Genesis, a well-known institution, strongly supports the market value potential of Reform DAO (RFRM)

远山洞见2024/08/29 05:59

By:远山洞见

I. Project introduction

Reform DAO is an innovative platform focused on decentralized market making, committed to making market making simpler, more transparent, and fair. By introducing the Bonding Treasury mechanism, Reform has created a community-driven ecosystem that uses a unique circular economy model to increase liquidity. This mechanism allows community members to receive rewards for providing liquidity, thereby enhancing the health of the market.

The ecosystem of Reform DAO is not just a tool. It works closely with project parties to assist in managing token market-making business, ensuring market stability and vitality. Reform's platform also integrates artificial intelligence technology to improve price discovery process and market efficiency by optimizing algorithms. RFRM tokens are an important part of the ecosystem, and holders can participate in governance, voting decisions, and share platform profits.

In addition, Reform DAO provides comprehensive resources and support to help project parties effectively manage liquidity and reduce the complexity of market operations. The platform is also committed to educating and motivating community members to participate, providing continuous liquidity support for projects, and ultimately promoting the progress of the entire decentralized finance (DeFi) ecosystem.

II. Project highlights

The highlights of Reform DAO are rich and unique, covering multiple key aspects.

1. Decentralized market-making mechanism: Reform DAO introduces a decentralized market-making model, abandoning the intermediary role in traditional

markets and directly allowing community members to participate in the market-making process. This approach not only enhances market transparency, but also makes market-making more fair and efficient.

2. Bonding Treasury and Circular Economy: Reform DAO's Bonding Treasury system is one of its core innovations. The system improves liquidity through a unique circular economy model, where participants can earn token rewards by locking in funds, thereby incentivizing continuous liquidity support. This mechanism not only enhances the market stability of the project, but also provides a profit opportunity for community members.

3. Artificial intelligence to optimize market operations: Reform DAO integrates advanced artificial intelligence algorithms, focusing on optimizing price discovery and market operations. The addition of AI helps improve market response speed and accuracy, ensuring market health and activity. Through this technology-driven approach, Reform DAO can better support project parties and liquidity providers.

4. Community-driven governance: Reform DAO emphasizes the core role of the community in project governance. Users holding RFRM tokens can not only participate in voting decisions, but also directly influence the development direction of the project through proposals and discussions. This decentralized governance model enhances the community's sense of participation and responsibility, ensuring the long-term development of the project.

5. Deep cooperation with the project party: Reform DAO is not only a tool platform, but also an important partner of the project party. By providing comprehensive market management support to the project party, Reform DAO helps them effectively manage the liquidity and market performance of tokens, reduce the complexity of market operations, and ensure the success of the project.

The innovative design of Reform DAO not only improves the efficiency of liquidity management, but also enhances community participation and project confidence.

III. Market value expectations

Reform DAO enhances its liquidity through a unique circular economy mechanism. Specifically, 65% of realized profits will be used to repurchase RFRM tokens, which will be transferred to Bonding Treasury to supplement its supply. Bonding Treasury then generates additional liquidity through token exchange, which is used for market making and further investment. In this way, Reform DAO not only does not destroy tokens, but also uses the repurchased RFRM tokens to continuously enhance liquidity and promote sustained profit growth.

The total amount of RFRM is 1 billion, and the initial circulation market value is 3 million US dollars. Compared with the decentralized market-making platform Tokemak in the same track and the DEX SushiSwap based on the automated market-making system, the potential market value has potential.

Tokemak (TOKE): circulating market value 35 million USD, token unit price 0.77U

-

SushiSwap (SUSHI): Market cap 170 million USD, token price 0.67U

If the market value of RFRM is the same as that of TOKE/SUSHI, the price and increase of RFRM tokens will be:

Benchmarking TOKE: The price of RFRM token can reach $0.35, with an increase of 1067%.

Benchmarking SUSHI: The price of RFRM token can reach $1.70, with an increase of 5567%.

IV. Economic model

The total amount of RFRM tokens is 1 billion. The token distribution structure and unlocking mechanism are designed to support the long-term development of the project, motivate early participants, and ensure the market stability of the tokens. The specific distribution and unlocking mechanism is as follows:

- Bonding Treasury 39%

Allocation Quantity: 390,000,000 RFRM

Unlocking mechanism: No release will be made during the token generation event (TGE), and all tokens will be locked for at least one year. This part of the fund will be used to collect liquidity for the market maker. The quantity in the bond vault will fluctuate: when someone exchanges tokens through the bond vault, the quantity will decrease; while when the repurchased $RFRM is returned to the bond vault, the quantity will increase.

