Bitcoin plummeted 25% in 7 days. Is the bull market still there?

In the past 24 hours, the entire network has liquidated about 767 million US dollars, of which long orders have liquidated 658 million US dollars and short orders have liquidated 108 million US dollars.

After Bitcoin fell below $60,000 yesterday, it fell below $53,000 today, and was quoted at $54,752 at the time of writing. Ethereum plummeted 12.9% to below $2,300. The crypto market fell across the board. High-market-cap targets such as OP, AVAX, and ENS, as well as new coins such as AEVO, ZK, W, REZ, SAGA, OMNI, and IO all fell by about 10%, hitting a new low since listing. In contrast, SOL only fell by 4.9%, showing a relatively strong performance.

According to Coinglass data, about $767 million of long orders were liquidated in the past 24 hours, of which $658 million were liquidated in long orders and $108 million were liquidated in short orders.

The sharp drop triggered large-scale liquidations on and off the chain. According to DefiLlama data, Ethereum has about $29.1 million in on-chain lending and liquidation quotas around $2,324. In addition, if Ethereum falls 20% from the current price, there will be about $164.4 million in lending and liquidation quotas on the chain. According to Coingalss data, based on the current mainstream CEX contract positions, if Bitcoin falls to around $51,500, it is estimated that each CEX contract will have $310 million in long orders liquidated.

Why did it fall again?

Election results unclear, "Trump trade" invalidated

Kamala Harris's surge in popularity in US election polls has dealt a double blow to the so-called "Trump trade", and the strategy that originally benefited from Trump's election is losing momentum. A few weeks ago, the assassination and Biden's withdrawal from the election were seen as favorable conditions for Trump's victory in the election, and the market expected that if Trump returned to the White House, he would adopt looser fiscal policies and financial supervision.

BlackRock Chief Investment Officer Neeraj Seth said in an interview with Bloomberg last Thursday that they have seen some Trump trades being closed and "such trades will be repeated from now to early November." After Trump promised to make the United States a "global cryptocurrency capital" and a "bitcoin superpower", the market performance of cryptocurrencies has been seen as a representative of the possibility of Trump returning to the White House. Arca Trading Director Kyle Doane said in an interview that Bitcoin's recent weakness may be due to Harris' "slowly rising support in the polls."

US stocks fall back, Buffett sends pessimistic signals

In August, US stocks continued to fall sharply, and the economic recession alarm triggered panic trading in the market. The SP 500 closed down 1.84%, the Nasdaq fell 2.43%, and the VIX index rose to 26.04%. Except for Apple (which announced results higher than market expectations), large technology stocks fell across the board. Nvidia fell more than 7% during the session. Chip and AI stocks were even worse. Philadelphia Semiconductor, TSMC, ARM, etc. all fell by about 5%.

Previously, the U.S. non-farm payrolls increased by 114,000 in July, the lowest record since December 2020, far less than the expected 175,000, and a sharp drop from the previous value of 206,000 (revised down to 179,000); and the unemployment rate rose to 4.3%, triggering a recession indicator with an accuracy rate of 100%. The market generally believes that the Fed's interest rate cut is "too late."

On the other hand, the performance of U.S. Treasuries also released dovish trading expectations. This week, U.S. Treasury yields fell across the board, with 10-year U.S. Treasury bonds breaking 4% for the first time since February, and two-year U.S. Treasury bonds, which are more sensitive to monetary policy, fell nearly 30 basis points last Friday, the largest drop since SVB's explosion in March last year.

At the same time, Warren Buffett, the stock god, is also "escaping the top" and sending pessimistic signals to the market. According to the latest quarterly report, as of the end of the second quarter, Berkshire Hathaway's Apple holdings fell from 789 million shares in the first quarter to about 400 million shares, a drop of nearly 50%. Other data show that the "Buffett indicator" (the ratio of the total market value of the stock market to GDP) has risen to 171%, indicating that the valuation of US stocks is obviously too high and is facing the risk of a sharp correction.

Yen rate hike, carry trade funds weakened

Another important factor at the funding level is the obstruction of yen carry trades. Recently, the Bank of Japan raised interest rates from 0% to 0.25%, the first increase in many years.

