Global crypto investment products' inflow streak tops $3 billion as Ethereum overtakes Solana YTD: CoinShares

Digital asset investment products attracted another $1.35 billion in net inflows last week, bringing their latest positive streak to $3.2 billion, according to CoinShares.“Ethereum seems to have turned a corner,” overtaking Solana as the altcoin with the most inflows year-to-date, CoinShares Head of Research James Butterfill said.

Global crypto investment products at asset managers such as Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares and 21Shares registered net inflows for a third consecutive week last week, totaling $1.35 billion, according to CoinShares' latest report.

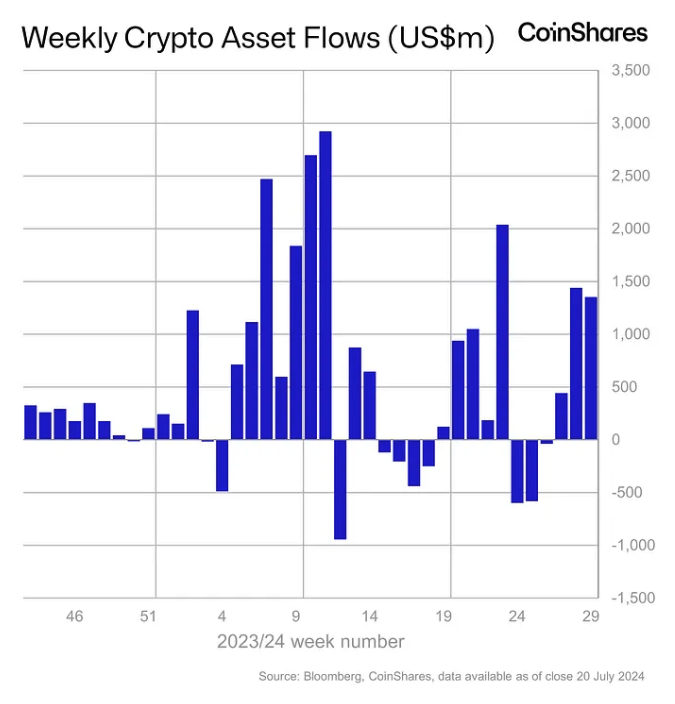

The run brings total net inflows to $3.2 billion since the beginning of July as “positive sentiment continues,” CoinShares Head of Research James Butterfill wrote . Exchange-traded product trading volumes also increased substantially, up 45% week-over-week to $12.9 billion, 22% of broader crypto market volumes.

Weekly crypto asset flows. Images: CoinShares .

Bitcoin BTC +0.93% -based investment products dominated as usual, with $1.27 billion in net inflows globally, while short-Bitcoin ETPs also saw $1.9 million in further net outflows. That brings short-Bitcoin net outflows to $44 million since March, “representing a massive 56% of assets under management — highlighting enduring positive sentiment since the April halving event,” Butterfill said.

U.S. spot Bitcoin exchange-traded funds made up the majority of those flows, adding nearly $1.2 billion in net inflows last week with Friday’s figure for Ark Invest’s ARKB ETF still pending.

'Ethereum seems to have turned a corner'

“The outlook for Ethereum ETH +0.028% seems to have turned a corner,” Butterfill added. Ethereum funds witnessed another $45 million of net inflows last week to surpass Solana SOL +4.58% as the altcoin-based investment product with the most net inflows year-to-date at $103 million compared to $71 million.

The Securities and Exchange Commission approved eight 19b-4 forms for spot Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, Ark Invest, Invesco, Franklin Templeton and Grayscale on May 23.

However, the issuers still need to have their S-1 registration statements become effective before trading can begin, which is anticipated to happen on Tuesday.

Regionally, U.S. and Switzerland-based funds led with $1.3 billion and $66 million in net inflows, respectively. However, Brazil and Hong Kong-based crypto investment products saw minor net outflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Key Indicators That May Help Traders Identify Bitcoin’s Next Potential Market Top

Bitcoin’s New All-Time High Sparks Potential Altcoin Rally Amid Market Optimism

Is Dogecoin (DOGE) Gearing Up for a Bullish Rally? Key Fractal Hints at a Major Upside Move