MultiversX (EGLD) Continues To Lead All Crypto Gaming Projects in Level of Development Activity: Santiment

The layer-1 blockchain MultiversX ( EGLD ) continues to lead the digital asset gaming sector in terms of development activity, according to the crypto analytics firm Santiment.

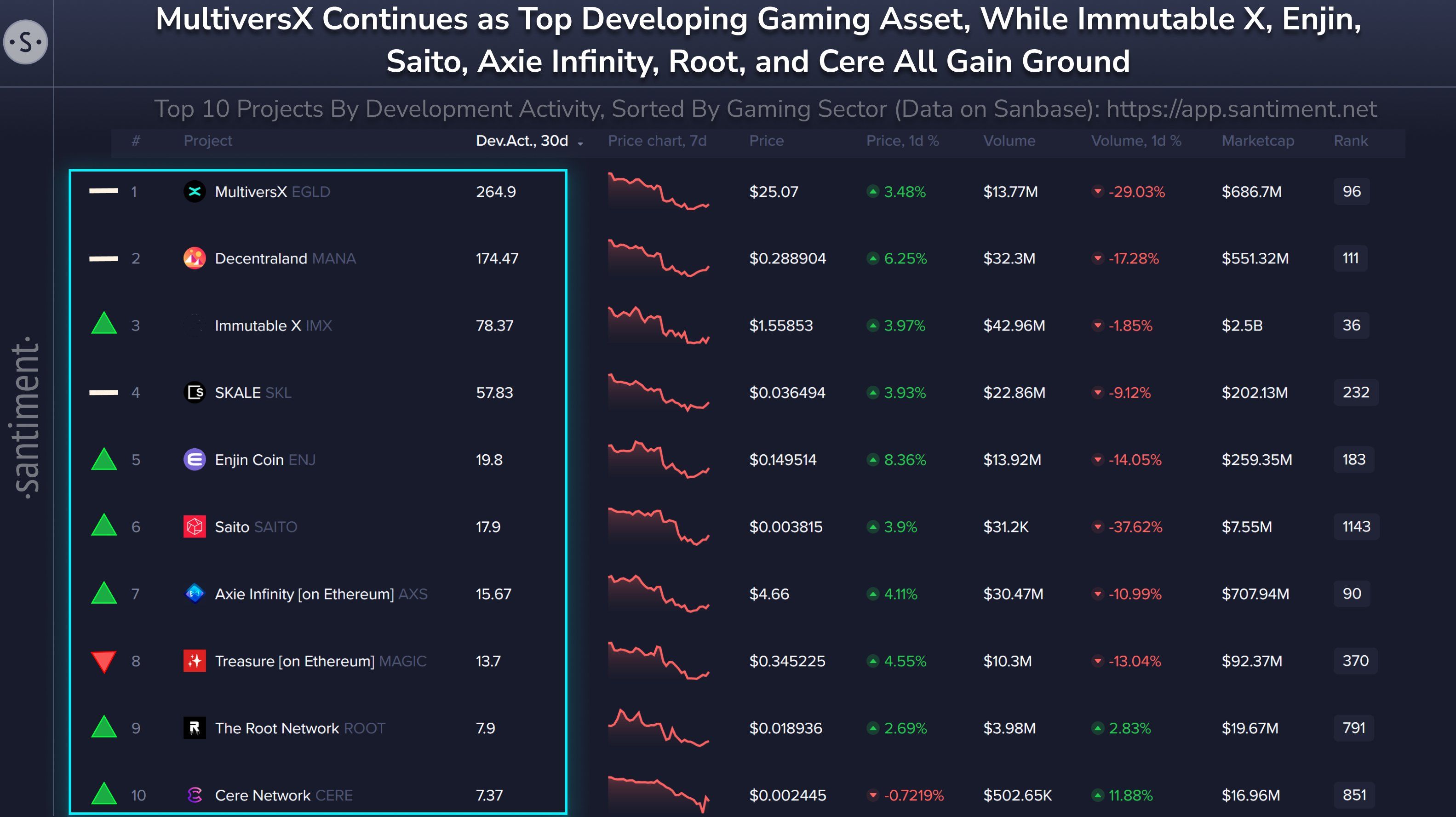

Santiment notes in a new post on the social media platform X that MultiversX, formerly known as Elrond, registered 264.9 notable GitHub events in the past 30 days.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,000 nodes. The project aims to help developers build next-gen applications. It has led the crypto gaming sector in terms of GitHub events since it passed the Ethereum ( ETH )-based virtual reality platform Decentraland ( MANA ) in May.

Decentraland remains in second in the space with 174.47 notable GitHub events in the past 30 days. The non-fungible token (NFT) layer-2 scaling solution Immutable X ( IMX ) came in third with 78.37.

Source: Santiment/X

Source: Santiment/X

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP ETFs: Ripple Predicts Inevitability in the Near Future

Institutional Interest Surge in XRP Futures ETFs Surpasses Ethereum, Paving the Way for Potential Spot ETF Approval

Ripple CEO Questions Crypto Senator’s Canceled Meeting

South Africa May Grant Starlink Regulatory Exemption

Dune Introduces Real-Time Multichain Platform Sim