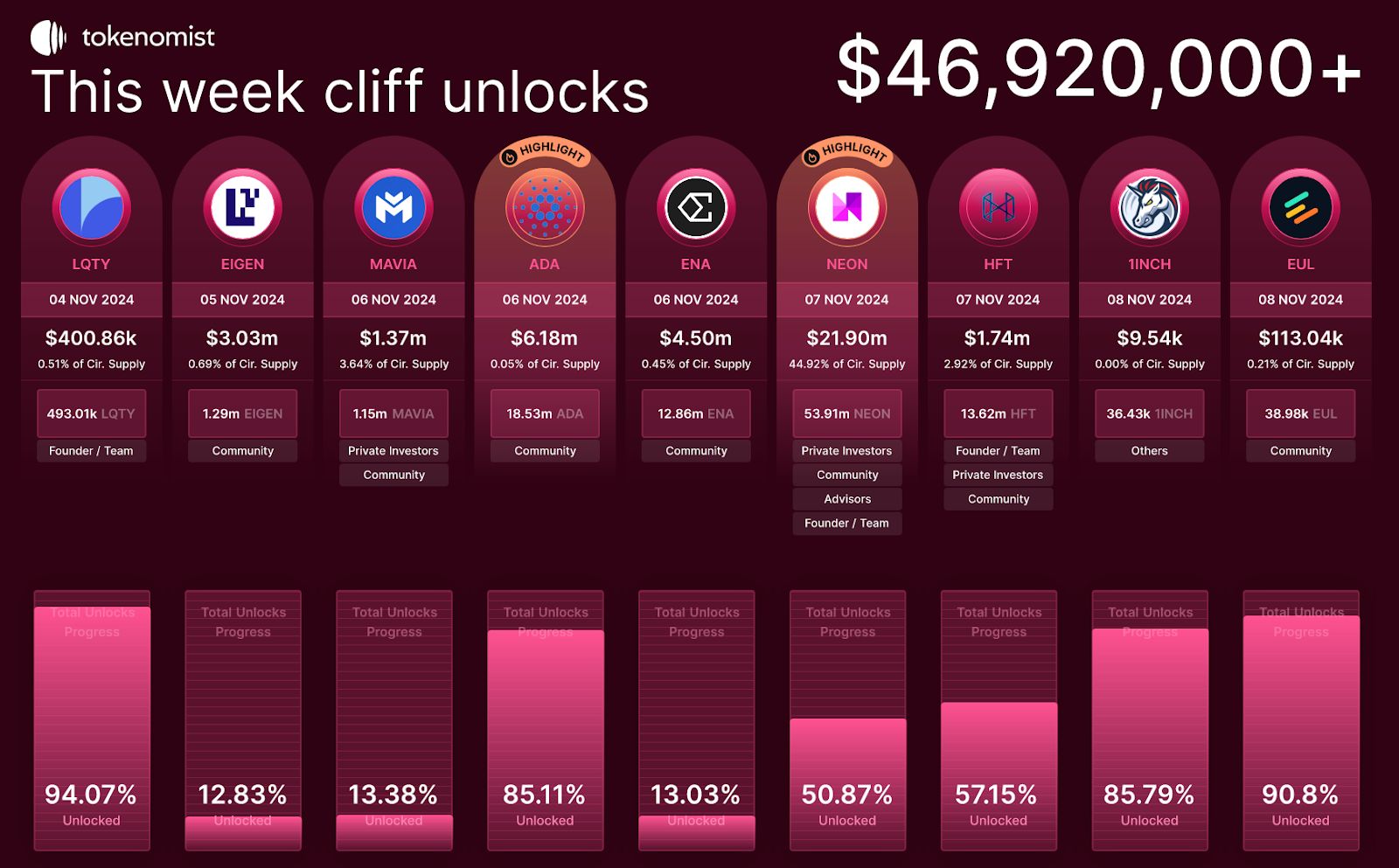

- Over $21.9 million in NEON will be released in the market.

- A massive $6.18 million in ADA will be unlocked as well.

- ADA has surged 16.31% in the past 24 hours and trades at $0.43.

More than $21 million worth of Neon EVM (NEON) tokens are set to enter the market, alongside over $25 million in other tokens, including Cardano (ADA), Ethena (ENA), EigenLayer (EIGEN), Hashflow (HFT), and Heroes of Mavia (MAVIA). This influx comes as the broader crypto market reached new highs and recorded significant gains.

According to the data posted on X by Tokenomist (formerly TokenUnlocks), a substantial 44.92% of the circulating supply of NEON (53.91 million NEON) will be unlocked, along with $6.18 million in ADA (0.05% of the circulating supply). Additionally, $400,000 in Liquity (LQTY) and $113,000 in Euler (EUL) will be released.

CoinMarketCap data indicates that NEON is currently trading at $0.4011, a 0.77% decrease over the past 24 hours. However, the altcoin has seen a considerable 26.03% increase over the last 30 days. In contrast, ADA surged 16.31% in the past day and now trades at $0.4308, a 25.45% rise over the past month. Meanwhile, LQTY and EUL are priced at $0.9167 and $3, respectively, with EUL climbing 6.58% and LQTY falling 2.12%.

Read also: Cardano Founder Faces Backlash Over “Cancer” Poll: Is Hoskinson Hurting ADA?

Additional Token Unlocks

Furthermore, $3.03 million (0.69% of the circulating supply) in EIGEN will be released, followed by $4.50 million in ENA (0.45% of the circulating supply). Also, $1.74 million in HFT (2.92% of the supply) will enter the market, along with $1.37 million in MAVIA (3.64% of the circulating supply). At the time of writing, ENA is trading at $0.4979, down 5%; EIGEN is priced at $3.07, down 1.81%; HFT is worth $0.1279, up 0.3%; and MAVIA is trading at $1.41, up 1.79%.

These token unlocks are anticipated to have a bearish effect on the market. While demand is expected to remain stable, the increased supply of these cryptocurrencies could lead to downward price pressure.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.