Crypto Taxes: Everything You Need to Know (2025 Edition)

Cryptocurrency has gone mainstream—whether you’re trading Bitcoin, minting NFTs, or yield farming on DeFi platforms, digital assets are no longer flying under the radar. But with greater adoption comes tighter regulation. In 2025, crypto taxes are unavoidable in most countries, and understanding how they work is critical for staying compliant—and keeping more of your gains.

This comprehensive guide explains how crypto taxes work, what’s changed in 2025, and how to make your crypto tax reporting.

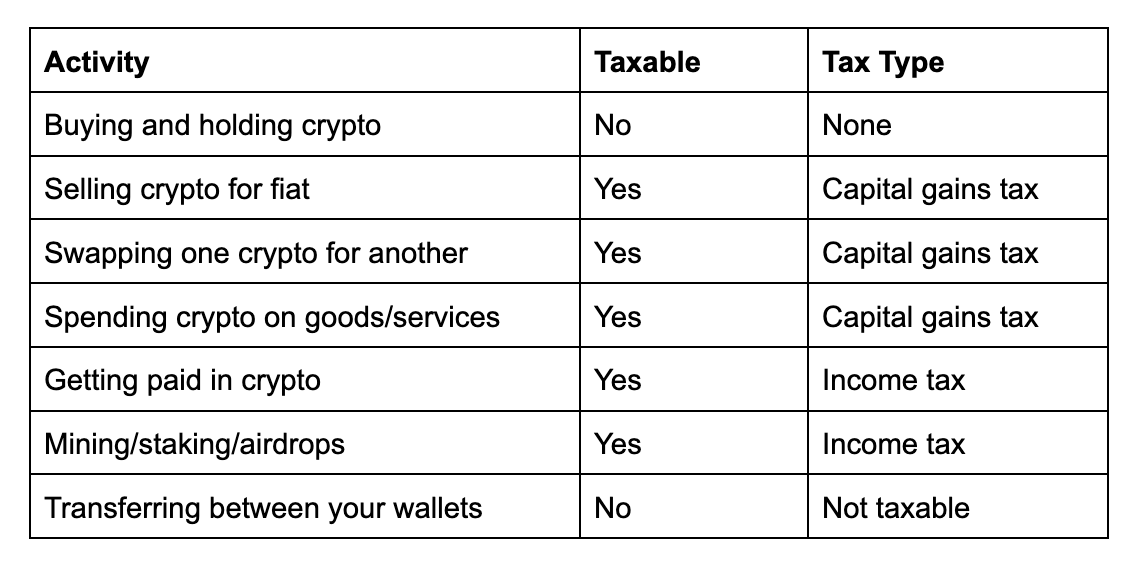

Do You Have to Pay Taxes on Crypto?

In most countries, yes.

Even though crypto isn’t considered legal tender in most jurisdictions, it is usually treated as property, assets, or digital commodities—and that means it’s taxable. Simply buying and holding crypto isn’t taxable. But when you sell, swap, spend, or earn crypto, you may have to pay taxes.

Crypto Tax Laws by Country

Crypto taxation varies significantly from one country to another. Some treat digital assets like stocks. Others like property. A few don’t tax them at all. Here’s how some of the world’s major economies—and tax havens—approach crypto in 2025.

United States

The IRS treats cryptocurrency as property. Selling, swapping, or spending crypto triggers capital gains tax, while earning crypto through mining, staking, or airdrops is taxed as income.

Capital Gains Tax Rates:

-

Short-term (held ≤ 1 year): taxed as ordinary income (10%–37%)

-

Long-term (held > 1 year): taxed at 0%, 15%, or 20%, based on income

Income Tax:

-

Mining, staking, airdrops, or payments in crypto are taxed as ordinary income when received.

What’s New:

-

Crypto exchanges must issue Form 1099-DA, reporting sales to the IRS and users.

-

Cost basis reporting will become mandatory in 2026.

-

DeFi platforms and self-custody wallets are currently not required to report, but users remain responsible for compliance.

The IRS is increasing enforcement, and crypto tax non-compliance may result in audits, penalties, or criminal charges.

United Kingdom

The UK classifies crypto as property and applies Capital Gains Tax (CGT) to disposals, while income from crypto (e.g., mining, staking, or getting paid) is subject to Income Tax.

