All-TIME Bitcoin HIGHS Expected by Next Week - Maximize Your Gains

Institutional Crypto Research Written by Experts

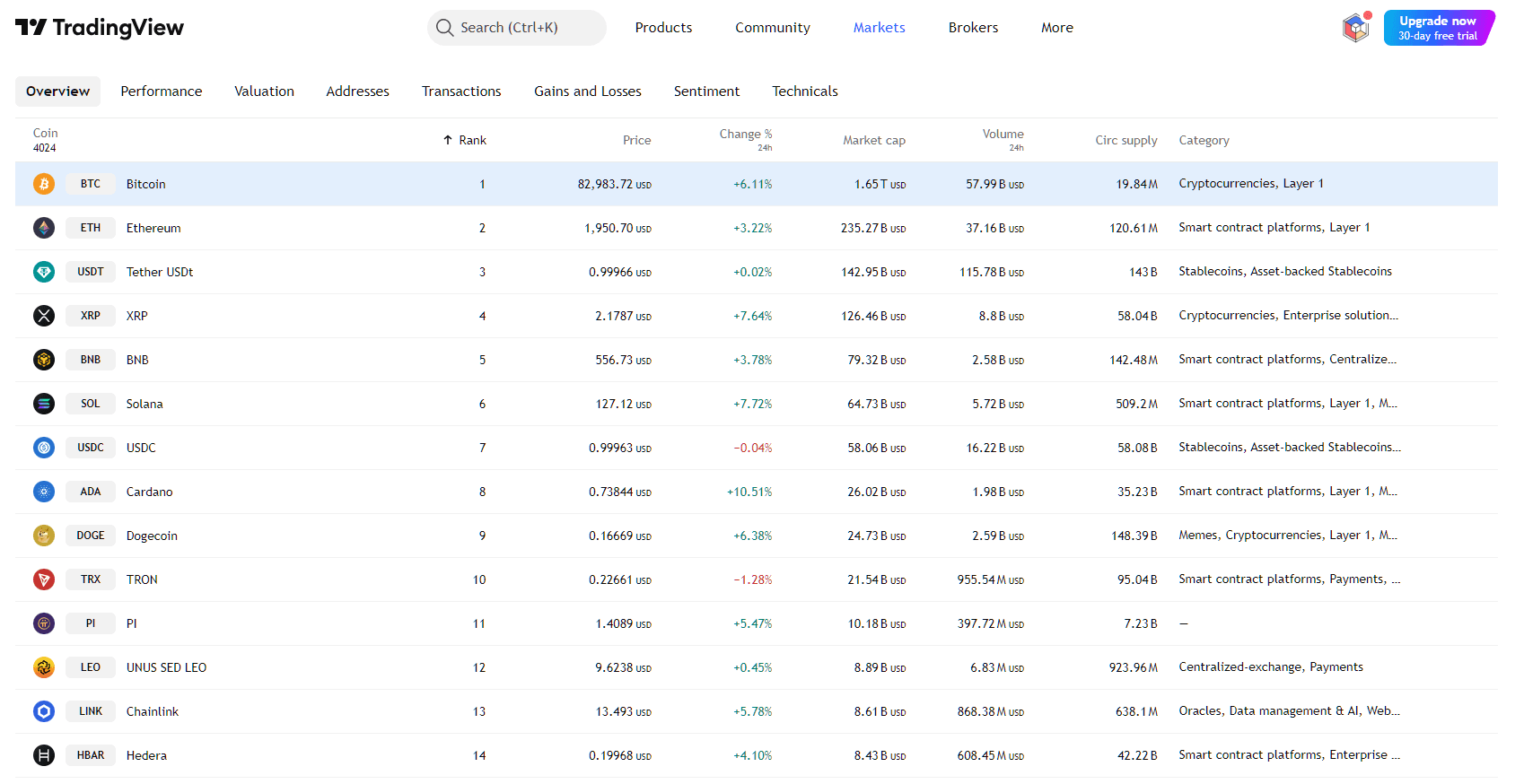

👇1-10) After Bitcoin’s consolidation, we're witnessing significant movements in the crypto market. Bitget’s exchange token BGB surged +16% following its Launchpad introduction, and Kaspa’s KAS token gained +36% with the introduction of KRC20, Kaspa’s blockDAG, which required users to purchase KAS tokens first. Binance's BNB token has hit an all-time high with a market cap of $105bn, while Ethena’s TVL has reached $3.1bn as funding rates expand, allowing ENA to rally by +10% during the last week.

👇2-10) We are bullish on Bitcoin. On May 21, we wrote, ‘Bitcoin: Multiple Buy Signals Activated, Don’t Miss Out. ' On May 26, we predicted, ‘Bitcoin New All-Time Highs Coming?’ Our report on May 30, ‘Inflation is the MAIN driver for Bitcoin,’ provided a solid thesis for the coming rally.

👇3-10) For traders, it was time to strap on risk and get more beta exposure. As we predicted, Bitcoin mining stocks are also on the rise. Bitdeer rallied +13% last night on the back of Tether’s $100m private funding round (potentially adding another $50m), while Bitfarms rallied as a prime takeover candidate in the sector. See our May 31 report.

👇4-10) The US economy is slowing, and for now, this is a good thing. GDP came in only a touch above 1%. The ISM manufacturing index has been in a contraction mode for several months, and the employment side keeps weakening, negatively impacting consumer spending. Last night, another critical and forward-looking job metric, job openings, slowed down significantly. All this will lead to lower inflation.

👇5-10) We will get more employment data this Friday. A weaker surprise could bring back rate cuts, and next week, we will get the CPI inflation report. If CPI YoY is 3.3% or lower, it will likely push Bitcoin to new all-time highs.

