November Web3 Security Incident Review: Total Loss Approximately $86.24 Million

In November 2024, there were 21 hacking incidents, resulting in losses of approximately $76.86 million, with $25.5 million recovered. The causes of the incidents included contract vulnerabilities, account hacks, and price manipulation, among others. Additionally, there were 9,208 victims of phishing incidents this month, with losses amounting to $9.38 million.

Author: SlowMist Security Team

Overview

In November 2024, the total loss from Web3 security incidents was approximately $86.24 million. Among these, according to the SlowMist Blockchain Hacked Archive (https://hacked.slowmist.io), there were 21 hacking incidents resulting in losses of about $76.86 million, with $25.5 million recovered. The causes of these incidents included contract vulnerabilities, account hacks, and price manipulation. Additionally, according to the Web3 anti-fraud platform Scam Sniffer, there were 9,208 phishing incident victims this month, with losses amounting to $9.38 million.

(https://dune.com/scam-sniffer/november-scam-sniffer-2024-phishing-report)

Major Security Incidents

MetaWin

On November 4, 2024, according to on-chain detective ZachXBT, the crypto gambling platform MetaWin was allegedly attacked, resulting in the theft of over $4 million on the Ethereum and Solana chains. MetaWin CEO Skel stated that the attacker exploited the platform's frictionless withdrawal system to breach MetaWin's hot wallet.

DeltaPrime

On November 11, 2024, the DeFi protocol DeltaPrime was attacked on Avalanche and Arbitrum, with initial loss estimates of $4.75 million. The root cause of this attack was the lack of input validation in the reward claiming feature.

(https://x.com/DeltaPrimeDefi/status/1855899502944903195)

Thala

On November 15, 2024, the Aptos-based DeFi project Thala was attacked, resulting in the theft of $25.5 million, with the attacker exploiting a vulnerability in its smart contract. The project team suspended the related smart contracts and froze some tokens, ultimately successfully freezing about $11.5 million in assets. After collaborating with law enforcement and several blockchain security teams, the project team successfully negotiated to recover the assets, allowing the attacker to keep $300,000 as a bounty.

(https://x.com/thalalabs/status/1857703541089120541?s=46\&t=bcMyidYO0QkS5ajIW9CBdg)

DEXX

On November 16, 2024, multiple users' funds on the on-chain trading terminal DEXX were stolen. According to the SlowMist Security Team, the losses from this incident have reached $21 million. Currently, the SlowMist Security Team is assisting DEXX officials and partners in ongoing analysis. On November 28, the SlowMist Security Team announced that they had collected 8,612 DEXX attacker addresses on the Solana chain, with EVM chain attacker addresses to be disclosed after the cleaning statistics are completed.

(https://x.com/MistTrack_io/status/1862134946090881368)

Polter Finance

On November 17, 2024, the Fantom-based DeFi project Polter Finance was attacked, resulting in losses of approximately $12 million. The attacker drained the BOO token reserves through a flash loan, artificially inflating the calculated price of BOO. This allowed them to borrow tokens far exceeding the actual value of the collateral, resulting in substantial profits. The platform's founder stated that they have reported to the Singapore authorities and attempted to contact the attacker through on-chain messages to negotiate the return of funds but have not yet received a response.

(https://x.com/polterfinance/status/1857971122043551898)

Feature Analysis and Security Recommendations

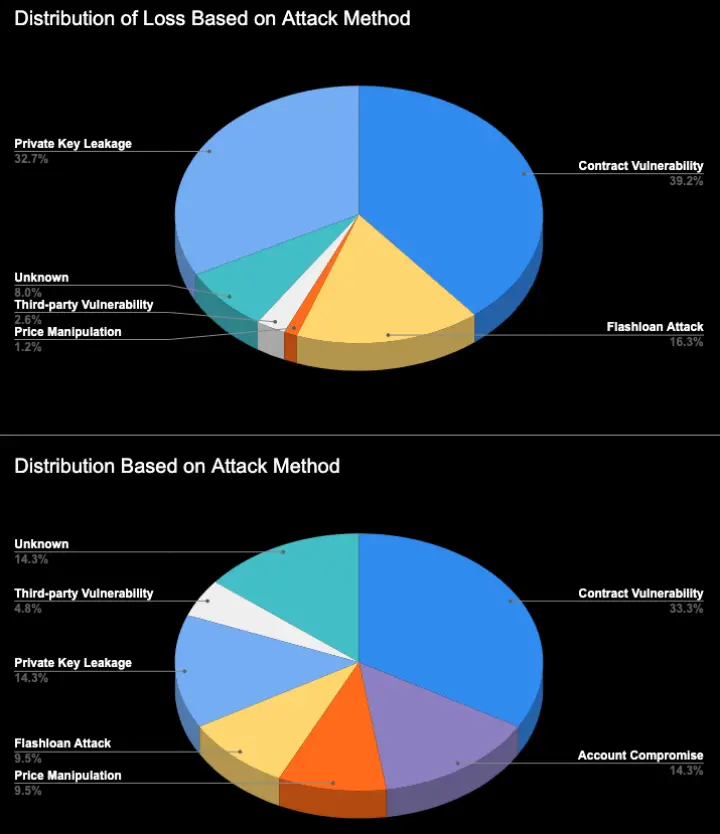

The number of security incidents and the scale of losses this month have significantly decreased compared to last month, reflecting ongoing improvements in security measures within the industry. Notably, contract vulnerabilities remain the highest proportion in terms of both the distribution of attack causes and the scale of losses. The seven incidents of contract vulnerability exploitation this month resulted in losses of approximately $30 million, accounting for 39% of total losses. The SlowMist Security Team advises project teams to remain vigilant and conduct regular comprehensive security audits, track and address new security threats and vulnerabilities to protect project and asset security.

Additionally, the SlowMist Security Team noted that there were real cases of AI poisoning attacks targeting the crypto industry this month. This phenomenon indicates that the target range of supply chain attacks is further expanding. Some developers, in pursuit of efficiency, may overly rely on AI-generated code while neglecting the review of code security. Therefore, the SlowMist Security Team reminds developers and project teams not to blindly trust the output results when using AI-generated code. All code should undergo rigorous security audits and testing before being put into actual use to prevent security risks and protect the project and users' assets. Meanwhile, project teams should strengthen overall supply chain security management, conduct comprehensive assessments of third-party tools and services, and continuously monitor security dynamics in related fields to respond promptly to new threats.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VELO’s Wave Trend Oscillator Flashes Bullish Signal—Is Another Massive Rally Coming?

Writers protest in London against Meta over AI trained using copyrighted work

Share link:In this post: Artists and writers protested against Meta at its London office for copyright infringement. The writers are angry at the social media firm for using their work to train its AI models without their permission. Meta however defended its position arguing it “respects third party intellectual property.”

Trump Family Crypto Pivot – Eric Trump Embraces Crypto & Trump's Empire Expands

Pornhub adds Bitcoin and Litecoin payments for Premium Subscription