- Staking Treasury 30%

Allocation Quantity: 300,000,000 RFRM

Unlocking mechanism: No release is made during TGE, and 0.05% of the remaining amount is unlocked every day. The amount of pledged funds gradually decreases over time, forming a publishing plan similar to

Bitcoin. This design aims to incentivize early participants while gradually reducing token rewards over time and as token value increases.

- Team Advisors 13%

Allocation Quantity: 130,000,000 RFRM

Unlocking mechanism: No release will be made during TGE, with a 12-month cliff period, followed by linear unlocking on a daily basis for the next 48 months. This part of the funds will be used to expand the team of core contributors and subcontractors, recruit new talents, and reward consultants who have made important contributions to the improvement of the DAO ecosystem.

- Operations Treasury 10%

Allocation Quantity: 100,000,000 RFRM

Unlocking mechanism: No release will be made during TGE, and then it will be linearly unlocked on a daily basis within 60 months. This part of the funds will be used to pay for the operating costs of DAO, including marketing, legal affairs, administrative management, and tax-related procedures, to ensure the continuous operation of DAO in the future and maintain competitiveness in the rapidly developing

cryptocurrency field.

- Early Backers 3%

Allocation Quantity: 30,000,000 RFRM

Unlocking mechanism: No release during TGE, and then linearly unlocked on a daily basis within 10 months. This part of the token will reward early supporters who hold tokens published on Binance Smart Chain for a long time during the snapshot period.

- Market Making 2.8%

Allocation Quantity: 28,000,000 RFRM

Unlocking mechanism: 100% released immediately upon TGE. This portion of the token is specifically designed to provide liquidity on centralized exchanges through cooperation with trusted partners, ensuring the effectiveness of the market-making process.

- Launch Incentives 2%

Allocation Quantity: 20,000,000 RFRM

Unlocking mechanism: No release will be made during TGE, and then linearly unlocked on a daily basis within 10 months. DAO will use these tokens to support listing and visibility on top exchanges, launch boards, and airdrops.

Liquidity Pool 0.2%

Allocation Quantity: 2,000,000 RFRM

Unlocking mechanism: 100% immediate release at TGE. This portion of the tokens will be included in the initial liquidity provision of the $ETH/$RFRM pool.

Token publishing (Emissions)

Reform's commitment to trading and emphasis on token publishing are reflected in its token economics design, aimed at incentivizing long-term holding and promoting early ecosystem adoption. As part of this strategy, staking rewards are significant in the early stages but gradually decrease over time. In addition, staking rewards have a one-year lock-up period, allowing market makers to profit through token buybacks on the open market. These tokens are then used to supplement the bound fund pool to attract more liquidity.

According to market-making analysis, Reform is confident in its ability to repurchase publishers annually, and may even exceed this goal. The ultimate goal is to provide appropriate returns for long-term holders.

V. Team and financing

- Team

The Reform DAO team consists of 15 core members who have accumulated rich experience in cryptocurrency and market making, totaling over 50 years. Core contributors to the team include Ichimoku (Head of Strategy), the founder of a leading cryptocurrency fund in Europe with 10 years of industry experience. Other key members such as Scorpio are responsible for trading and business development, Aslan is responsible for operations, Bella is responsible for communication, and Pauluz is responsible for marketing activities. Their backgrounds cover market making, basic research, trading, Web3 marketing, and DAO management.

In addition, Reform DAO is also supported by Growity Trading, with 25 developers, 5 quantitative analysts, and a team supervised by 3 project managers.

- financing

Reform DAO has received a $500,000 strategic investment from Growity, which not only provides the necessary capital for the launch of its trading engine, but also demonstrates Growity's firm support for Reform's development vision. Growity's investment represents its confidence in Reform's future development and provides important financial and technical support for its continued expansion in the Web3 field.

VI. Risk Warning

1. Market volatility risk: The value of RFRM tokens may be affected by market fluctuations, especially when liquidity is low or market sentiment changes. Investors should carefully manage their investment risks.

2. Project execution risk: Although Reform DAO has innovative market-making mechanisms and technical support, it may face problems such as poor execution, difficult Technology Implementation, or insufficient market acceptance during the project development process, which may affect the success of the project and the value of the token.

VII. Official links

Website:

https://www.reformdao.com/

Twitter:

https://x.com/ReformDAO

Discord:

https://discord.com/invite/reformdao

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

RSI breaks 4-month downtrend: 5 Things to know in Bitcoin this week

Bitcoin is attempting to bring the bull market back in full force, but market participants are wary, and even see a return to $76,000 after new all-time highs.

