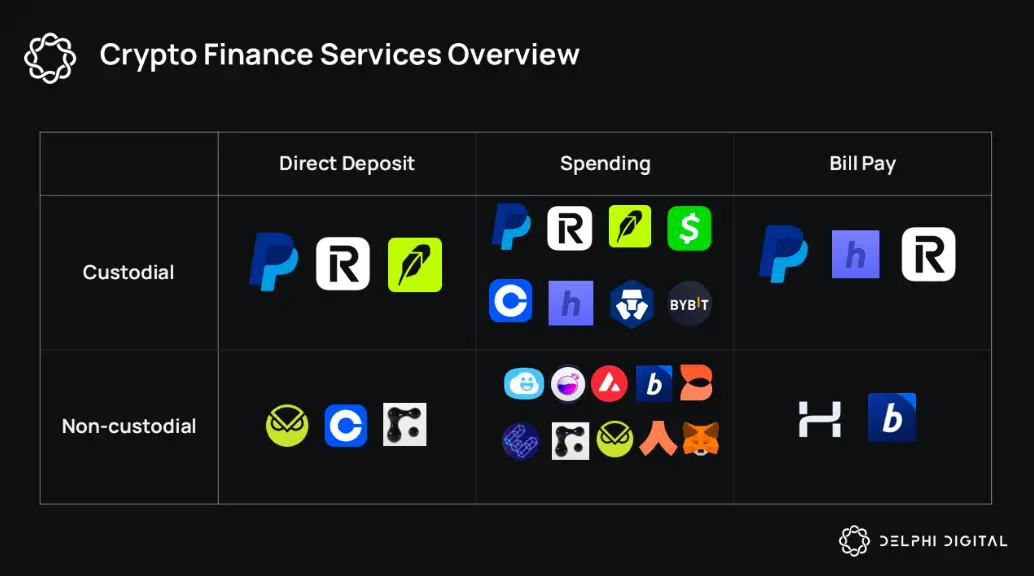

1. Consumer DeFi

Although DeFi has developed rapidly in recent years, it has not yet fully realized its potential and goals—namely, to completely replace traditional banking, provide services to ordinary users, and guide them into the Web3 world.

Crypto payment cards are revolutionizing DeFi by combining self-custody spending, DeFi yields, and fiat on/off ramps, providing users with a more convenient financial experience.

Recommended protocols to watch:

@coinbase

@holyheld

@gnosispay

@argentHQ

@MoonwellDeFi

@Fuse_network

2. Revenue-Sharing Stablecoins

Stablecoins are one of the most revenue-generating areas in the crypto space, but currently, the profits are mainly concentrated in the hands of the issuers.

The core idea of revenue-sharing stablecoins is to allow the applications that distribute them (such as decentralized exchanges, centralized exchanges, wallets, etc.) to also benefit from them, creating a new model—"Stablecoin Distribution as a Service."

These stablecoins not only have advantages similar to $USDT (such as cross-application composability and network effects) but also provide additional revenue incentives for distributors, attracting more applications to integrate.

Recommended protocols to watch:

@withAUSD

@Paxos

@m0foundation

3. Fat Wallets Theory

The "Fat Wallets" theory suggests that as blockchain protocols and applications become more streamlined, the development space for two key resources—distribution channels and order flow—will further expand.

Wallets, as the core front end for users to interact with the blockchain, can effectively convert these resources into revenue sources.

Recommended protocols to watch:

@infinex_app

@OneBalance_io

@ParticleNtwrk

@Ctrl_Wallet

4. DEX Market Share

Although several subfields of DeFi have achieved significant upgrades in 2024, changes in decentralized exchanges (DEX) have been relatively limited.

Spot DEX trading volume is expected to grow to 20-22% of centralized exchange (CEX) spot trading volume in the future, showcasing the potential of DeFi.

5. Solver-Based Protocols

Compared to standard AMMs (Automated Market Makers), DEXs that are deeply integrated with solver protocols perform better.

Solver-based and seeker-driven DeFi has already captured a significant share of trading volume and will continue to expand its influence in the future.

Recommended protocols to watch:

@SorellaLabs

@CoWSwap

@Uniswap

@ArrakisFinance

@HyperliquidX

6. Prediction Markets

During the 2024 U.S. elections, prediction markets performed strongly, with user numbers and trading volumes reaching new highs, but they failed to maintain long-term stability.

Today, these markets are transforming from traditional speculative platforms into innovative financial products and information discovery tools.

Recommended protocols to watch:

@trylimitless

@Truemarketsorg

@Polymarket

7. Starknet Ecosystem Rebound

The development trajectory of Starknet is similar to the early stages of Solana . Although Solana's technological advancements were overlooked due to negative sentiment, it ultimately achieved a strong rebound.

Starknet faces a similar situation: its promising technology is undervalued due to controversy but is gradually moving towards the mainstream market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nike Faces $5M Lawsuit Over RTFKT NFT Shutdown

Nike sued for $5M after RTFKT’s shutdown, with NFT buyers citing heavy financial losses.Nike Hit with $5M Lawsuit Following RTFKT ShutdownNFT Buyers Cite Heavy Losses and Broken PromisesBroader Impact on the NFT Market

BlockDAG Resets to $0.0025 & Launches Buyer Battles as Solana Sees ETF Boosts & NEAR Faces Growing Downside Risks

Check out the 2025 price forecast for Near Protocol (NEAR), Solana (SOL), and BlockDAG. See how BlockDAG’s $0.0025 presale price rollback is opening new doors among top crypto coins to watch.NEAR Protocol’s 2025 Forecast: Tough Road AheadSolana’s Institutional Momentum Could Reshape Its 2025 OutlookBlockDAG Resets Presale Price & Launches Buyer Battles to Energize BuyersNew Windows Are Opening, but Timing Is Key

Whale Buys 30K ETH and 600 BTC via Wintermute OTC

A whale acquires 30K ETH and 600 BTC through Wintermute OTC, transferring over $111M in USDC today.Details of the TransactionWhat It Means for the Market

Unstaked Enters Stage 2 with a Price Surging to $0.006695 as Cronos Eyes $0.12 and Aptos Aims for $13

Explore Aptos (APT) price prediction of $13, Cronos aiming for $0.12, and why Unstaked’s $0.006695 presale could offer 27x ROI as the best long-term crypto play.Why Unstaked’s Presale Could Be the Benchmark for 2025Aptos Builds Bullish Momentum: Updated Aptos Price PredictionCronos Price Clears Key Resistance, Eyes Bigger GainsWhy Unstaked May Outperform APT and CRO