Crypto Hedge Fund Nine Blocks Secures Dubai VASP License

- Nine Blocks has made history as the first licensed crypto fund in Dubai.

- The company obtained its license from VARA.

- Other plans by Nine Blocks include setting up its headquarters in Dubai.

In a historic move, Nine Blocks Capital Management FZE has become the first crypto hedge fund to obtain an operational license from the Dubai regulator.

Founded in June 2021 by ex-PwC crypto leader Henri Arslanian, Nine Blocks is a leading institutional-grade digital asset manager with around $100 million in Assets Under Management (AUM). Hong Kong’s Nine Masts Capital backs the company.

Nine Blocks Wins Dubai Crypto License

On November 27, Nine Blocks announced that it had obtained a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA).

The services the company anticipates launching in Dubai following the approval include access to the Nine Blocks Master Fund, a neutral product focused on “generating alpha from inefficiencies in the crypto markets using relative value, arbitrage and quantitative strategies.”

Besides managing digital assets for institutional investors, such as regulated banks and public companies in Dubai, Nine Blocks also noted that it is shifting its global headquarters to the Emirate.

Per the announcement, the approval culminates in a lengthy process that began with a knowledge-sharing and consultation MOU between the company and VARA.

Navigating Dubai Crypto Regime

Dubai crypto regulator has placed stringent licensing requirements toward fostering proactive and responsible market participation, including four compulsory rulebooks that virtual asset service providers must comply with.

For crypto asset managers like Nine Blocks, VARA mandates they further comply with its Virtual Aset Management and Investment Services Rulebook , which covers a range of areas, including client suitability, staff competency, risk management, and due diligence, impermissible activities, as well as client reporting and valuation.

On November 17, VARA fined 18 virtual asset service providers for failing to comply with its regulatory and directive guidance. Further, the regulator warned that the VASP licensing engagement deadline lapsed that same day.

Stay updated on Hex Trust’s recent win in Dubai:

Hex Trust Granted Full Crypto Operating License in Dubai

Read how Crypto.com secured a license from Dubai’s VARA:

Crypto.com Secures VASP Crypto License from Dubai Regulator

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

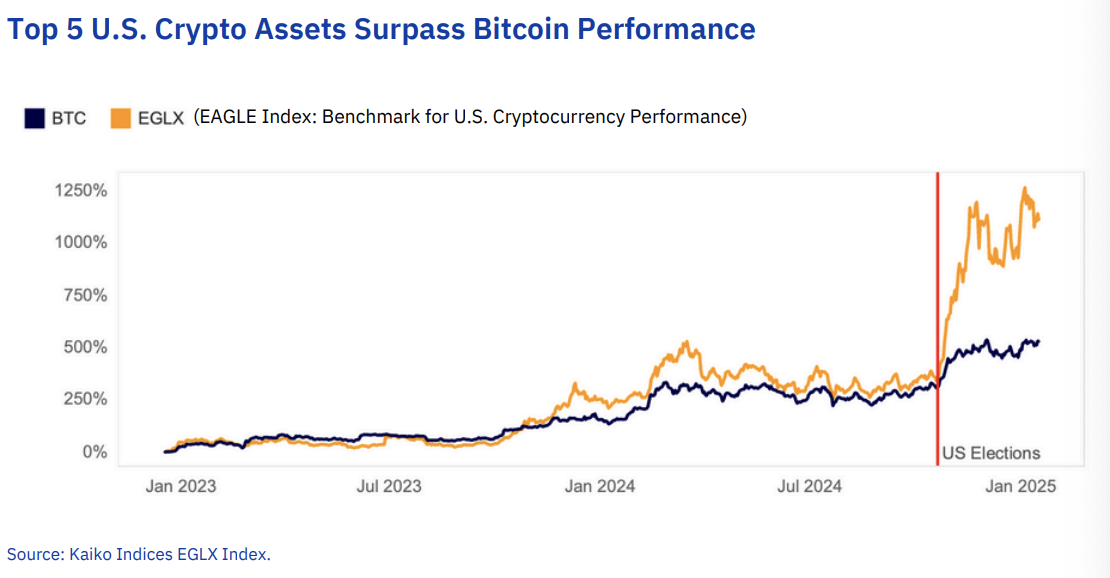

Altcoin volumes are ‘more concentrated’ than ever

Altcoin trade volume has returned to pre-FTX levels, but with a shrinking pool of market leaders

XRP price sell-off set to accelerate in April as inverse cup and handle hints at 25% decline

US Treasury Targets Houthi Crypto Wallets, Financial Network

Securitize Reports Highest-Ever Dividend of $4.17 Million for Tokenized Treasury Product