Bitcoin changes direction based on CPI higher/lower than the previous month (higher CPI, bearish Bitcoin, lower bullish)

👇6-10) On May 15, we turned bullish as inflation came in at 3.4%, which was lower than the 3.5% in the previous month. Back then, Bitcoin was trading near 62,000 – which coincided with our new line in the sand where we had to be bullish. Our preferred medium-term trend model switched bullish on May 16 at 65,000. A close above 71,500 (last price of 70,500) will trigger another buy signal.

👇7-10) Bitcoin has also broken above the mini-triangle (purple line), with the larger triangle (purple dotted line) likely breaking within the 71,500 area. A close above, triggered by lower US employment or inflation, will undoubtedly target new all-time highs between this Friday and next Wednesday. Hence, we expect that by the end of next week, Bitcoin will make new all-time highs (>73,500).

👇8-10) The SEC has posted warning tweets, a pattern that preceded the immediate approval of Bitcoin Spot ETFs and other SEC-regulated crypto products. An Ethereum ETF might soon be announced (S-1 approval). Nevertheless, we prefer Bitcoin, and positioning is also shifting back to Bitcoin.

👇9-10) Since Saturday, $1.6bn in additional Bitcoin futures exposure has been deployed. Last night, Fidelity had $+378m in Bitcoin Spot ETF inflows, Ark had $+140m, and Blackrock had +275m inflows ($+880m in one day). The second highest ever.

Does someone know something?

👇10-10) The options market expects Bitcoin to move by +/-6.6% by the end of next week, aiming for a price of 76,000 - in case of a rally. Implied vol is still relatively expensive at 52-53%. Buying upside leverage through perpetual futures or Bitcoin miners might be the better strategy with convex upside. Nevertheless, there is a very high probability that Bitcoin will make all-time highs soon. It’s time to strap on even more risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

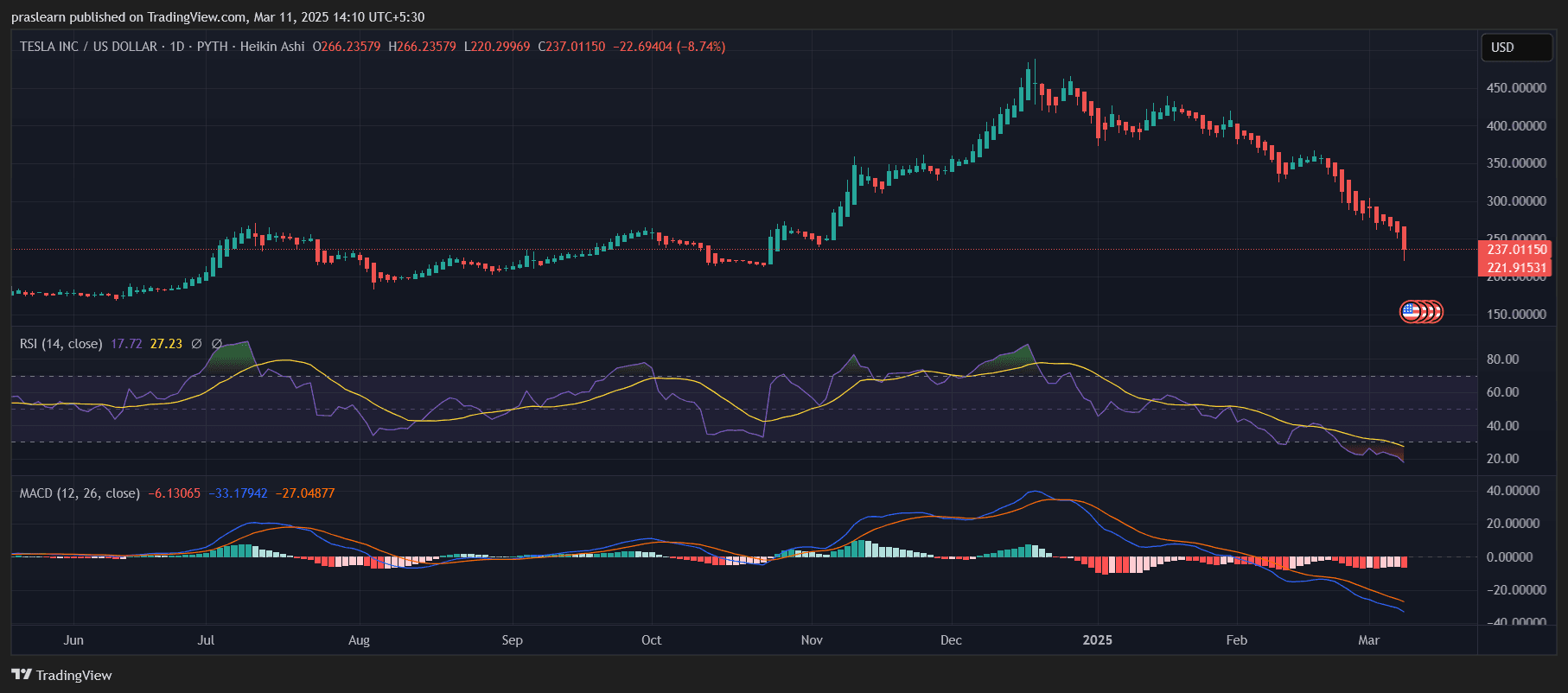

Correlation between equities and crypto has increased due to adoption

The market selloff is heavily tied to the increased correlation between equities and crypto, as crypto-friendly institutions are going more risk-off

Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

US-Canada Trade Tensions Escalate: Is This the Precursor to World War 3?

Better Buy for 2025: XRP vs. Nvidia?