Indonesia’s 2024 Crypto Transactions Exceed $30B with 21M Traders

Indonesia's crypto market has surged, surpassing $30 billion in transactions in 2024, with 21 million traders, reflecting a remarkable growth of 352% from the previous year.

Indonesia’s crypto market has reached a significant milestone, recording more than 475 trillion Indonesian rupiah (approximately $30 billion) in transactions as of October 2024.

This marks a dramatic increase from the $6.5 billion in transactions recorded in the same period last year, reflecting a 352% growth.

Indonesia Continues to Lead Global Crypto Adoption, Ranking in Top 20

According to the Commodity Futures Trading Supervisory Agency (CoFTRA), the market’s impressive expansion noted that cryptocurrency transactions in 2024 have already surpassed the total of $19.4 billion recorded in 2022.

However, Indonesia’s crypto transactions are still trailing behind 2021, when they reached around $54 billion, largely due to a bullish market that year.

The surge in transactions is accompanied by a growing number of crypto traders in Indonesia. The country now boasts 21 million crypto traders, with 716,000 using local registered exchanges.

This places Indonesia among the largest nations in terms of crypto trader numbers.

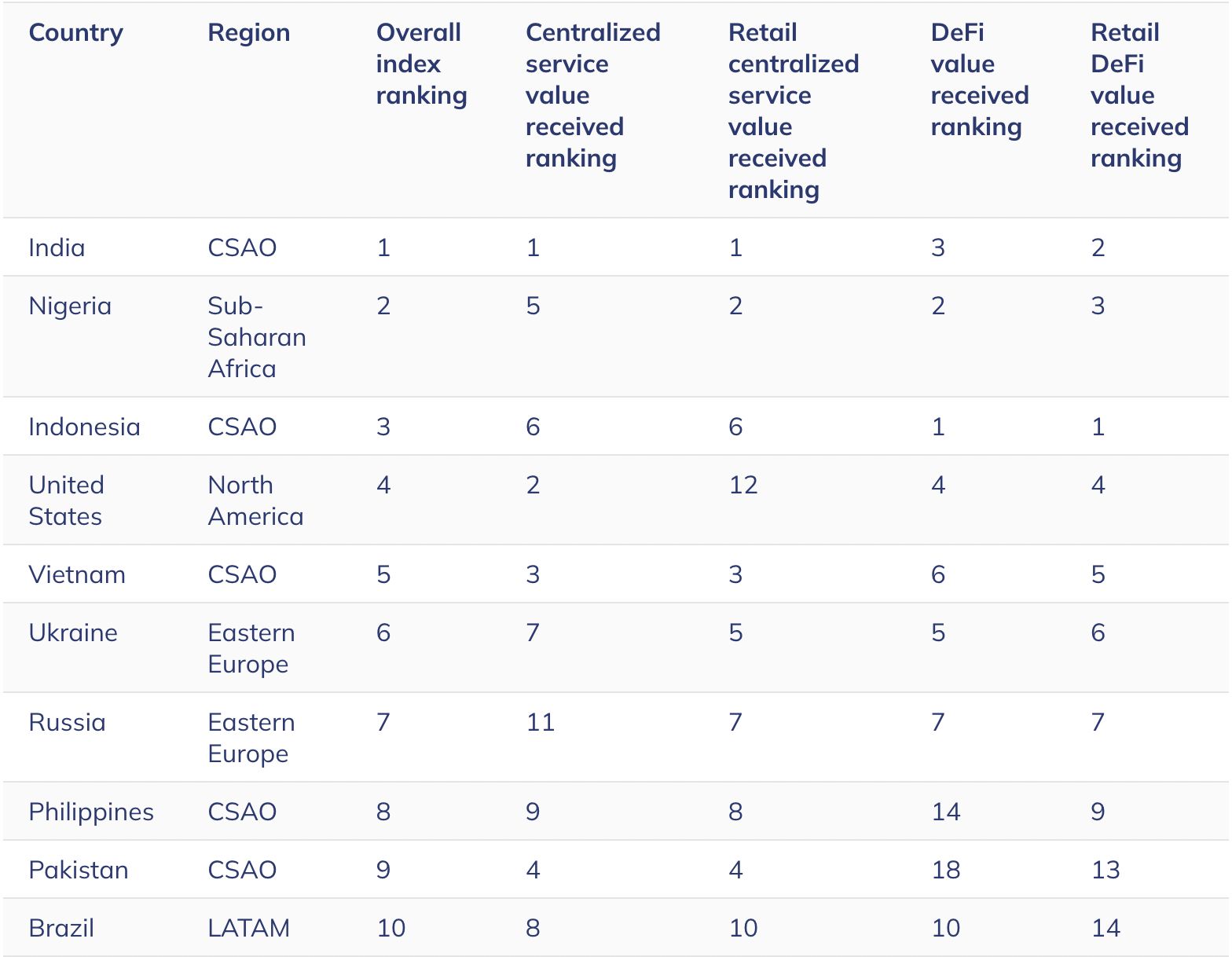

Source: Chainalysis

Source: Chainalysis

The latest data also supports Indonesia’s ranking in Chainalysis’s Global Crypto Adoption Index, which highlights Indonesia as one of the fastest adopters of cryptocurrency worldwide, alongside India and Nigeria.