Carry trades (or carry trades) typically involve traders borrowing funds at lower interest rates in developed markets and then investing in high-yield assets in emerging markets. Many investors have taken advantage of ultra-low interest rates to borrow yen for almost free to finance investments in other assets, but as rates rise, those leveraged positions become more expensive to maintain, bringing widespread instability to financial markets, including cryptocurrencies.

The yen carry trade is the most popular in emerging markets as volatility remains low and investors bet that Japanese interest rates will remain rock-bottom. But the yen appreciated more than 1% in recent days, and the sudden appreciation of this funding currency has hurt the carry trade, and the Bank of Japan hinted at further rate hikes at its latest meeting. Chris Turner, a strategist at ING, said in a report last week that the yen carry trade has suffered a setback in assets in recent months, and rising volatility has also led to a large number of institutions and investors being "forced to reduce their positions."

Selling pressure from Jump Crypto and Mt.Gox

There is also institutional selling pressure within the crypto market. On August 4, according to EmberCN monitoring and analysis, Jump Trading may be selling ETH: they are recently redeeming a wstETH worth $410 million (120,000) in batches into ETH and then transferring it to trading platforms such as Binance/OKX.

So far, they have redeemed 83,000 wstETH into 97,500 ETH in the 9 days since July 25. Among them, 66,000 ETH ($191.4M) have entered the trading platform. As of the time of writing, there are still 37,600 wstETH untransferred from their wstETH storage address; 11,500 stETH in the redemption ETH address is being redeemed into ETH; and 20,000 ETH is waiting to enter the trading platform in batches.

On July 31, the Mt. Gox address in Mentougou transferred 33,963.888 bitcoins to two addresses 6 minutes ago, worth about $2.25 billion. Among them, 33,105 bitcoins were transferred to the test address yesterday, and another 858.644 bitcoins were transferred to a newly created address. According to Ember's monitoring, after transferring 33,963.888 bitcoins on the same day, the Mt. Gox address in Mentougou still held 46,162 bitcoins, worth about $3.056 billion.

ETH performs poorly, will the meme continue to grow?

The first "519" this year was after Bitcoin broke through $69,000 to set a record high. At that time, Bitcoin fell below $60,000 overnight, causing more than $10 billion in liquidation on the entire network, and the Bitcoin volatility index once reached 78.81, close to the highest value in a year. However, the daily trading volume of Bitcoin ETF at that time set a record of $10 billion. That pullback can also be considered a normal retracement phenomenon after the historical high.

Related reading: "Bitcoin plummeted by $10,000 after the historical high. Is the sharp pullback a sign of a bull market?"

The second time happened two months ago when Bitcoin was halved. At that time, the entire network was liquidated with a total of $935 million, but the Bitcoin retracement was not very serious, only less than 10%, but almost all the altcoins led by ETH were not spared, and the crypto market was a bloodbath.

Related reading: "Altcoins usher in the "new 519", which is the main reason for the turbulent situation and the tax deadline? "

Although the market has experienced a general decline many times, the first two retracements did not affect the overall bullish market sentiment, and this time the analysts seem to have wavered.

On June 14, according to CoinDesk, despite strong U.S. stocks and favorable U.S. cryptocurrency policies, traders expect Bitcoin (BTC) prices to have a deeper correction in the coming weeks, mainly due to miners' selling activities and general profit-taking. FxPro senior market analyst Alex Kuptsikevich believes that "a new wave of dollar strength and demand for stocks are emerging. The demand for risky assets is gradually decreasing, forming a trend of Bitcoin's intraday highs falling."

"Bitcoin continues to test the strength of the 50-day moving average, but cannot find enough reasons to fall further. Such continuous testing of lows allows the bears to quickly succeed, with the next target at $60,000," he added.

Some observers say miners, who provide a large amount of computing resources to keep the Bitcoin network running, may be one of the selling groups. The analyst added: "The increasing net outflow of Bitcoin from miners does not necessarily put pressure on Bitcoin prices. However, prices tend to stagnate."

In addition, the expectations for Ethereum ETH do not seem to be enough for analysts to be bullish on Ethereum.

On June 12, Matrixport officially issued a statement stating that the ETH/BTC exchange rate has been on a clear downward trend since the merger of the PoW and PoS chains in September 2022. Although Ethereum occasionally surpassed Bitcoin for a short period of time, this situation did not last. As the exchange rate pair approaches the top of the downward channel, ETH may perform poorly again.

