With $SHIB and $DOGE Leading, Is $PEPE Set to Join the Rally?

- $PEPE is growing its influence in the bullish cryptocurrency market together with the memecoins such as $SHIB and $DOGE.

- A closer look at trends in the market as well as technical analysis could be a clear indication of further upside in the $PEPE.

- As it stands, $PEPE is promising as the memecoins are relatively risky, hence investors must be careful.

The recently launched memecoin $PEPE is set to soar higher on the charts as the market regains its interest and the overall crypto market turns bullish. Currently $PEPE is strengthening, traders are expecting that this pace may again add a zero, or even remove it, and raise the rate. This move comes at a time when other large memecoins , including $SHIB and $DOGE, are also charting the course, which sets a precedent throughout the market.

The highly positive outlook that bitcoin has provided for these tokens guarantees their ongoing support. Earlier, altcoins were increasing their rates multiple times higher in small time periods. This means that with the $PEPE, which has recorded much growth in its price, investors have their profits increase by 11 times in this memecoin market showing so much volatility.

Technical Indicators Suggest Growing Strength

Analyzing the technical outlook of $PEPE, it is recurring above critical support levels and has a positive trajectory that could translate to further hike in price. Currently, the coin is trading at $0.057771 with the support level at $0.057443 and its resistance level at $0.058053. With the rising buying pressure, there is a possibility of overcoming the resistance to form higher highs.

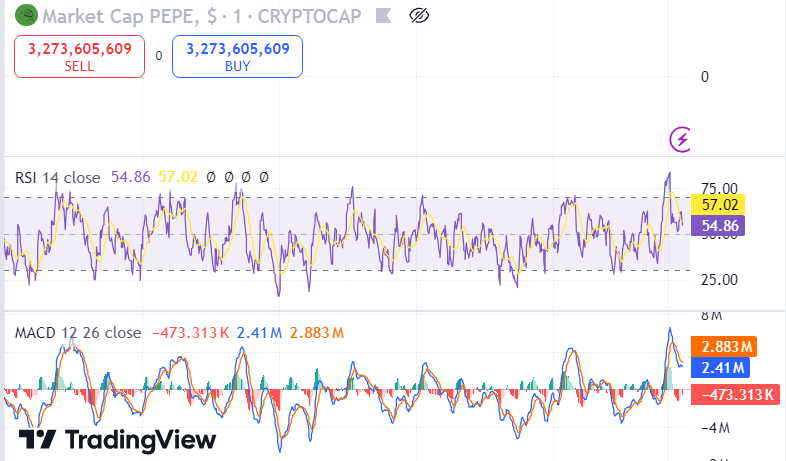

Relative strength index (RSI) is trading at 57 indicating a neutral point and a possibility of an overbought position. The Moving Average Convergence is trading above the signal line indicating a positive sign.If these patterns continue, traders could observe a fresh round of price increases in the following days.

Read CRYPTONEWSLAND on google news

Source: Trading View

Despite the positive projections of $PEPE, we should appreciate that memecoin in general tends to be rather unpredictable. Further significant successes, as evidenced by the fluctuations that have characterized $PEPE in the past, may however be followed by significant losses. Thus, one should apply great caution since fluctuations in prices can happen at any given time by traders.

disclaimer read moreCrypto News Land, also abbreviated as "CNL", is an independent media entity - we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.