Bitcoin ETFs recorded 17 consecutive days of inflows

US-based spot Bitcoin exchange-traded funds (ETFs) saw remarkable success on Wednesday, collecting daily net inflows of $488.24 million.

Wednesday (June 5) marked the 17th consecutive day of daily net inflows for all 11 spot Bitcoin ETFs, equaling the longest streak of positive inflows seen in January and February.

Interestingly, all 11 ETFs recorded either net inflows or maintained a neutral position. This positive trend follows closely on the heels of Tuesday's second-largest daily net inflow.

Bitcoin US ETFs witnessed an unprecedented positive trend, collecting $488 million in daily net inflows.

READ MORE:

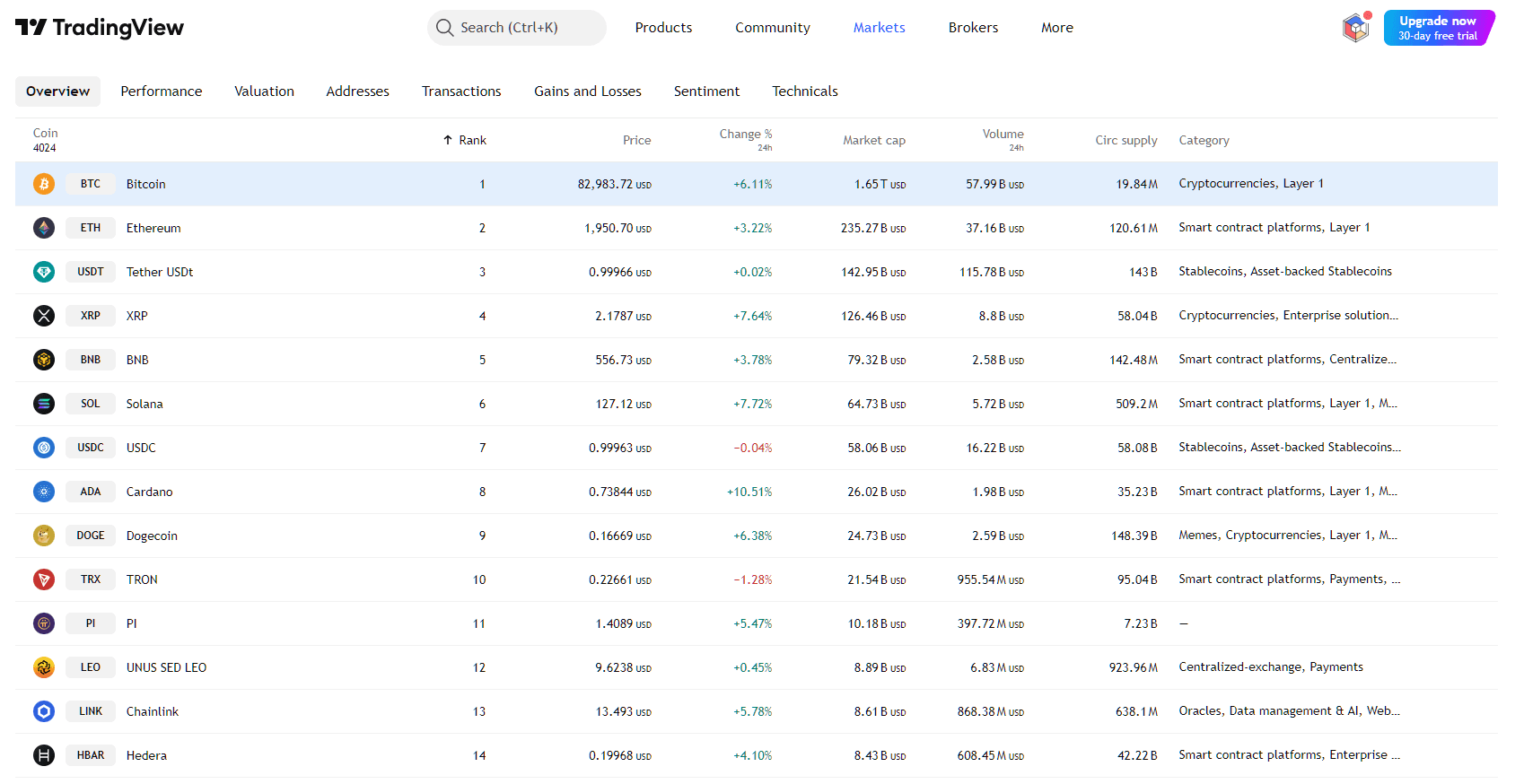

Is it a good time to buy Bitcoin at this price?According to the data SosoValue's leading driver of net inflows was Fidelity's FBTC, which attracted $221 million. BlackRock's IBIT was closely followed by net inflows of $155 million.

