Joe Coin Price Prediction: JOE Tops Meme Coin Gainers With 41% Surge As Traders Pivot To This ICO For 752% APY

The Joe Coin price surged 41% in the last 24 hours to trade at $0.03288 as of 03:20 a.m. EST on trading volume that jumped 7% to $3.5 million.

The pump made JOE the top meme coin gainer among major cryptos by market capitalization, according to CoinGecko.

Joe Coin Price On A Bullish Trend

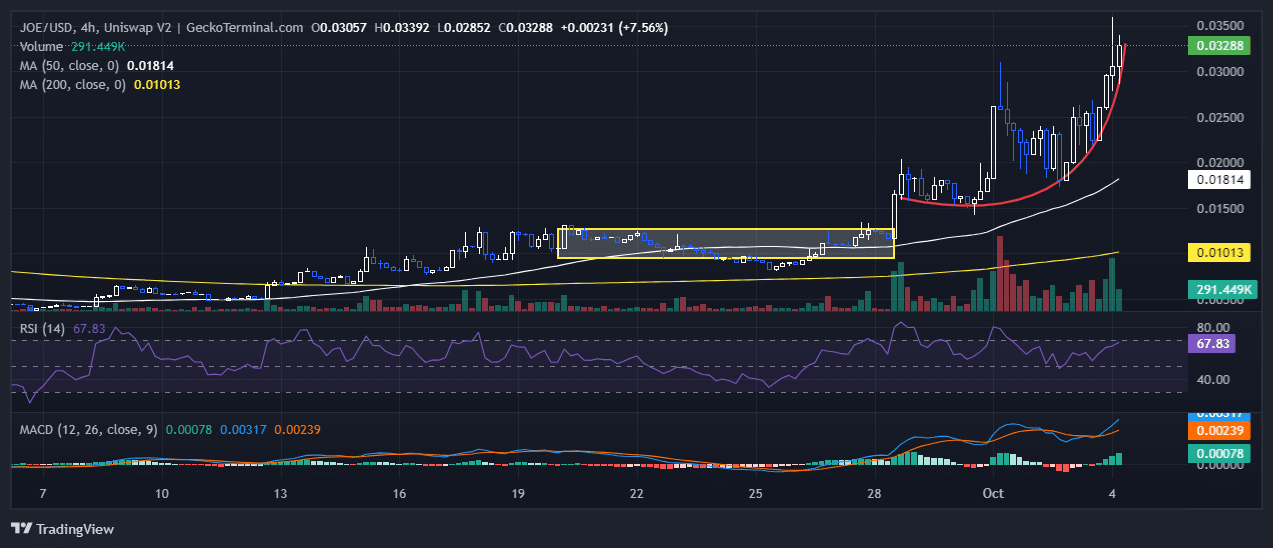

The JOE/USDT pair shows a strong bullish momentum, particularly in the most recent candles. There was a consolidation (sideways movement) between September 21 to October 1, highlighted by the yellow box, which formed a solid base for the price around the $0.012 range, according to data from GeckoTerminal .

After breaking out of that consolidation, the price rallied sharply, forming a curved “parabolic” move (marked by the red arc).

The price is currently sitting at $0.03288, after a strong upward surge of +7.56% in the last few candles, suggesting that buyers have taken control.

JOE now trades above both the 50-day and 200-day Simple Moving Averages (SMAs), which shows that the price of Joe Coin is still on a bullish trend.

Moreover, the Relative Strength Index (RSI) is hurtling towards the 70-overbought region, currently at 67, which shows that JOE is under intense buying pressure.

The bullish sentiment is further cemented by the Moving Average Convergence Divergence (MACD) crossing the neutral line. The green bars on the histogram also support the positive momentum.

JOEUSD Chart Analysis Source: GeckoTerminal.com

JOEUSD Chart Analysis Source: GeckoTerminal.com

Joe Coin Price Prediction

According to JOE/USD chart analysis on the 4-hour timeframe shows that JOE is currently on a sustained bullish stance. If the bulls sustain this trend, JOE could soar even higher to $0.045.

However, if the bears take control of the price at this level, JOE could plunge to the $0.018 support on the 50-day SMA.

Meanwhile, investors looking for alternatives may want to consider Crypto All-Stars (STARS) , an innovative new ICO that has raised over $1.97 million.

According to ClayBro, a prominent crypto analyst on YouTube with over 130K subscribers, $STARS has the potential to soar 10X after its launch.

Crypto All-Stars Presale Raises Over $1.97 Million – Best Meme Coin To Buy Now?

Crypto-All Stars is a revolutionary new platform that allows investors to stake leading meme coins in one place through its unique MemeVault protocol.

Holders of these top meme coins can stake them on Crypto All-Stars and earn passive income in STARS.

Crypto All-Stars can facilitate the staking of Pepe Coin, Dogecoin, Shiba Inu, Floki Inu, Brett, Mog Coin, Milady Meme Coin, Turbo, Toshi, Coq Inu, and Bonk.

Apart from staking other meme coins, you can also buy and stake your $STARS tokens, which offer a huge annual percentage yield (APY) of 752%.

You can buy $STARS tokens for $0.0014828 each. With a price increase coming in less than 3 days, don’t wait too long to secure the best possible price.

Purchase $STARS from its official website here using BNB, USDT, or a bank card .

Related News

- How to Buy Bitcoin Online Safely

- Bitcoin (BTC) Price & Future Predictions

- Dogwifhat Price Plummets 9% As Investors Flock To This New Meme Coin Rival With 5,392% APY

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DAC Platform and Fomoin Partner to Gamify Web3 Engagement and Rewards

Andreessen Horowitz’s Crypto Unit (a16z) Purchases $55M in ZRO Tokens

Bitcoin ETF has a net inflow of 1,147 BTC today, while Ethereum ETF has a net outflow of 3,775 ETH