Youthful Investors Drive Crypto Boom in Indonesia, with 60% of Users Aged 18 to 30

The Indonesian crypto market faced significant turbulence following the 2021 high, primarily due to the introduction of a “dual taxation” policy in 2022.

This policy added a 0.1% tax on crypto gains to standard income taxes, contributing to a marked decline in market activity.

Despite this setback, recent data shows a promising recovery, with 2024 transaction totals already surpassing those of the previous two years combined.

Indonesia’s impressive recovery is reflected in its position as the third-highest country on Chainalysis’s Global Cryptocurrency Adoption Index, with the country continuing to lead the Oceania/Asia region.

Seven of the top ten countries in the index are from this region, with only India and Nigeria surpassing Indonesia in adoption.

Recent policy changes in Indonesia, including the relaxation of restrictions on institutional investment through CoFTRA Regulation (PerBa) Number 9 of 2024, may have contributed to the September cryptocurrency rally.

Additionally, there have been calls for the government to reconsider the “double tax” policy as part of broader policy rewrites following President Prabowo Subiant’s reorganization efforts after taking office in October.

According to Bappebti data , the majority of crypto users in Indonesia are aged 30 and below, with over 60% of investors between 18 and 30. In September 2024, crypto transactions in the country totaled $2.1 billion.

This aligns with Indonesia’s sustained position in the top 20 global nations for rapid crypto adoption over the past three years.

Popular assets include Bitcoin, Ether, Tether, and Solana. This trend mirrors global patterns, with millennials and Gen Z increasingly investing in crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

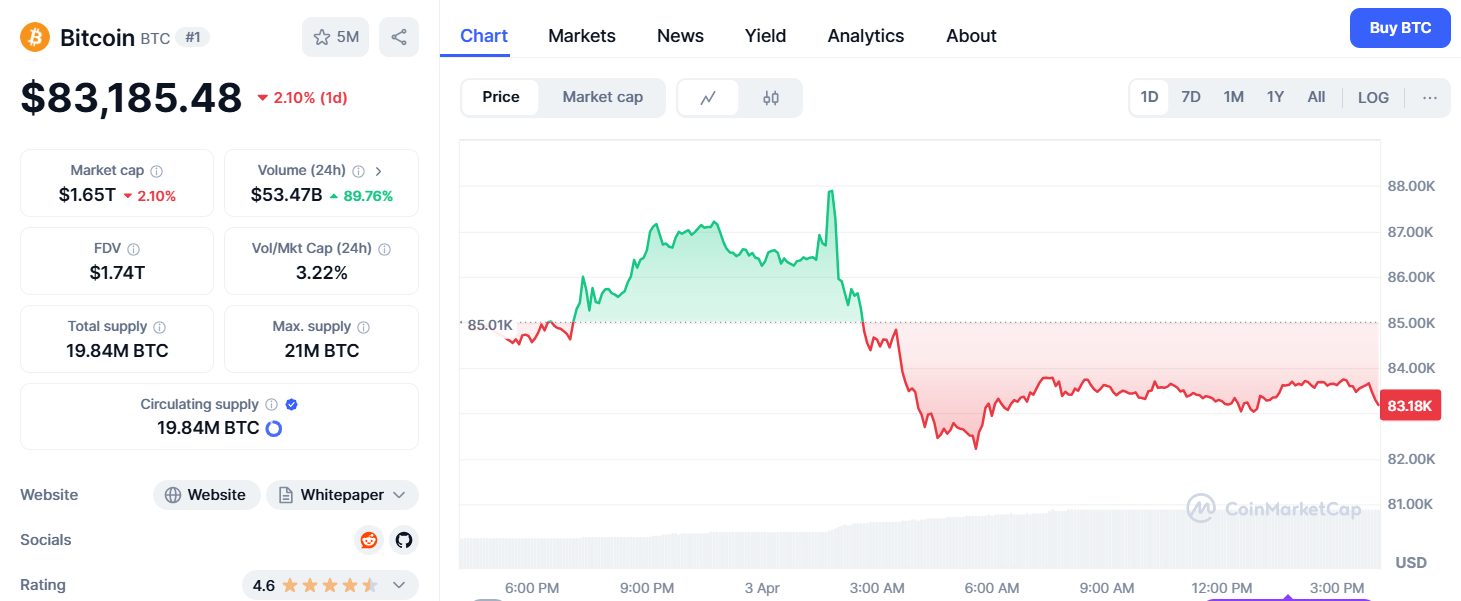

Crypto Market Becomes Casualty to Trump’s Tariff Announcements

Crypto Price Today (April 3, 2025): Bitcoin Falls After US Tariffs; ETH, XRP, SOL Fumbles

Analyst Expects BTC to Pump in April and Highlights Top 10 Hidden Gems with 200x Pump Potential

BIGTIME Surges Over 60% Within an Hour, Despite the $300 Million Liquidation in Crypto Under 4 Hours