Koma Inu Price Prediction: KOMA Plunges 6% As Traders Rush To Buy This Pepe Derivative That’s Raised Almost $20M In 10 Days

The Koma Inu price has plunged 6% in the last 24 hours to trade at $0.01286 as of 9:10 p.m. EST on trading volume that dropped 37% to $15 million.

Koma Inu Price Could Continue Soaring

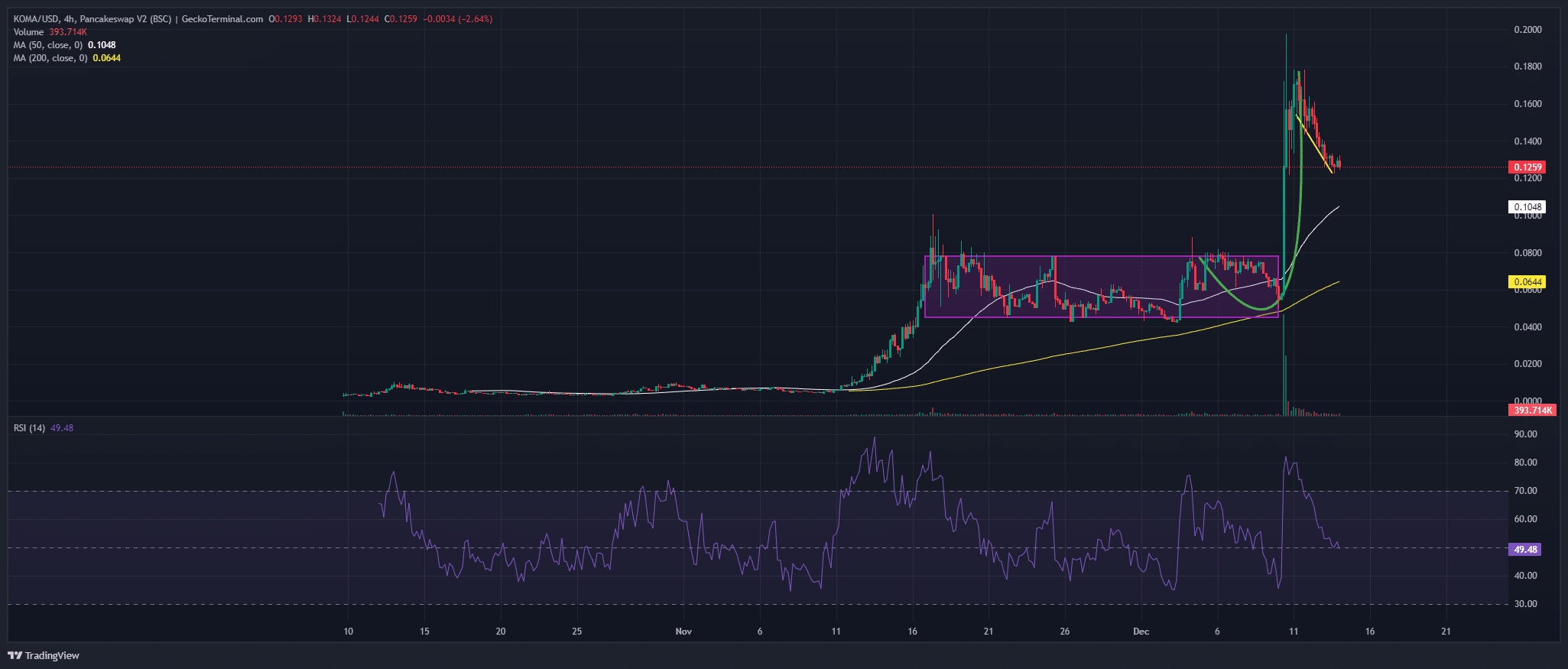

The KOMA/USD chart on the 4-hour timeframe shows a strong upward Koma Inu price movement followed by a period of consolidation and a subsequent breakout.

Early price action was on a sideways pattern from mid-November, trading within the $0.062 range, according to data from GeckoTerminal .

A breakout occurred around December 9th, propelling the price through a parabolic curve to a peak near $0.19 before a pullback. Currently, the price is retracing and trading around $0.1259, showing signs of consolidation.

The Koma Inu price now trades well above both the 50-day and 200-day Simple Moving Averages (SMAs), which still supports the upward momentum.

Meanwhile, the Relative Strength Index (RSI) is at 49.48, indicating neutral momentum. The RSI previously entered overbought territory during the parabolic price move, which aligns with the subsequent correction.

A reading near 50 suggests that the market is currently balanced between buyers and sellers, with the next significant move likely to determine momentum.

The price of Koma Inu remains in a bullish macro trend despite the recent pullback. The bull flag pattern and support from the 50-day SMA suggest that buyers may soon regain control, potentially leading to another upward breakout.

If the price breaks above $0.14 with strong volume, it could retest the recent high near $0.19. A successful breakout above $0.19 could open the door for further upward momentum.

KOMAUSD Chart Analysis Source: GeckoTerminal

KOMAUSD Chart Analysis Source: GeckoTerminal

However, failure to hold the $0.10 level could see the price retrace toward the $0.08 support zone.

Meanwhile, investors are piling into a new PEPE derivative called Wall Street Pepe (WEPE) , which crypto influencer ClayBro, with over 133k subscribers, predicts will make millionaires.

Wall Street Pepe Raises Almost $20 Million in 10 Days

Wall Street Pepe is a new coin that’s on a mission to empower small traders by offering exclusive market insights, trading tips, and strategies. In this way it aims to level the playing field, which it believes is tilted massively in favor of secretive whales.

By holding the $WEPE token, investors can also earn a remarkable 58% annual percentage yield (APY), providing a lucrative passive income stream.

Investors can buy $WEPE Token from the official website for $0.000364 using ETH, USDT, or a bank card.

If you would like to join investors who have pumped more than $19.7 million into the project at the rate of almost $2 million each day, buy as soon as you can. A price hike is due when funds raised hit $20.8 million, and it’s likely that won’t be long.

Related News

- Wall Street Pepe Sets New ICO Record With $14.2M Raised

- Most Viewed Cryptos on GeckoTerminal to Watch

- Top Meme Coins to Watch Today

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fidelity Introduces Crypto IRA With Bitcoin, Ethereum, Litecoin

Fidelity’s crypto IRA has no fees and gives investors the option to set it up as a Roth IRA, traditional IRA, or rollover IRA.

Circle files for IPO

XRP Open Interest Surges 1.27% to $3.64B, Options OI Jumps 35% – Volatility Ahead

FDUSD released an audit report in February: Reserve assets exceeded 100%, supporting 1:1 exchange