Bitcoin may have hit short-term price top ahead of US Election, analysts say

Bitcoin on-chain metrics indicate that the digital asset has hit a short-term price top ahead of the U.S. election, according to analysts.The largest digital asset by market capitalization has dropped from a local high on Monday above $69,000, to now hover above the $66,000 mark.

Bitcoin’s latest price movements suggest a potential short-term peak, with on-chain metrics indicating signs of market overheating, according to digital asset custodian Copper.

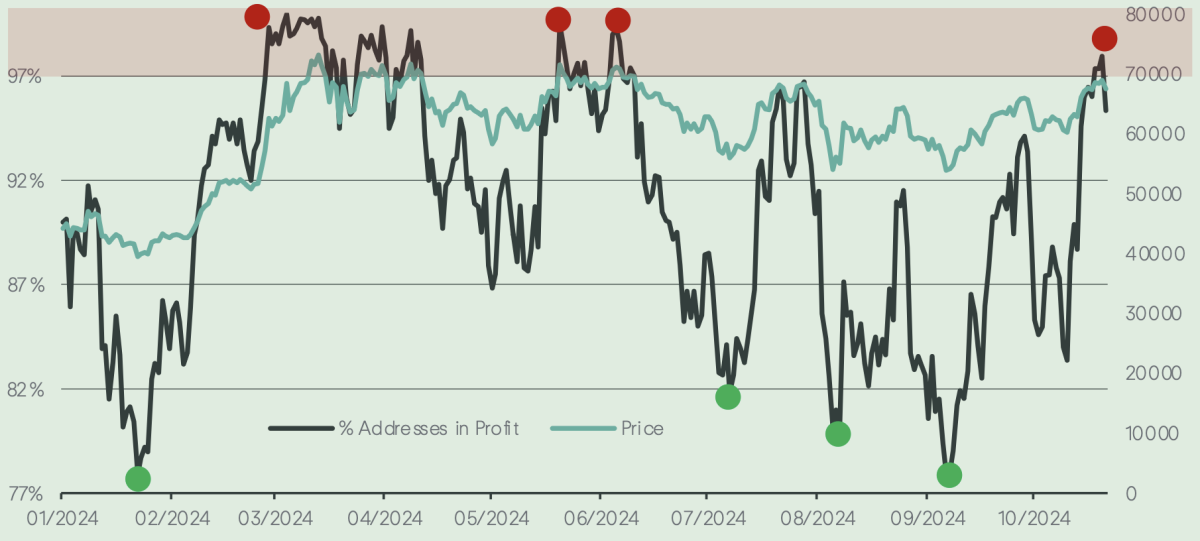

As bitcoin hovers above the $66,000 mark, Copper research analysts have studied key metrics, particularly those reflecting the profitability of addresses, to assess market sentiment ahead of the upcoming U.S. election.

The analysis of bitcoin’s on-chain data in this week's Copper Opening Bell report indicates that 98% of wallet addresses are now in profit based on the price at which bitcoin was last moved. Historically, when this ratio increases significantly—it was recently 75%—sell pressures often arise as investors look to lock in profits. According to Copper analysts, this could signal that bitcoin is nearing a short-term peak.

"Patterns emerge when large swings occur, and as we see a substantial percentage of addresses moving into profit, it typically leads to sell pressure," Copper analysts said. "This could suggest that the market is experiencing a temporary top ahead of the U.S. election."

ETF market reaction remains lukewarm

In addition to on-chain data, Copper analysts noted that despite strong inflows into spot bitcoin ETFs , overall enthusiasm remains subdued. As of mid-October, cumulative net inflows into spot bitcoin ETFs have surpassed $21 billion. However, after seven consecutive days of positive net inflows, ETF activity reversed to show negative daily flows on Tuesday.

According to data from SoSoValue, the 12 spot bitcoin ETFs reported total net outflows of $79.09 million. The day’s entire outflows came from Ark and 21Shares’ ARKB, which saw $134.74 million leave the fund.

"Certainly, markets have reacted to the recent seven days of inflows, and prices broke past the $69,000 mark for the first time since July. Yet, something seems amiss in terms of growth. At the start of the year, there was a large cluster of daily growth in ETFs, which has been absent from the markets lately," the Copper analysts added.

Meanwhile, analysts from the ETC Group highlighted that bitcoin demand has experienced its largest increase since April 2024. They attribute this upward trend to several key factors influencing the market.

Like Copper's report, the upcoming U.S. presidential election is one major catalyst they mentioned in their Wednesday report. The chances of former President Donald Trump winning the election have significantly increased, a development that has historically been positive for crypto markets.

Another factor driving demand that was cited was a general increase in risk appetite across the broader financial markets. Last week, both the U.S. stock market and gold prices reached new all-time highs, signaling that investors are becoming more willing to take on risk.

Additionally, ETC Group analysts said concerns over rising U.S. budget deficits could steer investors toward bitcoin as a safe haven. Since the beginning of September 2024, U.S. public debt has ballooned by nearly $500 billion, raising questions about the sustainability of the country’s fiscal policies.

"We believe the combination of bitcoin’s limited supply, shifting global monetary policies, and positive fourth-quarter seasonality will provide strong support for cryptoassets in the coming months," the ETC Group analysts said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Don’t Wait for Solana—These 5 Altcoins Are Primed to 10x Sooner

Bitcoin Price Rebound Could Push BTC to $150,000 and RCOF to $2 from $0.1

SOL falls below $190

Nillion: NIL token airdrop registration window has closed