Understanding NovaBank in one article: DeFi 3.0 on-chain banking protocol based on algorithmic non-stable currency NVB

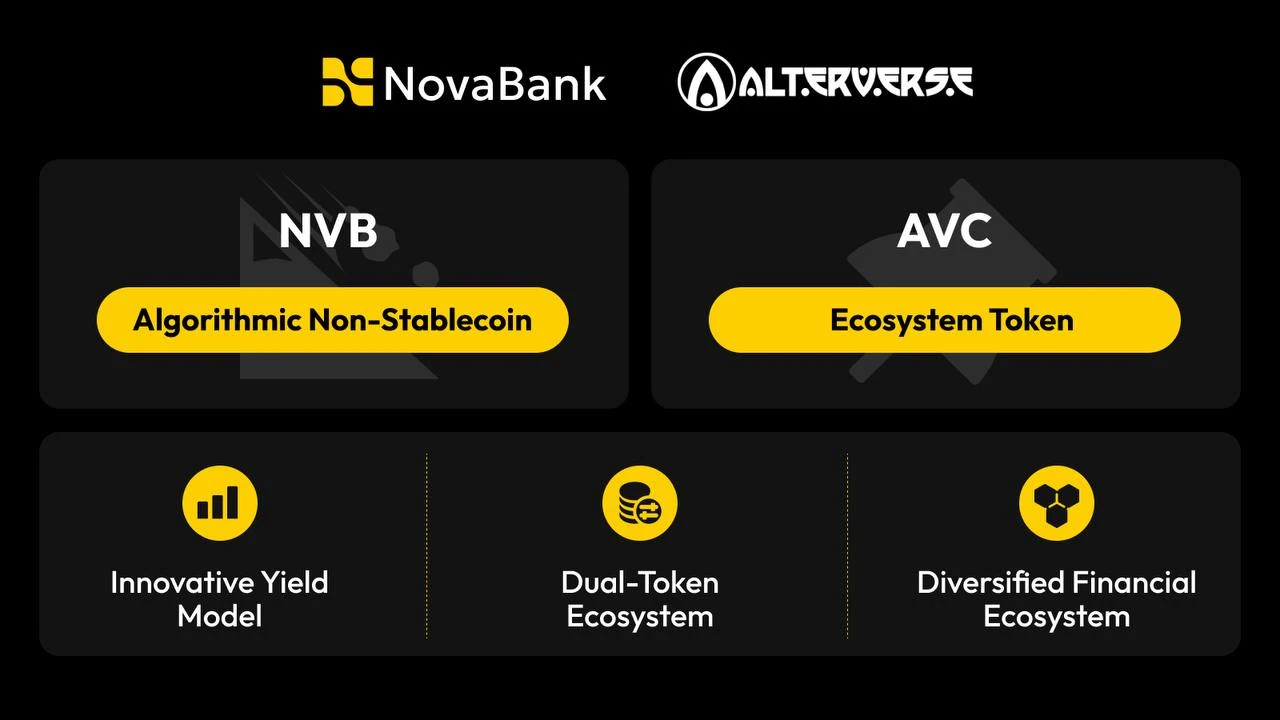

With the rapid development of decentralized finance (DeFi), more and more innovative projects have promoted the continuous transformation of this field. NovaBank was born in this context. It is based on the successful model of Olympus DAOs algorithmic non-stable currency OHM and has carried out iterative innovation on this basis. NovaBank has built a new on-chain banking protocol through its dual-currency ecology and diversified Web3 ecological integration, as well as fission incentive mechanism, aiming to provide users with more free and transparent decentralized financial services.

1. Introduction to NovaBank

NovaBank is an on-chain banking protocol based on the DeFi 3.0 architecture, with the algorithmic non-stablecoin NVB at its core. NovaBank draws on the underlying economic model of Olympus DAO, OHM, a proven and successful business model that ensures the long-term stability of the protocol. Through the automatic execution of smart contracts, NovaBank achieves full on-chain transparent operations of token issuance, market regulation, and revenue distribution.

NovaBank not only inherits the robust mechanism of OHM, but also greatly improves the fission speed of the community through the profit model, dual-currency ecological gameplay (NVB + AVC), and diversified integration in the Web3 field, realizes the ecological integration of private and public domains, and makes the overall protocol operation more stable.

2. NVB - Non-stable Coin Based on Algorithm

NVB is the core token of NovaBank, and its supply and price are regulated by an algorithmic mechanism to ensure the stability of the token market. NVB is issued based on market supply and demand, and is minted with a risk-free value (RFV) of 1 USDT as support, which ensures that the token can maintain stability and have long-term growth potential without external support.

Drawing on the OHM model of Olympus DAO, NovaBank further enhances the utility and growth potential of tokens through its revenue model and contribution value system. Compared with the traditional stablecoin model, NVBs algorithmic model allows for more flexible market regulation and effectively prevents excessive manipulation in the centralized financial system.

3. NovaBank’s six core contracts

1. Treasury Contract: The Treasury Contract is responsible for NovaBanks asset reserve management to ensure the security and stability of the protocol assets. Through continuous asset accumulation, the Treasury provides NVB with coinage support to ensure the long-term sustainable development of the protocol.

