After 36 hours, Microsoft, holding 78.4 billion dollars, will decide whether to invest in BTC

The prediction market on Polymarket has opened, is it just a matter of time before "big money enters"?

Author: Azuma, Odaily Planet Daily

On December 10 at 8:30 AM PST (December 11 at 12:30 AM Beijing time), Microsoft will advance a significant shareholder proposal regarding Bitcoin ------ to evaluate whether incorporating Bitcoin into its balance sheet aligns with the long-term interests of shareholders through a shareholder vote. Coincidentally, as BTC hovers around $100,000, this vote is widely regarded by the market as another key event influencing the cryptocurrency market this week, alongside the CPI and the situation in South Korea.

Background of the Proposal

The shareholder proposal was initially submitted by the American conservative think tank National Center for Public Policy Research (NCPPR).

NCPPR stated that during ongoing inflation, a company's success depends not only on its operational performance but also on its ability to preserve profits. According to the Consumer Price Index (CPI), the average inflation rate in the U.S. over the past four years has been 5% (NCPPR believes the actual inflation rate may be higher). Therefore, companies have a fiduciary duty to protect profits from devaluation in addition to increasing them. However, Microsoft has failed to effectively protect its assets from devaluation as it has invested most of its assets in U.S. government securities and corporate bonds.

NCPPR emphasized in the proposal that "although Bitcoin is somewhat volatile, it remains an excellent, if not the best, inflation hedge," and thus recommended that Microsoft evaluate allocating at least 1% of its assets to Bitcoin.

