Bitcoin and CPI – Betting Against Consensus

10xResearch2024/07/11 09:16

By:Markus Thielen

👇1-10) Last Saturday (July 6), we

recommended a tactical bullish position on

Bitcoin ahead of this week’s CPI data when Bitcoin traded at $56,746. We anticipated that a rate cut rally could push Bitcoin near $60,000. Yesterday, Bitcoin rallied to $59,350 due to short covering ahead of the CPI, fulfilling our rally expectations.

👇2-10) Our bullish stance on Bitcoin in late 2022 and early 2023 puzzled many participants. Contrary to most economists' predictions, we expected a significant US inflation (CPI) decline from nearly 8% to about 3% by late 2023. During our presentations, we demonstrated how Bitcoin responded positively to lower inflation.

👇3-10) In January 2023, this scenario played out when Bitcoin rallied +5% on the CPI release day. Economists still expected a high inflation number, while traders were bearish. This was followed by another Bitcoin move of +6% the next day and another +5% afterward. As predicted, lower inflation set off the Bitcoin rally in 2023.

👇4-10) This week’s CPI report is complex as anticipation of a decline has already caused a short-cover rally of +5%. Trading on data releases and events requires a deep understanding of the always-shifting market expectations and changing positioning. An outsized move depends on the surprise factor AND how traders are positioned.

Bitcoin - bottoming out?

👇5-10) This time, stocks have rallied in anticipation of a lower CPI print, with the volatility index (VIX) rising—a rare occurrence, indicating significant upside call buying ahead of the CPI release. Headline CPI YoY is expected to decline from 3.3% to 3.1%, while Core CPI is expected to remain at 0.2%, still lower than the early 2024 consecutive 0.4% prints.

👇6-10) Our models suggest a period of possible downside surprises in inflation, with an expected CPI decline to 3.1%. If Core CPI comes in at 0.1%, this would mark the third consecutive surprise below expectations and positively impact the market. Bitcoin should then rally.

👇7-10) This scenario would push September rate cut expectations to 100% (up from 80%), with Fed Chair Powell signaling at the next FOMC meeting on July 31 that the September meeting would be ‘live.’ If Core CPI comes in even lower, with a 0.0% MoM print, a July rate cut might be priced in, albeit slightly early. Bitcoin should even rally more.

👇8-10) Derivatives

markets are pricing in two full rate cuts (51 basis points of easing with each cut being 25 basis points), more than Fed expectations. Hence, a dovish pivot by FOMC members, including Fed Chair Powell, remains possible. Economic data surprises are at their lowest since 2015, suggesting the Fed may need to act sooner (September) rather than later (November).

👇9-10) Bitcoin’s reaction to CPI is complex and less predictable based solely on data. However, considering our positioning, inflation expectations, and judgment, we expect a +3% Bitcoin rally if Core MoM comes in at 0.1% or lower, a +2% rally if it is between 0.11% and 0.19%, a +1% rally if it is between 0.2% and 0.25%, and a -2% decline if it comes in at 0.3%.

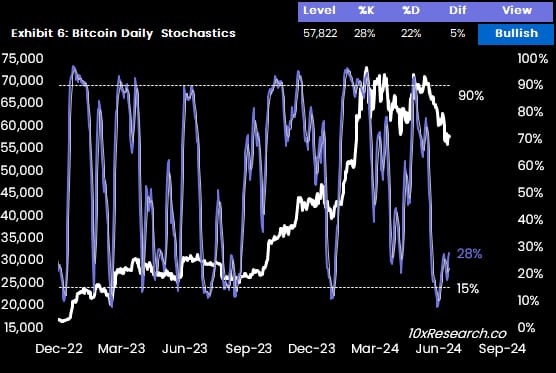

👇10-10) Betting against consensus is ideal when our analysis diverges from market expectations AND when positioning is contrary. This month’s CPI print may not be as dramatic as previous months, but a lower number could still sustain bullish sentiment, with traders managing downside risk with tight stop loss levels (e.g., $57,000). With all three reversal indicators turning bullish, Bitcoin might enjoy a rally for a few more days.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Trump’s Liberation Day Tariff Live: Impact on Crypto Market

Cryptotimes•2025/04/02 20:22

Trump’s Tariff Announcement To Push XRP Price Beyond $3?

Cryptotimes•2025/04/02 20:22

Bitcoin Nears $90K Breakout: Descending Triangle Signals Major Move

Cryptonewsland•2025/04/02 20:00

Cardano Price Prediction: Can ADA Price reach $1 After Market Consolidation?

Cryptoticker•2025/04/02 18:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,562.59

-0.86%

Ethereum

ETH

$1,867.73

-2.48%

Tether USDt

USDT

$0.9998

-0.02%

XRP

XRP

$2.09

-2.75%

BNB

BNB

$598.58

-1.83%

Solana

SOL

$125.17

-0.97%

USDC

USDC

$0.9998

-0.03%

Dogecoin

DOGE

$0.1689

-2.47%

Cardano

ADA

$0.6674

-2.09%

TRON

TRX

$0.2373

+0.32%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now