- Ethereum spot ETFs set to launch next week, offering regulated exposure to ETH prices.

- Seven of the ten upcoming ETFs have fee waivers to attract initial investment.

- Analysts are concerned about Grayscale’s high 2.5% fee impacting adoption.

The cryptocurrency community is waiting with bated breath as a new wave of Ethereum (ETH) spot ETFs is set to roll out next week. These ETFs, slated to go live on major exchanges like CBOE, Nasdaq, and NYSE, will provide exposure to ETH price movements in a more direct and regulated way.

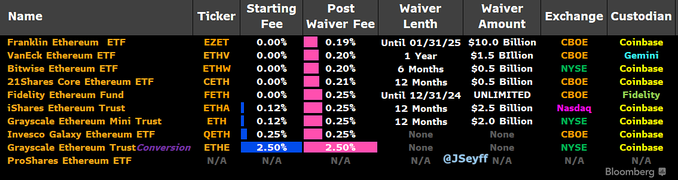

ETF analyst James Seyffart recently provided in-depth insights on the upcoming Ethereum ETFs on X (formerly Twitter), highlighting their fee structures and waiver terms. As per Seyffart, seven out of the ten ETFs have implemented fee waivers , a clever move likely aimed at attracting initial investments and building market momentum. However, details regarding ProShares’ ticker, fee structures, etc. are still awaited.

Source:James Seyffart

The first on the list of forthcoming ETFs is the Franklin Ethereum ETF (EZET). With a starting fee of 0.00%, the fee waiver extends until January 31, 2025. The waiver amount is set at $10.0 billion, and it will be listed on the CBOE exchange with Coinbase as its custodian.

The VanEck Ethereum ETF (ETHV) also comes with an initial zero fee. After the waiver, the fee will be 0.20%, effective for a year. The ETF has a waiver amount of $1.5 billion and will trade on the CBOE exchange, with Gemini as its custodian.

Bitwise Ethereum ETF (ETHW) also begins with a fee of 0.00%, which will rise to 0.20% after a 6-month waiver period. It has a waiver amount of $0.5 billion and will be listed on the CBOE exchange, with Coinbase acting as its custodian.

21Shares Core Ethereum ETF (CETH) will go live with a fee of 0.00%. After a 12-month waiver period, the fee will increase to 0.21%. With an ETF waiver amount of $0.5 billion, CETH is set to trade on the CBOE exchange, with Coinbase as its custodian.

Fidelity Ethereum Fund (FETH) commences with a fee of 0.00% and will charge 0.25% post-waiver, extending until December 31, 2024, with an unlimited waiver amount. It will be available on the CBOE exchange, with Fidelity serving as its custodian.

iShares Ethereum Trust (ETHA), however, has an initial fee of 0.12%, which will increase to 0.25% after a 12-month waiver period. The ETF has a waiver amount of $2.5 billion and will trade on Nasdaq, with Coinbase as its custodian.

With a starting fee of 2.50%, Grayscale Ethereum Trust (ETHE) is the most expensive of all, with no waiver. It will not be listed on a specific exchange, and has Coinbase as its custodian.

Invesco Galaxy Ethereum ETF (QETH) starts with a fee of 0.25%, with no waiver period or waiver amount specified. It will be listed on the CBOE exchange, with Coinbase as its custodian.

ProShares Ethereum ETF details have not been released, including the exchange and custodian.

These ETFs, with their diverse fee structures, waiver lengths, waiver amounts, and custodians, offer investors multiple options to access Ethereum exposure in the traditional financial markets. The introduction of these ETFs is expected to significantly impact the Ethereum market, boosting the altcoin’s visibility and accessibility to traditional investors. Market participants are urged to keep a close eye on these developments as they unfold next week.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.