2. Sales Contract: The sales contract regulates the issuance of tokens through a market supply and demand balance mechanism, ensuring that the price and liquidity of NVB always remain at a healthy level.

3. Bond Contract: Bond contracts provide users with the opportunity to purchase NVB at a discount. By holding bonds, users can inject more liquidity and RFV into the protocol, ensure the stable flow of funds, and enjoy the opportunity to acquire tokens at a low cost.

4. Pledge contract: The pledge contract allows users to obtain stable compound interest by staking NVB. The users pledge income is automatically rolled over, which increases the stability of asset appreciation and helps the platform maintain market liquidity.

5. Profit Exercise Period Contract: This contract ensures that the users profits are gradually released according to the established cycle, avoiding short-term fluctuations from affecting long-term profits, providing users with higher fund security and profit stability. At the same time, users can accelerate the release of profits by destroying the ecological token AVC, thereby gaining greater flexibility.

6. Contribution value algorithm contract: NovaBank rewards users for their contributions through a contribution value algorithm. The greater the contribution, the greater the reward. This mechanism encourages users to actively participate in platform construction and improve the overall activity of the protocol.

IV. NovaBank’s innovative highlights

1. Dual-currency ecological gameplay: In addition to NVB as the core token, NovaBank also introduced the ecological token AVC (Alterverse is led by Binance). AVC not only provides power for NovaBanks economic cycle, but also accelerates the fission of the community and user participation. Users participate in NVB single-coin staking to obtain extremely high APY returns, and introduce AVC destruction to accelerate the release of returns. At the same time, the ecological destruction income is regularly repurchased and destroyed by DAO voting, truly achieving two-way empowerment of private and public domains, which greatly improves user participation and community stickiness.

2. Decentralized governance: NovaBank relies entirely on community governance, and users can participate in the decision-making and voting of the protocol by holding NVB. This decentralized management model ensures the transparency and fairness of the protocol and avoids the manipulation of the financial system by centralized institutions.

3. Diversified Web3 ecological integration: NovaBank is not just a DeFi protocol, it is also committed to integrating diversified application scenarios in the Web3 field such as NFT, DAO governance, GameFi, payment, RWA, etc., which enhances the user activity and community interaction of the platform. With the development of the treasury value-added plan, it will also provide a variety of financial services in the future, such as lending, financial management, and profit distribution, providing users with more options for asset management and value-added.

4. Continuously innovative revenue model: NovaBanks revenue model gradually releases users pledge revenue through the exercise period, and users can accelerate the release of revenue by destroying AVC. This flexible and controllable revenue model allows users to enjoy more autonomy while obtaining long-term stable returns.

5. Community fission and private domain + public domain combination: Through the ecological dual-currency model, NovaBank has successfully achieved the combination of private domain community and public domain ecology. Users can not only obtain income through staking, but also obtain more token rewards by participating in the fission incentive policy, thereby promoting the expansion of the community and the self-value-added of the ecology.

5. NovaBank’s Economic Model

NovaBanks underlying economic logic draws on the OHM model of Olympus DAO. Its token NVB regulates supply through an algorithmic mechanism and is backed by a risk-free value (RFV) of 1 USDT. This mechanism ensures the long-term stable growth of the token and has a high degree of market adaptability.

In addition, NovaBanks economic flywheel model includes two parts: static income and dynamic income. Users can obtain static compound interest income by staking NVB, and obtain dynamic income through contribution value reward system and bond incentive mechanisms. The 0.4% (initial balance point) block income of one block time every 8 hours ensures the long-term interests of staking users.

6. How does NovaBank solve traditional financial problems?

1. Breaking down centralized barriers: NovaBank’s decentralized protocol allows users to no longer rely on centralized financial institutions. Users can directly control their own assets and income, eliminating dependence on traditional banks and financial intermediaries.

2. Transparency and auditability: All operations of NovaBank are completed on the chain through smart contracts, which are open and transparent. Users can query and audit the operation of the agreement at any time to ensure the security of funds.

3. Lower the threshold for financial participation: Through algorithmic mechanisms, NovaBank can dynamically adjust market liquidity, and users can easily participate in the DeFi ecosystem without high financial knowledge and complex operations.

7. Future Prospects of NovaBank

NovaBank has successfully created a decentralized on-chain banking protocol based on the underlying algorithm mechanism of Olympus DAO and an innovative multi-ecological economic model. NVB is the core token, and AVC is the driving force of the NovaBank 1.0 ecosystem, providing users with long-term stable returns and diversified ways to participate.

NovaBank is not only an innovative decentralized on-chain banking protocol, but also a complete crypto-financial ecosystem. Through algorithmic regulation, decentralized governance, and a multi-ecological model, NovaBank has achieved an efficient combination of community and users, greatly promoting the development of decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EigenLayer announces that the penalty mechanism is now live on the mainnet

A whale bought 3,659.83 ETH with 5.88 million DAI after sleeping for 2.8 years

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Tron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop