Binance-backed pSTAKE Finance launches Bitcoin liquid staking solution

Binance Labs-backed liquid staking protocol pStAKE Finance has unveiled its liquid staking solution for Bitcoin in the latest development for Bitcoin-native decentralized finance (DeFi).

pSTAKE Finance’s solution, built on top of Babylon’s Bitcoin staking protocol, aims to simplify the Bitcoin staking process and offer additional yield generation opportunities for Bitcoin ( BTC ) holders.

The protocol decided to build Bitcoin-based staking solutions from a fundamental belief in the world’s oldest cryptocurrency, aiming to make it a yield-generating asset, according to Mikhil Pandey, the co-founder and chief strategy officer of pSTAKE Finance.

Pandey told Cointelegraph:

“Having fundamental faith and belief in Bitcoin, yields, and constantly identifying and solving crucial problems in this industry are some of the reasons behind moving in Bitcoin’s direction. The opportunity to make Bitcoin a yield-generating asset, something that hasn’t existed inherently, is very exciting. Yield-generating Bitcoin is powerful for all ecosystems and not just Bitcoin L2s.”

The initiative is part of a wider movement known as Bitcoin DeFi (BTCFi), which aims to bring DeFi capabilities to the world’s first blockchain network.

Investor interest in Bitcoin-native DeFi solutions started growing with the 2024 halving , which also saw the launch of Bitcoin Runes — a new protocol for issuing fungible tokens on the Bitcoin network.

The independent venture capital (VC) arm of Binance, Binance Labs, has also shifted its focus to BTCFi ahead of the halving after announcing an investment in Bitcoin-native restaking protocol BounceBit on April 11.

Related: BTCFi is an ‘enormous opportunity’ to make Bitcoin a productive asset — Stacks

The launch of the liquid staking solution marks pSTAKE’s first endeavor into Bitcoin-native DeFi, after building its liquid staking protocol on Cosmos for the past three years.

BTCFi is making Bitcoin a yield-generating asset for the first time.

pSTAKE’s new solution is among many protocols aiming to make Bitcoin a yield–generating asset.

At the beginning of May, Hermetica announced the launch of the first-ever Bitcoin-backed synthetic United States dollar with yield-generating capabilities. Slated for release in June, the new synthetic dollar, USDh, will offer users yields of up to 25%.

According to pStake’s co-founder, the BTCFi industry is seeing the culmination of various promising products that make Bitcoin more capital-efficient. However, he believes that there’s still more development needed before BTCFi could match Ethereum-level DeFi. Pandey explained:

“Ethereum’s tech had to go through a lot of evolution before the actual DeFi Summer in 2020. The Bitcoin DeFi landscape will likely follow a similar journey of development and progress before we see a full-fledged BTCfi Summer.”

However, making Bitcoin a more versatile asset holds a significant financial opportunity, added Pandey:

“With less than 1% of the Bitcoin market cap in DeFi today, we could see huge growth as we develop more secure and reliable ways to generate yield on Bitcoin.”

Related: Stacks active accounts reach record high amid growing interest in Bitcoin DeFi

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

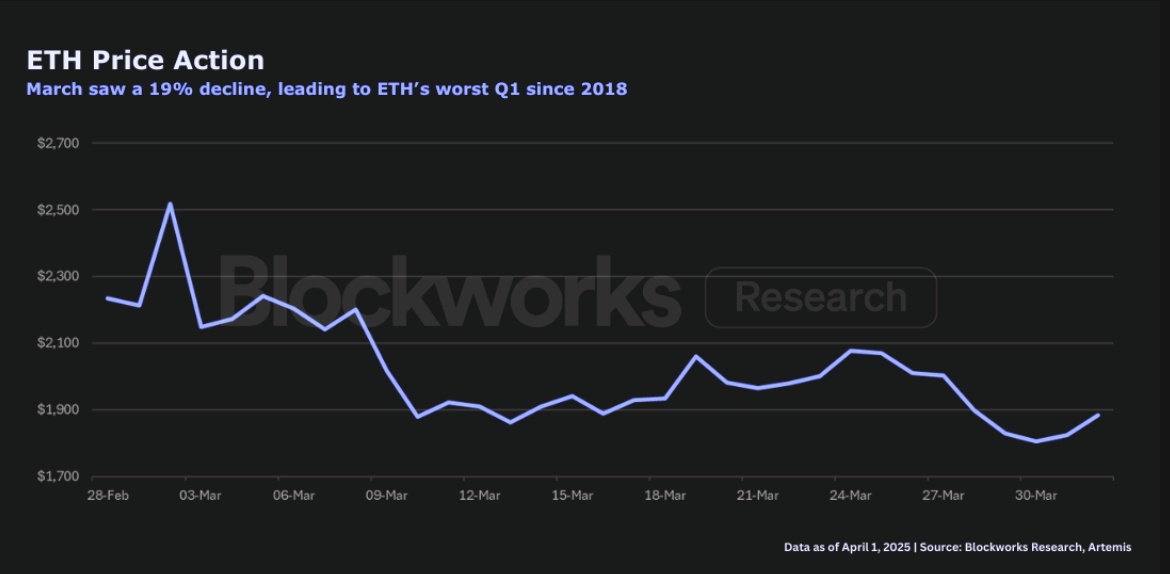

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far