As for the biggest hype gimmick meme coin of this cycle, BitMEX founder Arthur Hayes expressed optimism. Arthur Hayes said that the Dogecoin ETF may be launched at the end of this cycle, and said that his prediction is based on the substantial growth rate of dog-themed meme coins over the years.

Raoul Pal, CEO and co-founder of Real Vision, also agreed with Arthur Hayes' prediction that a Dogecoin ETF will appear at the end of the market cycle. He expressed strong support for a Dogecoin ETF and discussed the possibility with Jan van Eck, CEO of investment management firm and spot Bitcoin ETF provider VanEck.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario

XRP News: What's on May 19 for XRP?

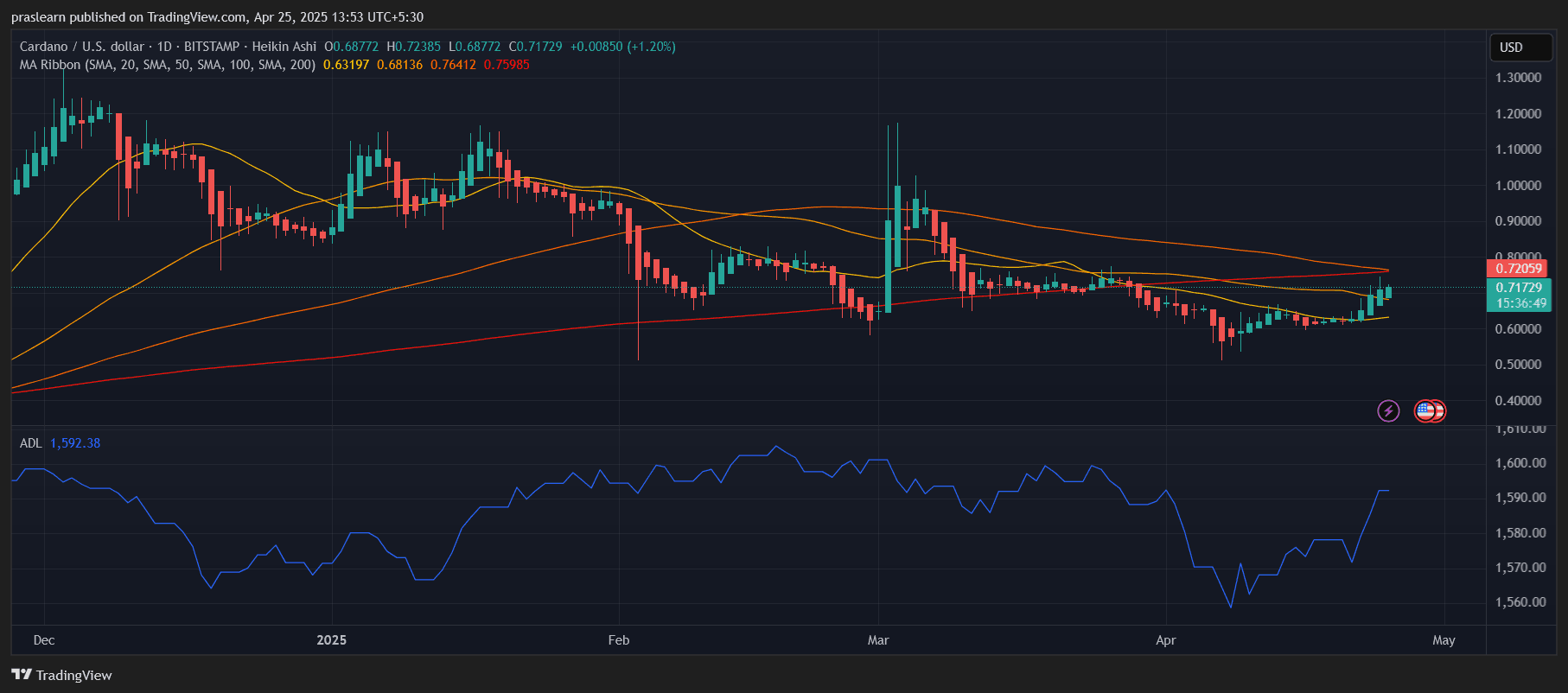

ADA Explodes Past $0.70 — What Now?

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.