Ark Invest and 21Shares' ARKB saw significant inflows of $71 million, while Bitwise's BITB saw daily net inflows of $19 million.

Grayscale's GBTC recorded net inflows for the second day in a row, totaling $15 million. VanEck's ETF, along with those of Invesco and Galaxy Digital, recorded net inflows of $4 million each.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

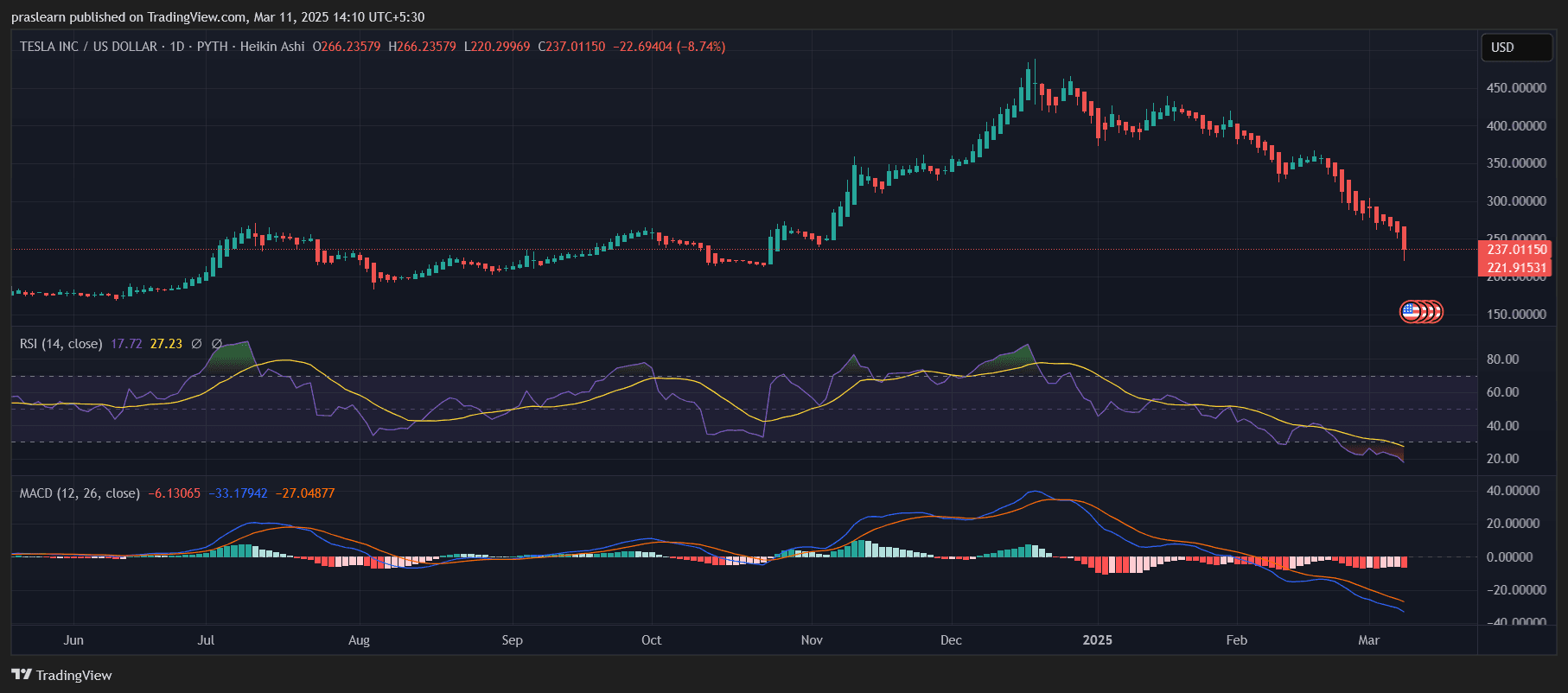

Correlation between equities and crypto has increased due to adoption

The market selloff is heavily tied to the increased correlation between equities and crypto, as crypto-friendly institutions are going more risk-off

Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

US-Canada Trade Tensions Escalate: Is This the Precursor to World War 3?

Better Buy for 2025: XRP vs. Nvidia?