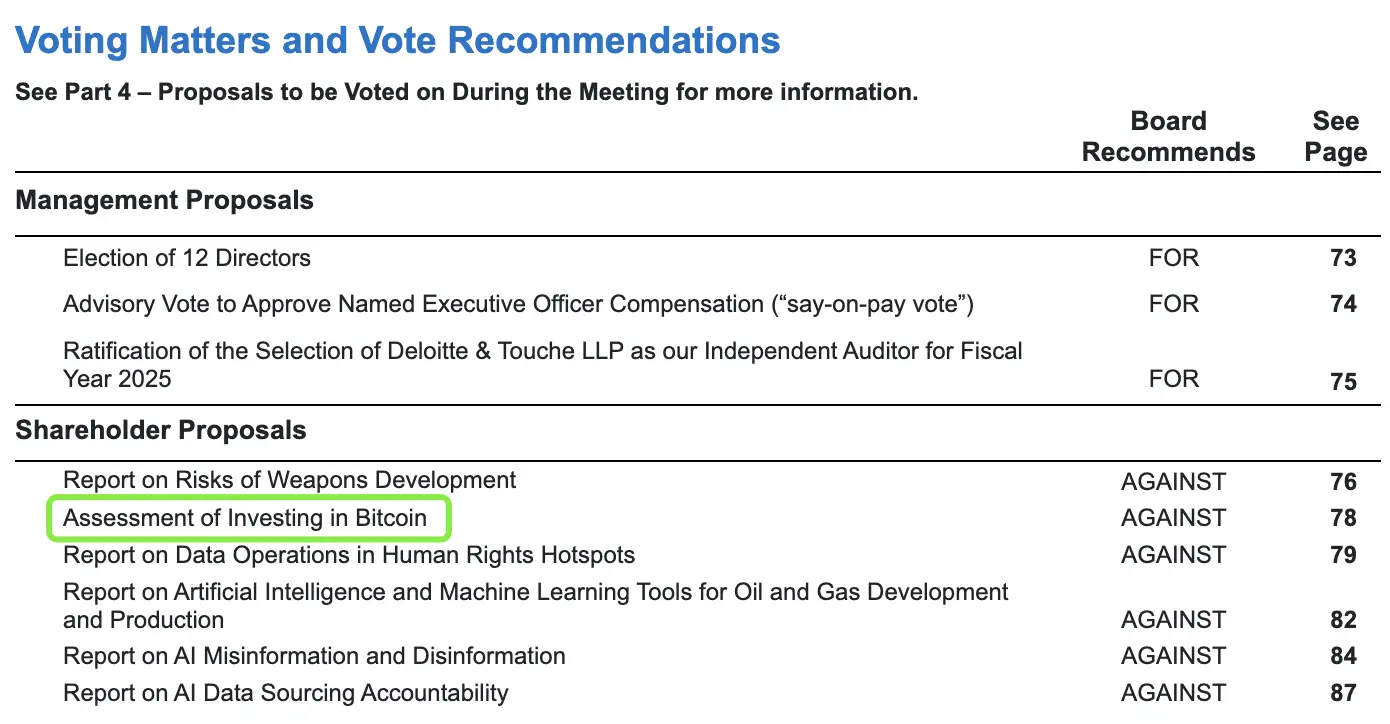

According to documents already filed with the U.S. Securities and Exchange Commission (SEC), the proposal is expected to open shareholder voting on December 10 local time, along with several other proposals.

Will the Vote Pass?

Although the current cryptocurrency community has high expectations for this vote, it remains uncertain whether Microsoft's shareholders will agree to the proposal.

In the documents submitted to the SEC, Microsoft's board has clearly expressed opposition to the proposal, stating that the management has previously evaluated this topic but believes that corporate funds require stable and predictable investments to ensure liquidity and operational funding.

While the upper management has made its stance clear, relevant institutions/individuals supporting the proposal are still actively advocating to push it forward.

On one hand, BlackRock, which holds 7% of Microsoft shares, is expected to participate directly in the vote and is likely to cast a supportive vote; MicroStrategy co-founder Michael Saylor has also presented a 44-page PPT to Microsoft CEO Satya Nadella and the board, emphasizing the changes in the Bitcoin regulatory environment, hoping to sway the upper management's attitude.

On the other hand, on the more radical Reddit forums, many supporters of the proposal are actively calling for Microsoft's small and medium shareholders to vote in favor.

However, even so, the market's expectation for the proposal's passage is still not optimistic. Polymarket's real-time betting data shows that the probability of the proposal passing is only 13%.

If Passed, How Much Buying Power Is There?

Although the voting expectations remain unclear, we can still get a preliminary glimpse of how much money Microsoft could allocate to buy BTC if the proposal passes by looking at its reserves.

Macrotrends data shows that as of September 30, 2024, Microsoft's cash reserves amount to $78.428 billion.

This means that if the proposal passes smoothly and allocates at least 1% of its funds as suggested by NCPPR, it would represent a buying power of at least $780 million.

NCPPR Continues to Push, Is Amazon Next After Microsoft?

This morning, NCPPR submitted a similar shareholder proposal to another tech giant, Amazon, suggesting that Amazon evaluate incorporating Bitcoin into its asset reserves. This time, NCPPR recommends that Amazon invest at least 5% of its total assets.

CZ also commented on this event through his personal X account, asking when Amazon would accept Bitcoin payments.

Although the SEC has not yet outlined the progress of this proposal, Jubilee Royalty founder and CEO Tim Kotzman stated that a related announcement is expected to be released in April 2025, and thus it may be reviewed at the 2025 annual shareholder meeting.

From the already involved MicroStrategy and Tesla to the potentially involved Microsoft and Amazon, Bitcoin's expansion into the mainstream world seems to be accelerating. Although the upcoming Microsoft meeting may not immediately pass this vote, it may just be a matter of time based on the trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fidelity Introduces Crypto IRA With Bitcoin, Ethereum, Litecoin

Fidelity’s crypto IRA has no fees and gives investors the option to set it up as a Roth IRA, traditional IRA, or rollover IRA.

Circle files for IPO

XRP Open Interest Surges 1.27% to $3.64B, Options OI Jumps 35% – Volatility Ahead

FDUSD released an audit report in February: Reserve assets exceeded 100%, supporting 1:1 exchange