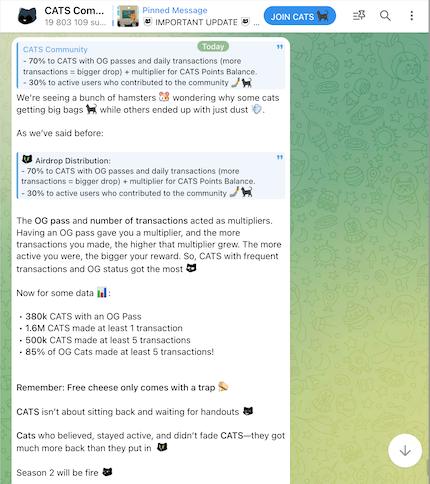

CATS on why some cats getting big bags while others ended up with just dust

We’re seeing a bunch of hamsters wondering why some cats getting big bags while others ended up with just dust.

As we’ve said before:

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

The OG pass and number of transactions acted as multipliers. Having an OG pass gave you a multiplier, and the more transactions you made, the higher that multiplier grew. The more active you were, the bigger your reward. So, CATS with frequent transactions and OG status got the most

Now for some data :

• 380k CATS with an OG Pass

• 1.6M CATS made at least 1 transaction

• 500k CATS made at least 5 transactions

• 85% of OG Cats made at least 5 transactions!

Remember: Free cheese only comes with a trap

CATS isn’t about sitting back and waiting for handouts

Cats who believed, stayed active, and didn’t fade CATS—they got much more back than they put in

Season 2 will be fire

P.S. We know that a small group of CATS still has issues with uncounted OG passes or transactions, even though most of the problems were handled and solved before the airdrop. We want to ensure that no cat receives fewer CATS than they deserve

Soon, we’ll be opening a CATS hotline for airdrop/balance issues to make sure every cat is taken care of

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.

TRUMP Coin Jumps 70% on President's Dinner Event for Top Token Holders