Cointelegraph•2025/03/24 09:16

Research Report | SIREN Project Detailed Analysis & Market Valuation

远山洞见•2025/03/24 07:15

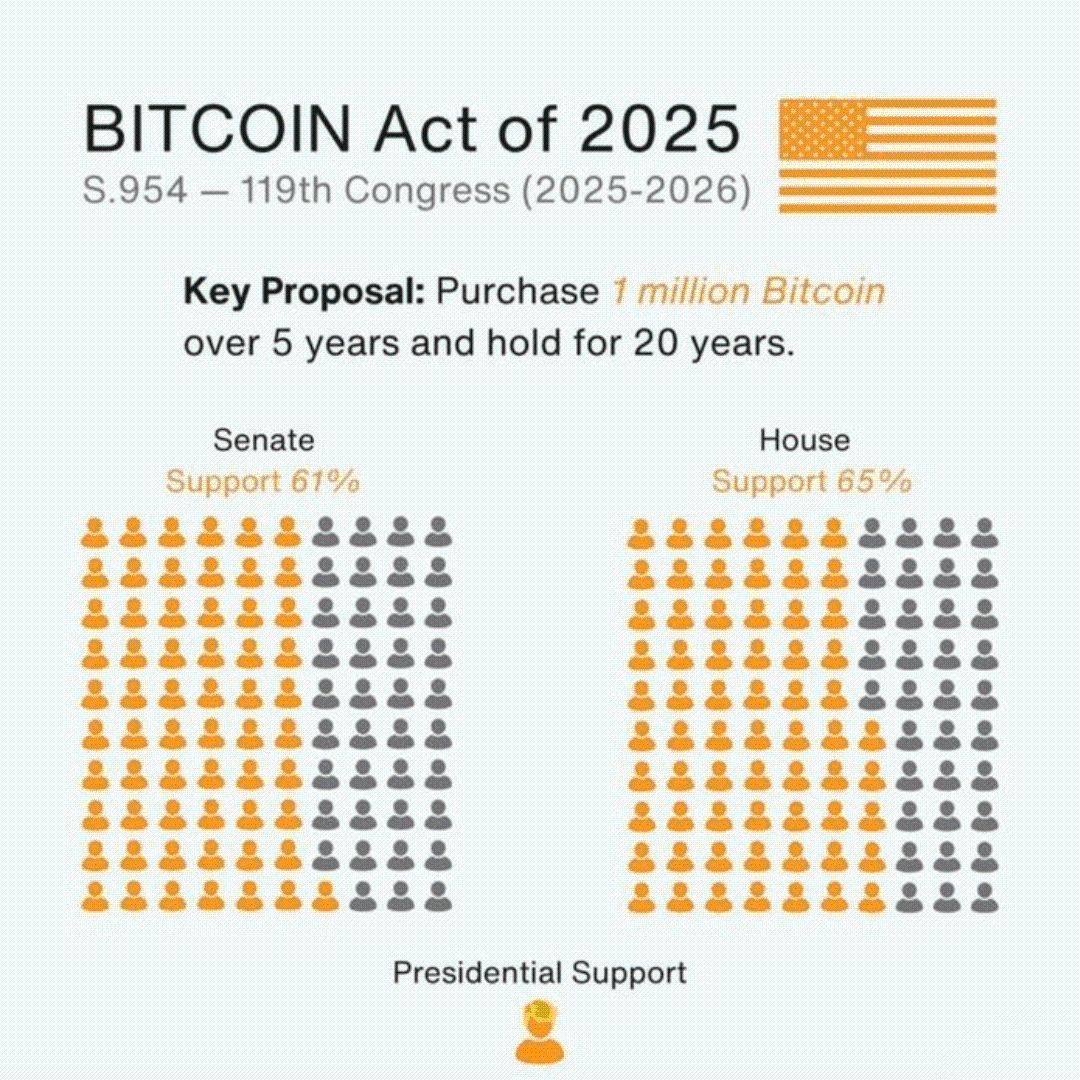

U.S. BITCOIN Act of 2025: Strategic Bitcoin Reserve Gains Majority Support in Congress

Cryptoticker•2025/03/24 06:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,746.16

+3.56%

Ethereum

ETH

$2,094.32

+3.83%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.47

+2.73%

BNB

BNB

$630.06

+1.34%

Solana

SOL

$141.95

+6.69%

USDC

USDC

$1

-0.01%

Dogecoin

DOGE

$0.1769

+3.14%

Cardano

ADA

$0.7327

+2.89%

TRON

TRX

$0.2290

-3.08%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now