Conflux Foundation commits $500M to fuel PayFi Web3 payments solution

The Conflux Foundation plans to invest $500 million to support the growth of PayFi, short for Pay Finance, a Web3 payments solution.

Conflux’s $500 million investment will come from its ecosystem fund and will go toward developing PayFi, a blockchain-based payments platform that aims to bring traditional finance services to the blockchain.

PayFi aims to create a “more integrated value network,” by bringing financial products like credit cards, invoice financing and reverse factoring onto the blockchain, Conflux Foundation announced on Nov. 11.

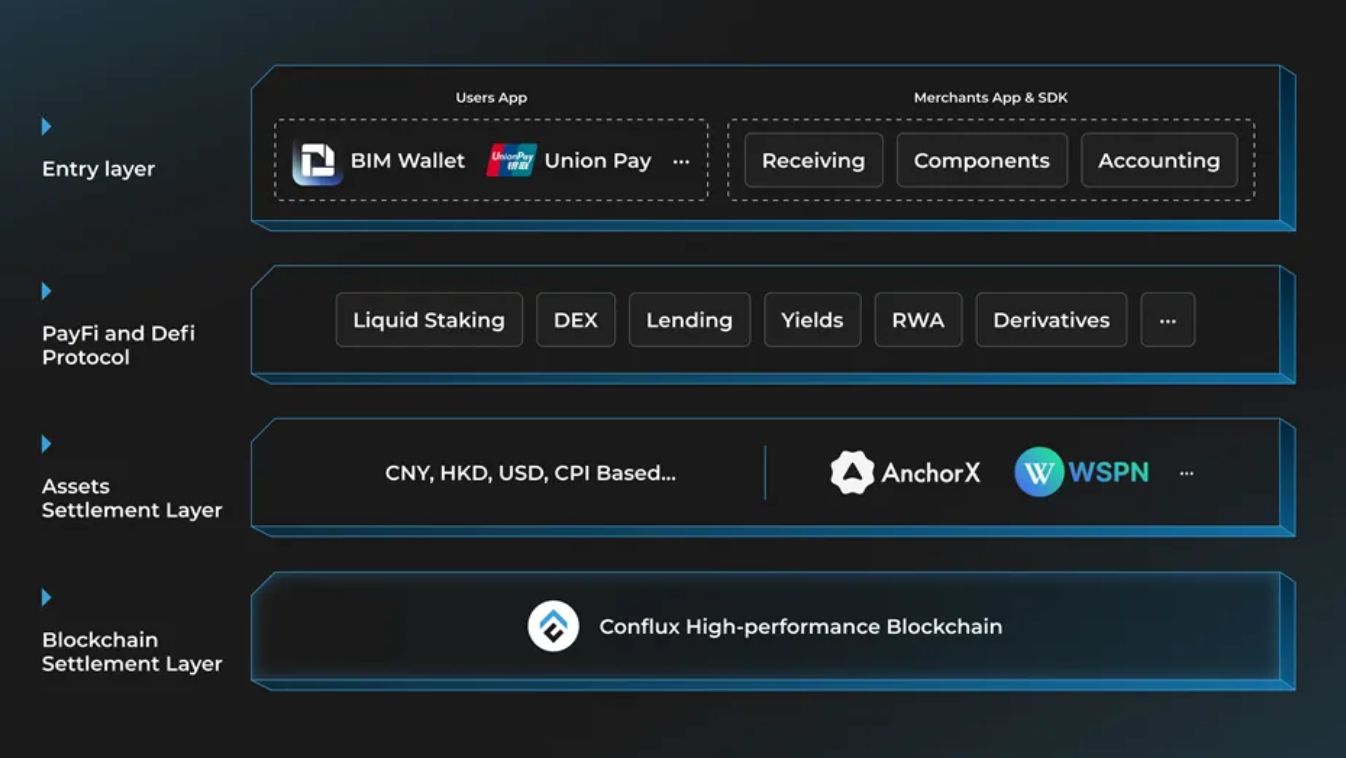

The Conflux PayFi Stack. Source: Medium.com

The PayFi stack is built on the Conflux blockchain, a layer-1 network focused on stablecoin and payment infrastructure for consumer-grade payments.

Blockchain applications with intuitive user experiences could attract more mainstream cryptocurrency users, as the usability challenges of current decentralized finance (DeFi ) applications are a major barrier for new crypto investors.

Related: Trump’s presidency could bring SEC reform and pro-crypto regulations

This is a developing story, and further information will be added as it becomes available.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Justin Sun Stands Firm: No Plans to Sell Ethereum Assets

In Brief Justin Sun insists on retaining Ethereum assets despite market downturns. Plans for collaborations with Ethereum developers aim to enhance Tron's vision. Strategic partnerships could strengthen Tron's market position moving forward.

Crypto Capo Predicts Bitcoin Surge as Market Signals Shift

In Brief Crypto Capo predicts a potential Bitcoin surge beyond $85,000. Render shows promise if it bounces back from its support level. Investors are advised to monitor market dynamics closely.

Stablecoin transactions outpaced Visa payments last quarter: Bitwise

Q1 may have been “frustrating,” but things are looking brighter for Q2

Brazil court sentences Braiscompany Team 170 years of jail for crypto scams