A new wallet has withdrawn multiple tokens worth a total of $17.43 million from CEX in the past 3 hours

PANews reported on April 15 that according to Lookonchain monitoring, a new wallet starting with 0xcbeC withdrew tokens worth $17.43 million from Binance in the past 3 hours, including:

48,922 AVAX (approximately US$1.86 million),

621,003 FETs (approximately $1.45 million),

5.14 million GRT (approximately US$1.44 million),

1.9 million MATIC (approximately US$1.41 million),

532,444 OP (approximately US$1.29 million),

135,751 RNDR (approximately US$1.26 million),

174,421 DOT (approximately US$1.23 million),

1.6 million FTM (approximately US$1.15 million),

68,598 LINK (approximately US$993,000),

5.3 million DOGE (approximately US$851,000),

115,427 PENDLEs (approximately US$802,000),

17.49 million GALA (approximately US$779,000),

410,819 GHST (approximately US$767,000),

409,826 AEVO (approximately US$728,000),

326,926 DYDX (approximately US$719,000),

124.6 billion PEPE (approximately US$681,000).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Today 24/03/2025: How Much Can $BTC Reach $90K This Week?

Bitcoin and XRP lead $644 million injection, breaking streak of crypto fund outflows

Fartcoin Sees 22% Surge, Reaches Monthly Peak

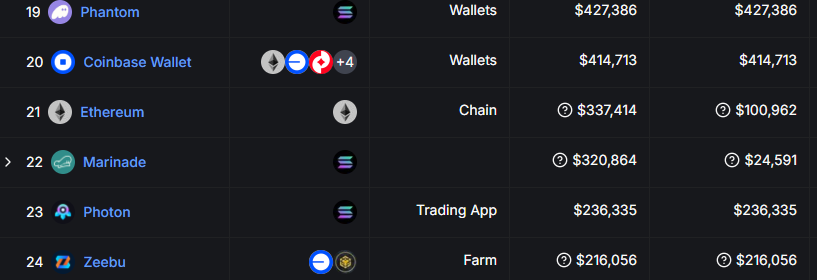

Ethereum’s L1 revenue from transfers falls to $100K in the past 24 hours

Share link:In this post: Ethereum (ETH) gas fees offer transactions as low as $0.02 as activity on the network slowed down. L2 protocols pay virtually zero fees to the L1, further cutting into Ethereum’s revenues. The cheap gas conditions brought out new on-chain games with token minting.