Capital Gains Tax:

-

18% for basic-rate taxpayers

-

24% for higher/additional-rate taxpayers

-

Annual CGT exemption is now just £3,000

Income Tax:

-

Crypto earned from work, services, mining, or staking is taxed as income at 20%, 40%, or 45%.

HMRC also uses share pooling rules and the 30-day rule to calculate gains. DeFi tax guidance is currently under review, with new legislation expected soon.

European Union

There is no unified EU crypto tax law—each country sets its own rules:

-

France: 30% flat tax on crypto-to-fiat gains. Crypto-to-crypto is not taxed.

-

Germany: Crypto held over one year is completely tax-free. Short-term gains are taxed as income.

-

Italy: 26% flat tax on gains above €2,000. A proposed law may raise this to 42%.

-

Portugal: Crypto gains are tax-free if the assets are held for over a year. Short-term gains are taxed at 28%.

What’s Coming:

-

By 2026, DAC8 will require all EU crypto platforms to report user transactions to tax authorities—similar to the U.S. 1099-DA.

Canada

Canada treats cryptocurrency as a commodity, not legal tender or foreign currency. Crypto is taxed under Capital Gains Tax or Income Tax, depending on use.

-

Investors: Capital gains apply when you sell or trade crypto. Only 50% of the gain is taxable at your marginal income rate.

-

Traders and Miners: If you trade frequently or operate a crypto-related business, profits may be taxed as business income (100% taxable).

-

Crypto Income: Earnings from mining, staking, or receiving crypto for goods/services are taxed as income at the full marginal rate.

Canada Revenue Agency (CRA) requires clear records of every transaction, including fiat values and wallet details. Crypto-to-crypto trades are also taxable.

Japan

Japan taxes cryptocurrency as miscellaneous income for individuals, not capital gains. This places crypto under higher progressive tax rates.

-

Income Tax: Profits from trading, mining, or earning crypto are taxed up to 55% (national + local) depending on total income.

-

No distinction between long-term and short-term gains.

-

Crypto-to-crypto transactions are also taxable events.

