Volume 196: Digital Asset Fund Flows Weekly Report

Low inflows overall at US$30m, but Solana suffers its largest outflows on record

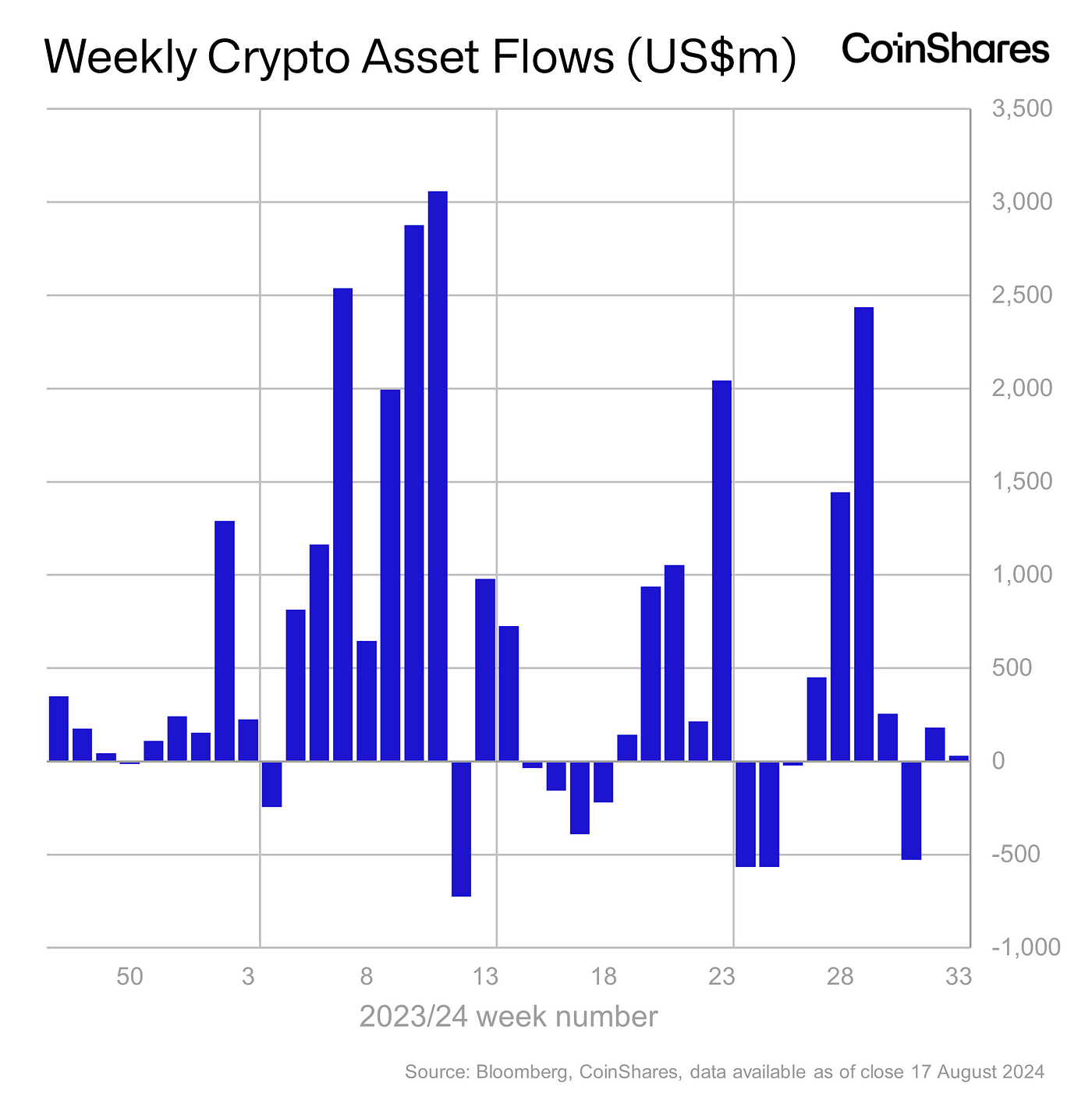

- Last week, digital asset investment products experienced minor inflows totalling US$30m, as recent macroeconomic data implied the FED were less likely to cut interest rates by 50 basis points in September.

- Ethereum saw only US$4.2m inflows last week, although this masked a flurry of activity between providers.

- Solana saw outflows of US$39m, the largest on record, as it faced a sharp decline in trading volumes of memecoins, on which it heavily relies.

Last week, digital asset investment products experienced inflows totalling US$30m. However, this modest figure conceals varying trends among different investment product providers, as established providers continued to lose market share to issuers of newer investment products. Weekly trading volumes on investment products fell to nearly 50% of the week prior at US$7.6bn, as recent macroeconomic data implied the FED were less likely to cut interest rates by 50 basis points in September.

