Avalanche Price Pumps 13% As Grayscale Launches AVAX Fund, While Experts Say This New Meme Coin Might 10X

The Avalanche price jumped 13% in the last 24 hours to trade at $26.20 as of 00:44 a.m. EST, with trading volume surging 43% to $464 million.

This comes as one of the largest asset managers in the industry, Grayscale, expands its crypto offering by launching an Avalanche (AVAX) trust.

The fund will allow accredited investors to gain exposure to the cryptocurrency.

Avalanche Price To Continue Soaring

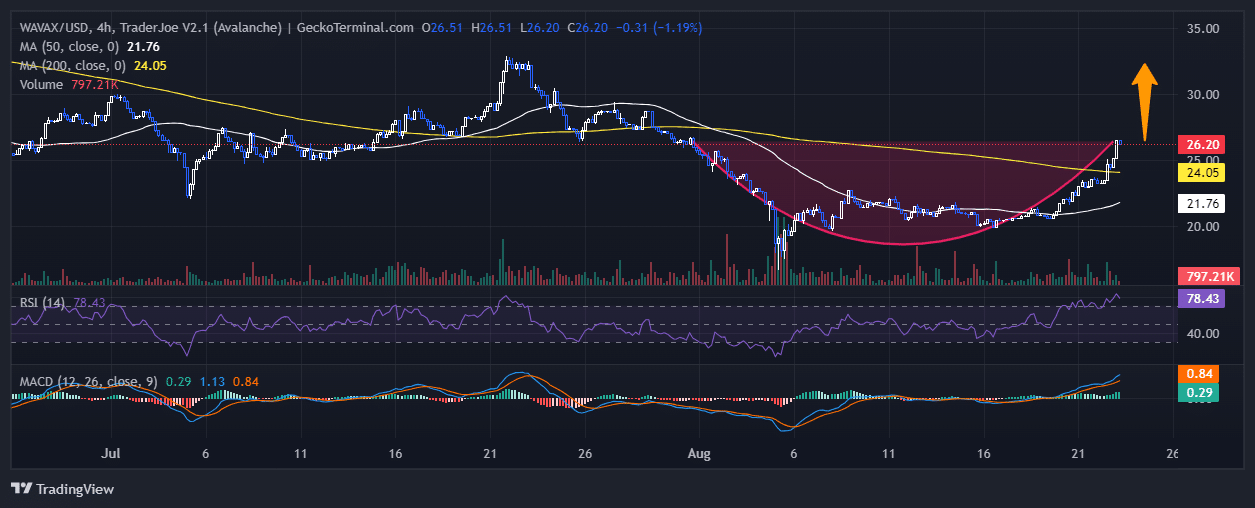

The Avalanche bears capitalized on the death cross at $27.45 to exert pressure on the price at the beginning of August, according to data from GeckoTerminal .

However, the bulls later found support at $19.94, which then allowed the price to soar back to the $26.61 resistance, forming a rounding bottom pattern.

The AVAX price bulls are looking to capitalize on the pattern to propel the price up it now trades well above both the 50-day and 200-day Simple Moving Averages (SMAs).

Moreover, the Relative Strength Index (RSI) is climbing above the 70-overbought region, currently at 78, showing that AVAX is under intense buying pressure. The soaring RSI also shows that the asset is currently overvalued, a cautious factor for investors who want to invest.

The Moving Average Convergence Divergence (MACD) also crosses above the neutral line, a signal that AVAX is on an upward trend.

Avalanche Price Chart Analysis Source: GeckoTerminal.com

Avalanche Price Chart Analysis Source: GeckoTerminal.com

Avalanche Price Prediction

The Avalanche price analysis on the 4-hour chart shows that AVAX is on a bullish rally, as the RSI and MACD support the asset’s bullish prospects.

With the green bars on the MACD forming over the zero line, the price of Avalanche is currently on positive momentum. This may encourage the bulls to keep pushing the price up, as they currently target the $32.37 resistance zone.

However, with the RSI showing that AVAX is currently overvalued, investors may view this as a selling signal, which may prompt a selloff. If selling picks up at this level, the price of Avalanche could plunge back to the $21.76 support level (50-day SMA).

Meanwhile, as the Avalanche price soars, investors are rushing to buy the new meme coin Crypto All-Stars (STARS) , which YouTuber Jacob Bury says has the potential to soar 10X after launch.

The Crypto All-Stars Presale Raises Over $683K – Best Meme Coin To Buy Now?

The Crypto All-Stars presale continues to attract investors, raising over $683K in a little more than a week.

Crypto-All Stars is a revolutionary staking platform that brings together the most celebrated meme coins in one place through its unique MemeVault protocol.

Holders of these top meme coins can stake them on Crypto All-Stars and earn passive income in STARS.

The main meme coins on Crypto All-Stars include Pepe Coin, Dogecoin, Shiba Inu, Floki Inu, Brett, Mog Coin, Milady Meme Coin, Turbo, Toshi, Coq Inu, and Bonk. More will be added in coming months.

Apart from staking other meme coins, you can also buy and stake $STARS tokens , which have an impressive annual percentage yield (APY) of 2,178%.

You can buy $STARS tokens currently for $0.0013966 each. With a price increase coming in less than 3 hours, you should act fast to get the meme coin at the best possible price.

Purchase $STARS from its official website here using BNB, USDT, or a bank card.

Related News

- Best Meme Coins to Invest in: Top Picks for Exponential Gains! 🚀

- Best Crypto to Watch in 2024: Top 5 Cryptocurrencies with High Potential

- A How-To Guide on Buying Cryptocurrency Safely in 2024

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A whale who shorted ETH 50 times has made a profit of more than $78 million

The market expects the US to further cut interest rates by 76 basis points in 2025

Trump's latest tariff policy is approaching, and US stocks may be in trouble