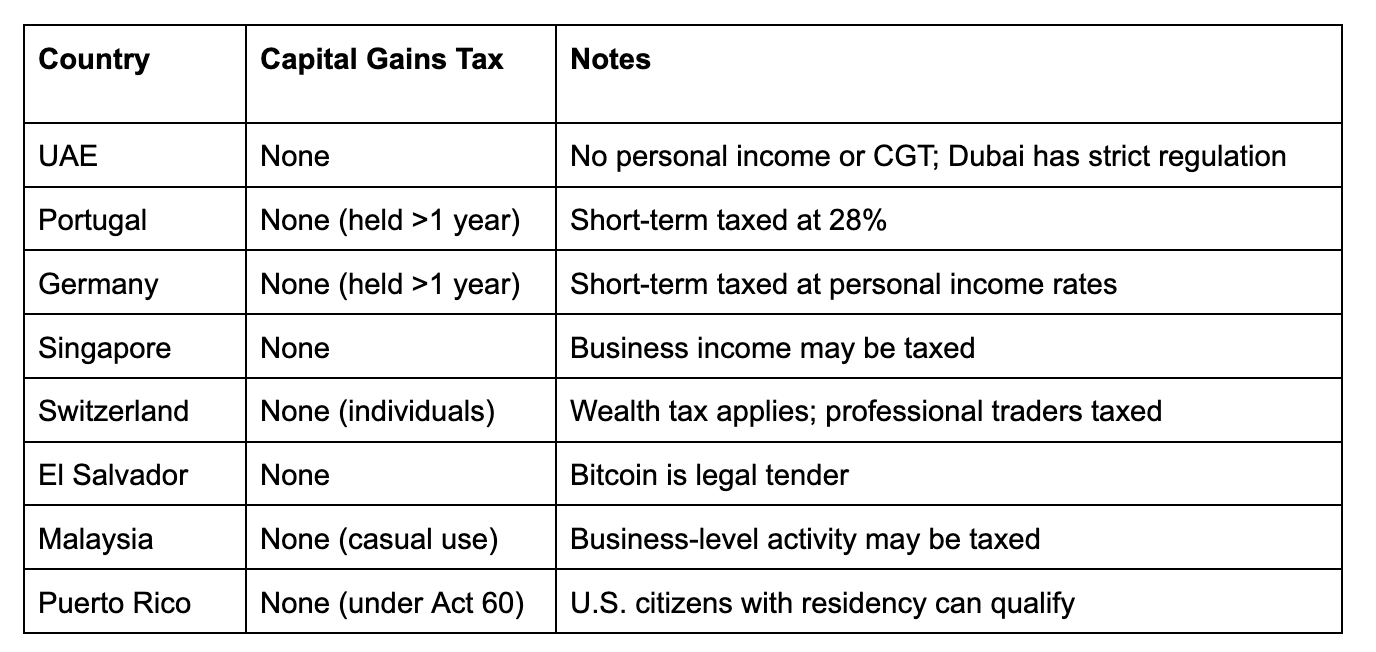

Crypto Tax Havens: Where Crypto Gains Aren’t Taxed

Some countries offer zero or minimal tax on crypto gains, especially for long-term holders or qualified residents.

Note: Tax residency, minimum stay requirements, and compliance with local laws are essential to benefit from these regimes legally.

What’s Next for Crypto Taxes?

Crypto taxation is evolving fast, and 2025 is just the beginning. Here’s what to expect going forward:

1. Global Reporting Standards: Governments are tightening oversight. The U.S. has introduced Form 1099-DA, and the EU’s DAC8 directive will require platforms to report user data across borders by 2026. International frameworks like the OECD’s CARF are also gaining traction.

2. DeFi and NFTs Under Review: Expect clearer tax rules on staking, lending, liquidity pools, and NFTs. Many jurisdictions are drafting legislation to close current gaps in DeFi taxation.

3. Smarter Tech, Less Anonymity: Blockchain analytics and AI-powered tax tools are making it easier for tax agencies to trace and audit crypto activity—especially across centralized and decentralized platforms.

4. Rise of Crypto-Friendly Jurisdictions: More countries are offering tax incentives, digital nomad visas, and crypto hubs to attract talent and capital—while others may introduce stricter exit or wealth taxes.

5. From Avoidance to Optimization: As rules become clearer, the focus will shift to legal tax strategies: long-term holding, loss harvesting, and smart residency planning.

Make Tax Reporting Easier with Bitget Tax API

For crypto investors, one of the biggest challenges isn’t knowing that crypto is taxable—it’s tracking and organizing all the transactions needed for accurate reporting. With growing tax obligations and stricter enforcement globally, keeping clean records has become essential.

To simplify this process, Bitget has introduced a dedicated Tax API that helps users retrieve and organize their trading history across the platform for tax reporting.

What the Bitget Tax API Offers

-

Secure Access to Transaction Data: Once users enable Google 2FA and create an API key, they can automatically retrieve their full transaction history—no more manual exports.

-

Seamless Partner Integration: Bitget integrates with trusted crypto tax tools like KoinX, allowing users to sync data directly and generate detailed, compliant tax reports.

-

Faster, Error-Free Filing: With all trading records formatted and imported into tax software, users can reduce reporting errors and avoid potential audits or penalties.

How to Use It

-

Log in to Bitget and navigate to the Tax API section.

-

Enable Google 2FA and generate a new API key.

-

Connect to a tax partner (e.g., KoinX) and begin syncing your data.

-

Generate reports based on your location’s tax rules and submit accordingly.

As crypto tax rules become more rigorous, tools like Bitget’s Tax API are essential for staying compliant while minimizing administrative burden.

Final Thoughts

Crypto taxation may feel complex, but it’s a sign of the industry’s growth and permanence. As governments refine their policies, investors and builders alike are gaining the clarity they need to operate responsibly and strategically. Staying informed is no longer optional — it’s part of being a modern crypto participant. Understanding how, when, and where your crypto is taxed is now just as important as knowing when to buy or sell.

Fortunately, the tools and guidance available are improving. With more standardized rules, automated reporting solutions, and growing support from exchanges like Bitget, crypto users have what they need to stay compliant without getting overwhelmed. In this next chapter of digital finance, those who plan ahead — and treat taxes as part of their long-term strategy — will be best positioned to thrive.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

- Pi Network Mainnet Launch: A New Era for Mobile Mining2025-04-11 | 10m