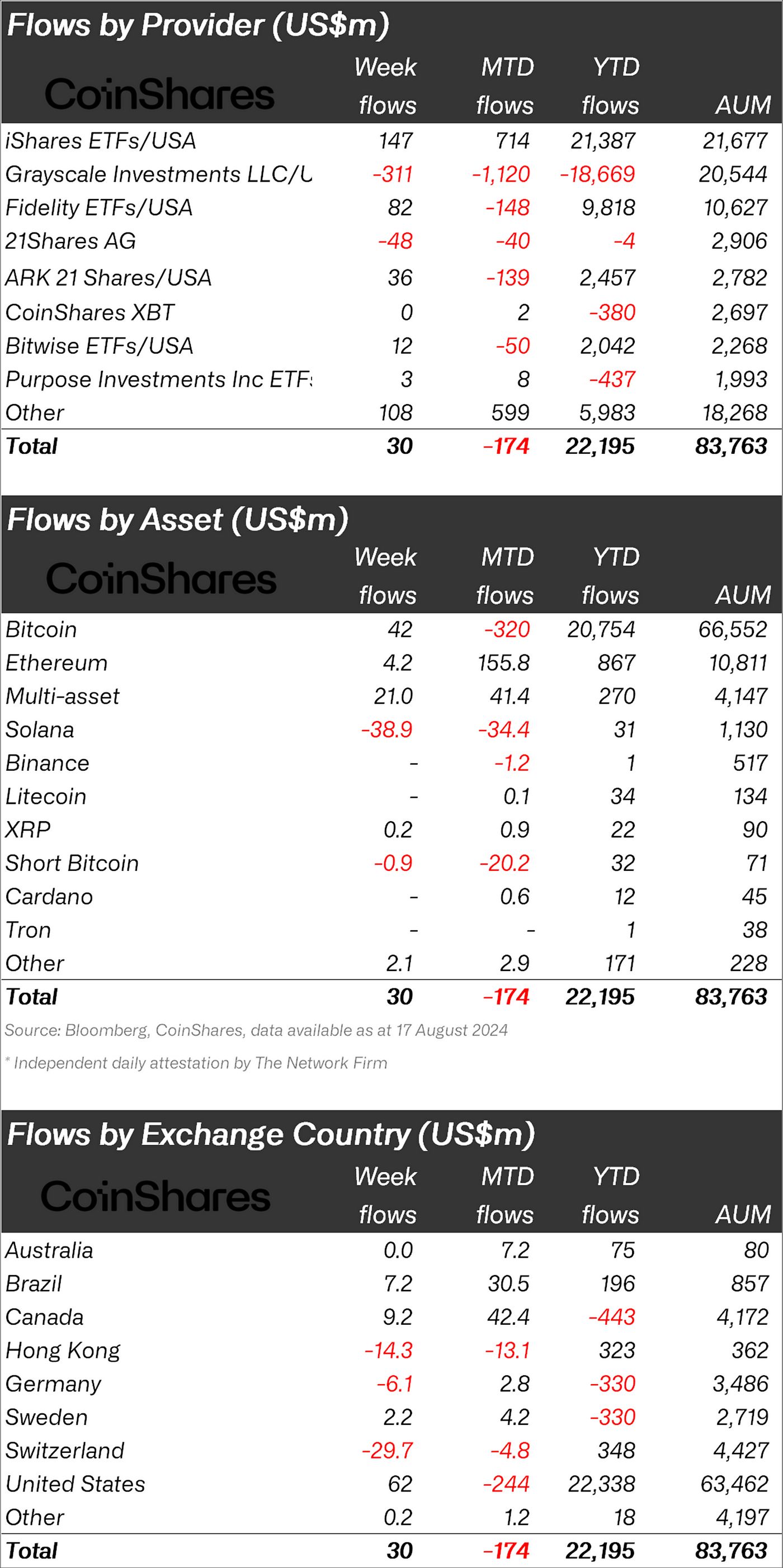

Flows were very mixed from a regional perspective, the US, Canada and Brazil saw inflows of US$62m, US$9.2m and US$7.2m respectively, while Switzerland and Hong Kong saw the most significant outflows totalling US$30m and US$14m respectively.

Bitcoin saw inflows saw the most significant inflows, totalling US$42m, while short-bitcoin ETFs saw outflows for the second consecutive week totalling US$1m.

Ethereum saw only US$4.2m inflows last week, although this masked a flurry of activity, with new providers seeing US$104m inflows, while Grayscale saw US$118m outflows.

Solana saw outflows of US$39m, the largest on record, as it faced a sharp decline in trading volumes of memecoins, on which it heavily relies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana (SOL) on Verge of Critical Downfall, Bitcoin (BTC) Eyeing $100,000, XRP: Sleeping or Skyrocketing?

Cardano Price Approaches $0.99: Will ADA Finally Break $1 Resistance in May 2025

ADA ETF Hopes Soar as Grayscale Boosts Cardano Holdings

Grayscale’s Cardano accumulation sparks a surge in ADA ETF optimism, with approval odds rising from 20% to 70%.ADA ETF Approval Odds Surge from 20% to 70%What This Means for Cardano and the Crypto Market